Economist Jeffrey Tucker: ‘Can you Imagine BTC price if it had scaled?’

American Institute for Economic Research editorial director Jeffrey Tucker reignited the long-running Bitcoin scaling debate with a tweet earlier today.

The economist — who has long been a proponent of Bitcoin (BTC) — suggested the current price is much lower than it otherwise would have been because the underlying technology has not been “properly scaled”.

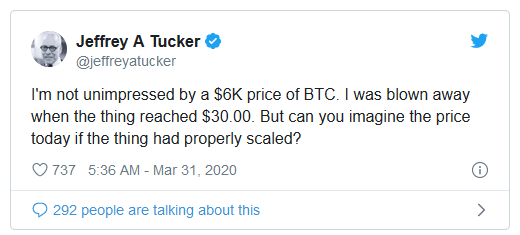

On March 31, Tucker tweeted:

The Tweet expands on comments Tucker made earlier this month on RT, during a panel discussion with noted Bitcoin skeptic Peter Schiff. During the debate he said too much time had been wasted on this “ridiculous scaling problem” which had ultimately prevented mainstream adoption:

“Adoption hasn’t gone far enough and it hasn’t come into consumer use like it should and would have if it had been able to scale. Now we’re seeing what happens when Bitcoin was not properly scaled.”

Tucker said Bitcoin was designed to thrive in times like the current financial crisis, and suggested the reason it hasn’t is due to its scaling problem:

“Bitcoin was innovated to become a safe haven during times just like this. So why aren’t we seeing Bitcoin become the safe haven that it was developed to be, and was for a number of years?”

Vitalik Buterin and Blockstream weigh in

The BTC scaling issue has been one of the most heated debates in cryptocurrency. The base layer network isn’t able to process transactions quickly enough to enable wide scale, mainstream adoption as a currency. The debate over raising the block size as a solution ultimately led to the Bitcoin Cash (BCH) and Bitcoin SV (BSV) forks, while Bitcoin itself adopted the layer two Lightning Network as a scaling solution.

Tucker’s March 31 tweet sparked a debate among prominent members of Crypto Twitter. Ethereum (ETH) co-founder Vitalik Buterin encouraged the economist to look at the long awaited Ethereum 2.0, which is due to launch this year, stating it will have “high scalability but without the centralization that rely solely on increasing block size.”

This provoked much derision from Bitcoin development company Blockstream’s CEO Adam Back, and CSO Samson Mow, who wrote “Lols” and posted a ‘crying with laughter’ emoji respectively.

Scaling has nothing to do with the price

On chain analyst Willy Woo suggested that scaling has nothing to do with the price or market cap, pointing to gold as an example:

“Gold is $9T. How many transactions per second does gold do? I mean shipping the underlying between vaults. That's BTC main chain. The swaps we do on ETFs and derivatives is Gold's layer 2. That s--t scales, so will BTC's layer 2.”

Bitcoin Advisory founder Pierre Rochard said the price would be the same regardless as scaling is "not the bottleneck for adoption."

Bitcoin proponent Vijay Boyapati argued it was not necessary to imagine a “properly scaled” Bitcoin, as that was Bitcoin Cash: "The price would be $200; the price of BCash. i.e., the market massively discounts what you consider "proper scaling" and greatly values immutability."

Investor and author Tuur Demeester said Tucker's tweet had annoyed him: "Having been in Bitcoin as long as you have you should know better imo — Bitcoin is scaling just fine."

To which Tucker laid down a challenge: “Well, let's get off Twitter and discuss this like gentlemen sometime.”

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.