Dormant Bitcoin and Ethereum continue climb, signaling end of bearish trend

- Dormant Bitcoin and Ethereum investments are moving, one of the best indicators of a bull run.

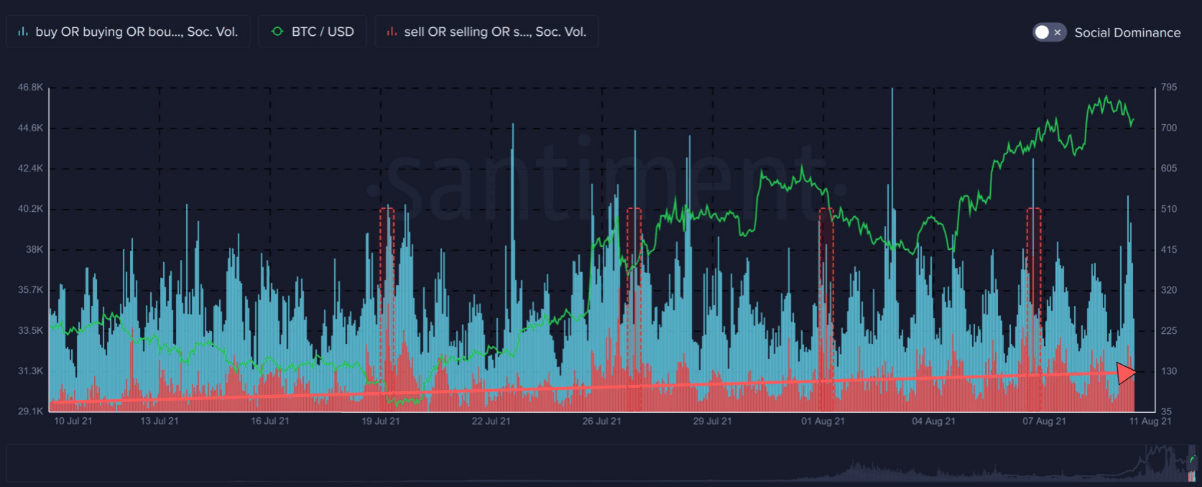

- Mentions of “sell” or “selling” BTC are up on top crypto exchanges.

- Coinbase releases second quarterly report for 2021.

- Ethereum and Bitcoin compete against other crypto assets for dominance in trade volume.

The correlation between Bitcoin and Ethereum has increased, and indicators suggest that a bearish period has ended for the top cryptocurrencies.

Movement of crypto held by long-term investors signals bull run

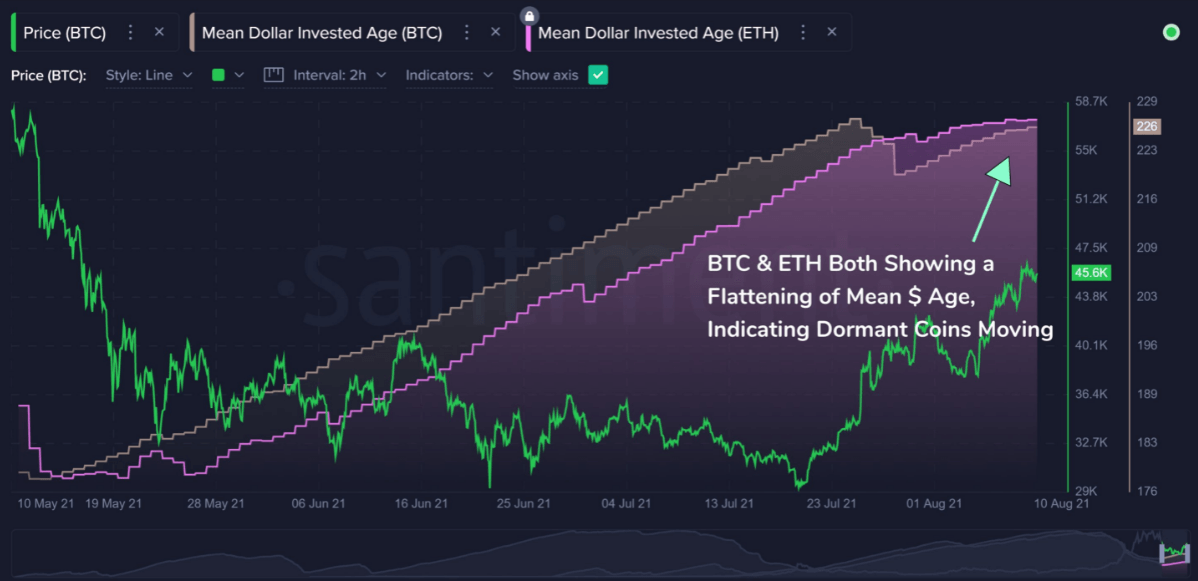

One of the key indicators that signal the end of a bearish period is the mean dollar invested age. This indicator measures the average duration that dollars invested in Bitcoin and Ethereum were held in an address without any movement.

Dormancy and lack of movement are considered negative signs for the crypto's price. Currently, the average age of dollars has stopped rising for Bitcoin and Ethereum, and this implies that BTC and ETH held dormant in investors' wallets is now on the move.

Mean dollar invested age

Indicators that predict the movement of price based on dormancy quantify traders’ intent (to buy or sell). On similar lines, Willy Woo, an independent Bitcoin analyst, quantified supply shock in BTC and ETH to predict future price movements.

Woo has presented several methods to calculate traders' intent by estimating the supply that is not available against the available supply.

Woo explains long-term holder supply shock (LTHSS) as the movement of coins that have not moved in a long time or were considered unavailable. The mean dollar invested age indicator currently suggests that BTC and ETH are both subjected to a long-term holder supply shock, which is bullish for the cryptocurrencies' price.

Woo states that LTHSS provides a broader macro view of bull and bear phases of the market. In his recent tweet, Woo remarked that Ethereum supply shock is at an all-time high.

Ethereum supply shock well and truly at all time highs.

— Willy Woo (@woonomic) August 10, 2021

Looks like the market overpriced it in May but is probably underpricing it July / August. pic.twitter.com/PIUKN6DLv9

Mention of "sell" or "selling" on crypto platforms

Analysts and traders support BTC and ETH's bullish outlook, but Coinbase's second quarterly report for 2021 highlights how the top cryptocurrencies compete with altcoins for retail and institutional demand.

Total trading volume for BTC and ETH accounted for 50%, down from 60% in quarter one. Both retail and institutional traders have contributed to the increase in altcoin trading volume. This trend could negatively impact the price rally of Bitcoin and Ethereum in the next quarter.

Luke Martin, host of the Profit Maximalist show that explores trading strategies in crypto, described the current state of the market in his recent tweet:

That sweet spot where bitcoin is taking a breather after pumping but general market is still bullish enough that altcoins pump harder...nothing better.

— Luke Martin (@VentureCoinist) August 10, 2021

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.