Dogecoin struggles with consolidation as it continues to wait for the return of its 700,000 investors

- Dogecoin has been stuck moving only sideways for more than two months now.

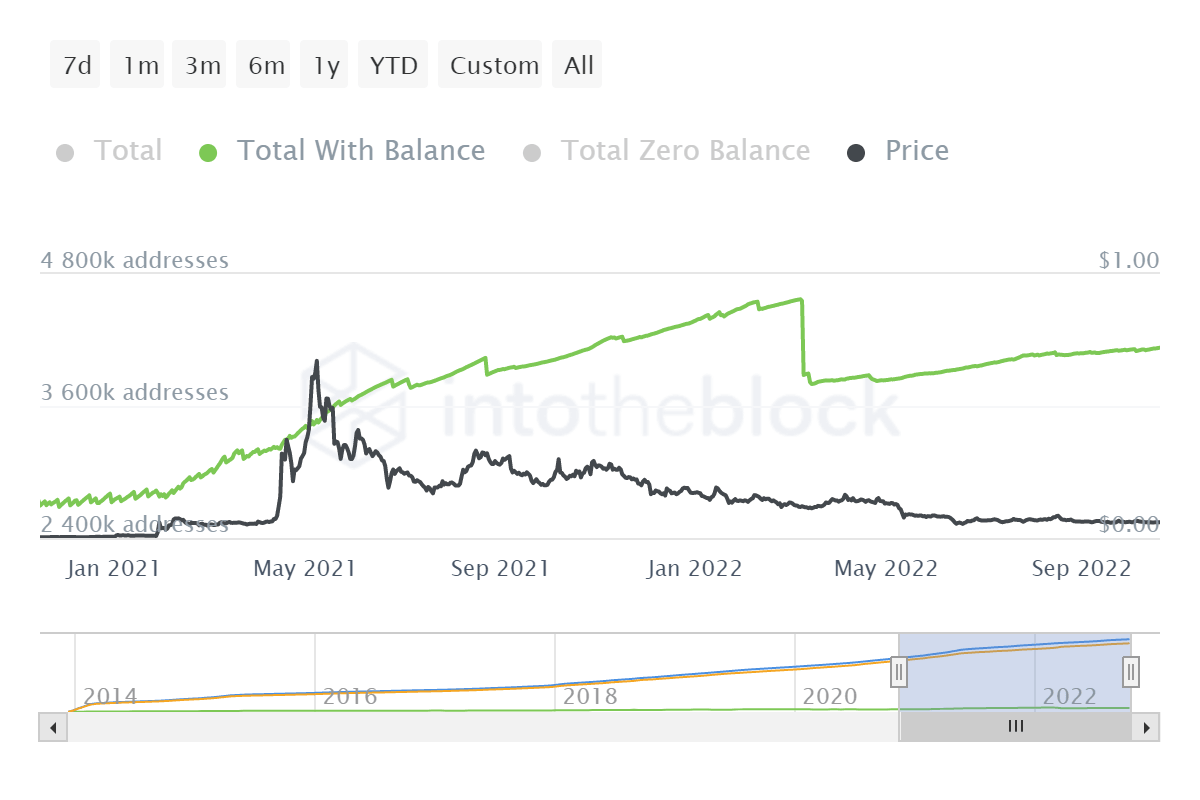

- Back in March, more than 700k DOGE holders left the network within 48 hours, less than half of which have returned since.

- Reclaiming those investors, combined with the changing market conditions, would serve as a major price boost for Dogecoin.

Dogecoin has not noted any noticeable change in price due to no significant development either within the network or externally. As a result, investors haven't been finding the asset particularly lucrative. The few who did will have to wait for a while longer before any profits appear in their portfolio.

Dogecoin's loss

Back in March this year, an interesting instance took place when more than 700,000 DOGE holders exited the market within the same 48 hours. Although the reason behind the same remains unknown, it did make Dogecoin investors slightly conscious concerning price action.

Dogecoin addresses

Fortunately, no impact on price was observed, and following this, post regular fluctuations, DOGE settled around $0.059 in August. Since then, the momentum has been completely sideways. Stuck within the Fibonacci Retracement of $0.1729 and $0.0491, DOGE has not even reached close to breaching through the 23.6% Fib line. Coinciding at $0.0783, this level represents a key support area for DOGE's recovery of the local top at $0.1729.

Although price indicators seem to be pointing towards a no at the moment. All three Simple Moving Averages - 50-day (red), 100-day (blue) and 200-day (green) - have been acting as resistance for DOGE for almost two months now.

Furthermore, this month, the somewhat positive upper hand DOGE had also been wiped away following the bearish crossover on the MACD.

Chances of recovery?

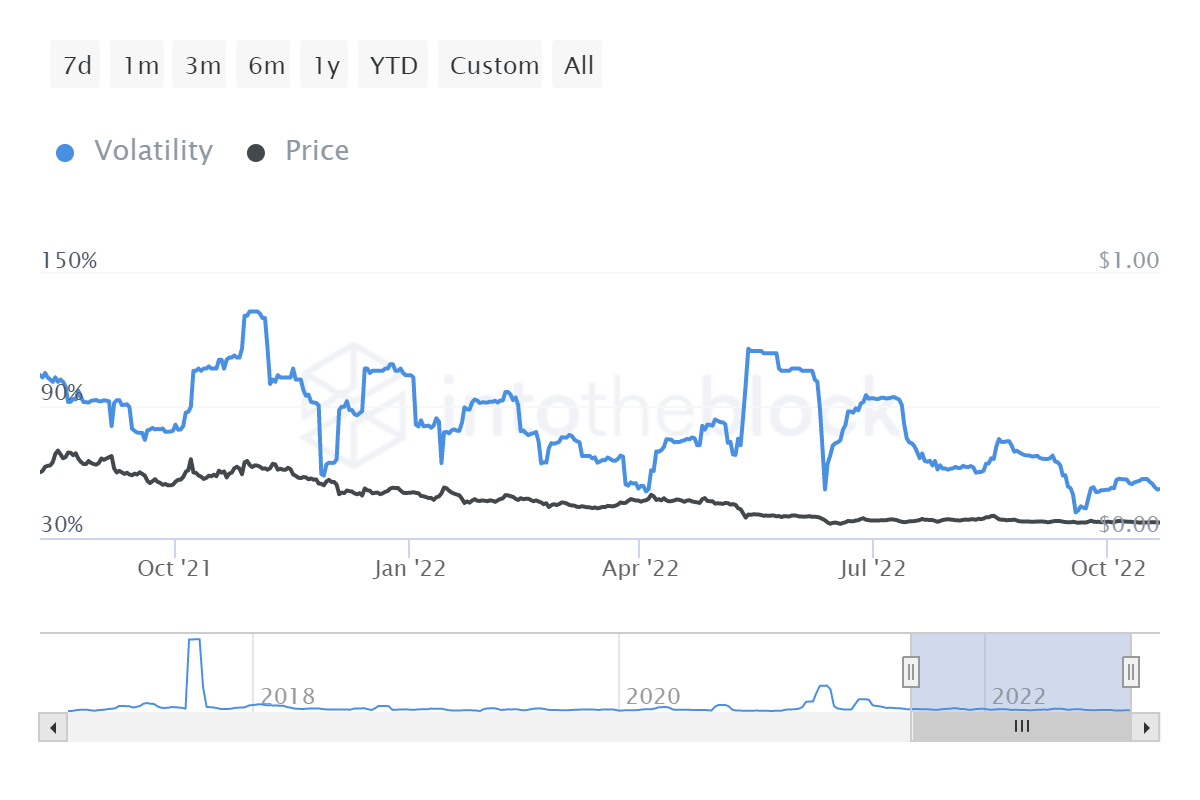

Since, as mentioned above, Dogecoin currently has no significant external development on the horizon, it remains dependent on the broader market cues. Additionally, the asset's volatility is also a crucial factor.

If the volatility remains low, the chances of a price swing also decrease, which would keep DOGE stuck at current price levels. Currently, Dogecoin's volatility is at a mere 52%, and in order to break free of the consolidation curse, this figure would need to double at the least.

Dogecoin's volatility

Only then could Dogecoin experience some semblance of a recovery.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.