Dogecoin Price Prediction: DOGE tackles $0.21 resistance after 5% gain, but derivatives remain weak

- Dogecoin gained 5% on Monday after over two weeks of steady declines, constituting a 35% loss.

- The memecoin's open interest and funding rates have remained weak, aligning with its decline in the past two weeks.

- DOGE is tackling the $0.21 resistance as its technical indicators hint at a recovery.

Dogecoin (DOGE) is up 5% on Monday, joining the general crypto market in showing recovery signs. In a bid to offset a 35% decline in the past two weeks, the top memecoin is tackling the $0.21 resistance, strengthened by key technical indicators.

DOGE derivatives and on-chain data remain at weak levels despite recent rise

Dogecoin is showing recovery signs on Monday, rising about 5% as it looks to break out of its bearish trend over the past two weeks. The memecoin declined 35% from the last two weeks of July, spanning into August 3.

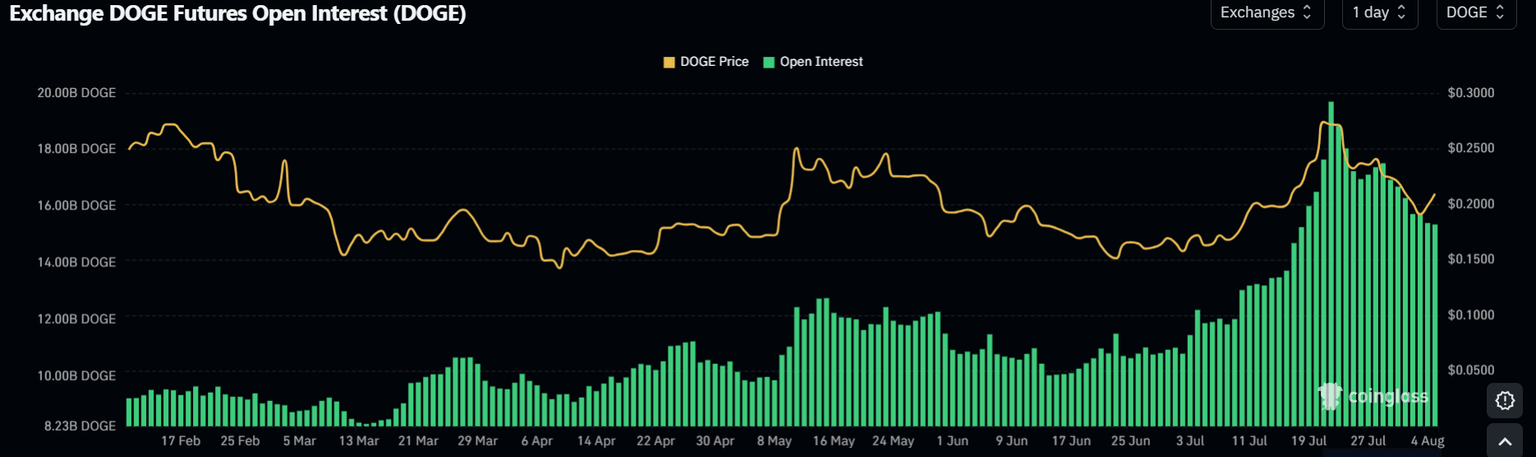

The weakness in DOGE is also reflected in its futures open interest, which has been declining steadily alongside its price.

Open interest (OI) refers to the total number of outstanding contracts in a derivatives market. During its price decline, Dogecoin's OI dropped from 19.69 billion DOGE to 15.36 billion DOGE. At the same time, its funding rates have remained largely at low levels after plunging from overheated conditions in mid-July.

DOGE Open Interest. Source: Coinglass

Meanwhile, DOGE whales, entities holding 10-100 million tokens, added firepower to the downtrend with their selling spree of over 740 million DOGE tokens since July 17, per Santiment data.

DOGE tests $0.21 as Stoch recovers from oversold conditions

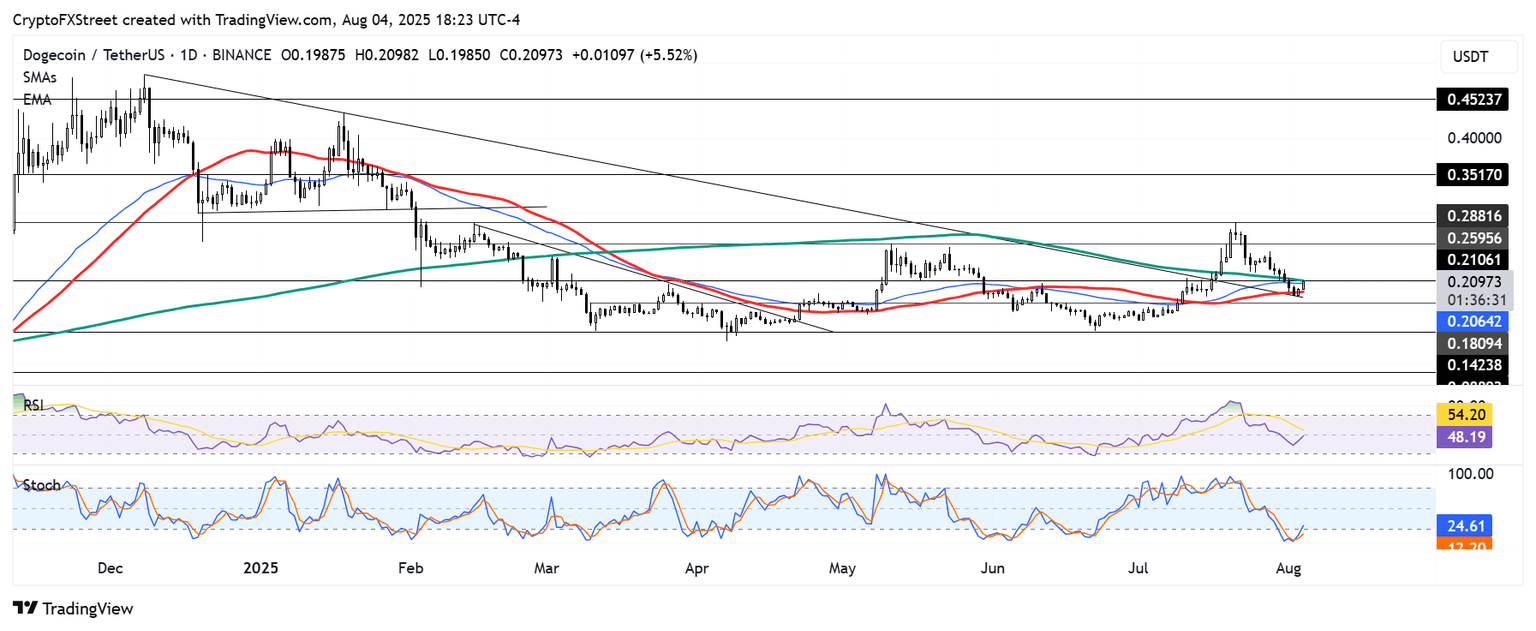

On the technical side, DOGE bounced off a descending trendline extending from December 2024 and is testing the $0.21 resistance, which is strengthened by the 50-day Exponential Moving Average (EMA) and 200-day Simple Moving Average (SMA). A move above this level and a subsequent flip of the $0.26 hurdle could see the top memecoin rise to tackle its six-month resistance at $0.28.

DOGE/USDT daily chart

Dogecoin's Stochastic Oscillator (Stoch) is also showing signs of recovery from oversold conditions, while the Relative Strength Index (RSI) is testing its neutral level line. A firm move above the neutral level in both momentum indicators could spark a strong recovery for the memecoin.

On the downside, DOGE could decline toward $0.14 if it fails to hold the $0.18 level.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi