Toncoin eyes ascending triangle support following Verb Technology's $558 million TON reserve plan

- Verb Technology plans to launch the first ever TON treasury following a $558 million PIPE investment.

- The company revealed it will rebrand as TON Strategy following the close of the PIPE deal.

- Verb shares skyrocketed over 150% following the announcement, but TON failed to react, declining toward a right-angle triangle support.

Toncoin (TON) is down 6% on Monday despite Verb Technology's (VERB) plans to raise $558 million via a Private Investment in Public Equity (PIPE) offering to establish a TON treasury.

TON declines amid Verb Technology's $558 million treasury plan and rebrand to TON Strategy

Nasdaq-listed social commerce company Verb Technology is set to raise $558 million in a private placement to become the first publicly-traded firm to adopt Toncoin as a primary treasury reserve asset, according to a statement on Monday.

The PIPE investment involves the sale of approximately 58.7 million shares at $9.51 each. The company claims the funding round has drawn participation from more than 110 investors, led by Kingsway Capital and anchored by Blockchain.com, Vy Capital, Ribbit Capital and Graticule.

Following the expected close of the transaction on or around August 7, Verb Technology will rebrand as TON Strategy Co. and will use most of the proceeds to purchase TON.

The rebrand is expected to bring crypto and institutional finance leaders into TON Strategy Corp's executive team. Manuel Stotz, CEO of Kingsway Capital and President of the TON Foundation, will serve as Executive Chairman of the company. Veronika Kapustina, a former advisor to the TON Foundation and ex-Morgan Stanley banker, will take on the role of CEO. Sarah Olsen, co-founder of Europa Partners and former Head of Corporate Development at JPMorgan's Kinexys, will serve as CFO, while Blockchain.com CEO Peter Smith will join as a special advisor.

"In my judgment, permanent capital vehicles are particularly suitable for long-term holdings of TON, which not only has the potential to compound in value, but also offers staking yield, meaning TSC can benefit from staking rewards," said Manuel Stotz, incoming Executive Chairman for TON Strategy Corp.

Verb Technology added that it will lock up 36% of its shares for up to 12 months. It also plans to keep 77% of the potential capital from the PIPE investment in cash, which it claims will equal about 5% of TON's total circulating supply.

Verb Technology shares rose over 150% following the announcement, but TON failed to react, down 6% in the past 24 hours.

TON could bounce off ascending right-angle triangle support

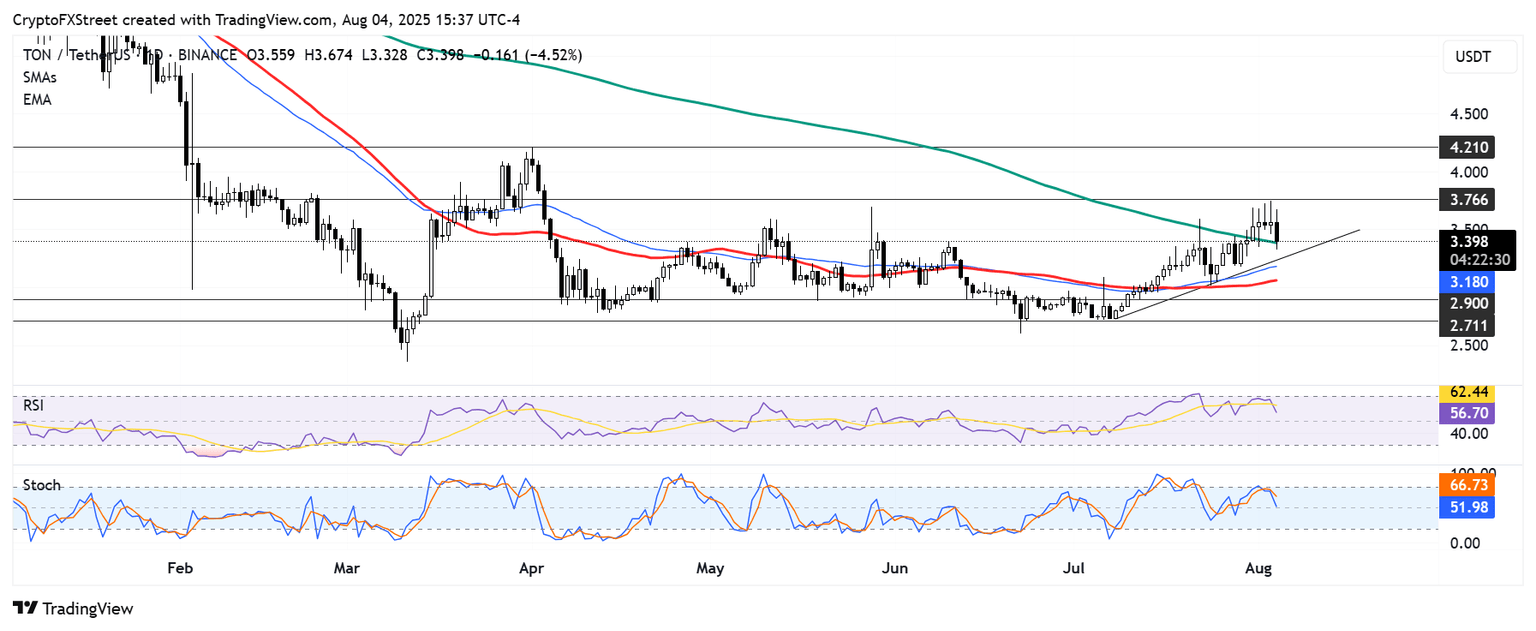

After crossing above the 200-day Simple Moving Average (SMA) last week, TON saw a rejection at the resistance near $3.76 on Sunday. Following its subsequent decline, the altcoin is testing the 200-day SMA. The lower boundary trendline of an ascending right-angle triangle could provide support on the downside if the 200-day SMA support fails. Further down, TON has key support levels near the 50-day Exponential Moving Average (EMA) and SMA, $2.90 and $2.71, respectively.

TON/USDT daily chart

On the upside, TON could retest the $3.76 resistance if it bounces off the triangle's ascending trendline. A move above $3.76 could stretch its rally to the $4.21 hurdle.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are trending downward toward their neutral level line, indicating a weakening bullish momentum.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi