Dogecoin Price Prediction: DOGE rises 3% as Bit Origin unveils $500 million Dogecoin treasury

- Bit Origin announced that it entered into an agreement with investors to raise $500 million to launch a Dogecoin treasury.

- The company claims to have raised an initial $15 million to kickstart its DOGE acquisition strategy.

- DOGE is up 3% and could stretch its rally to $0.26 if it overcomes the convergence of several key resistance levels.

Dogecoin (DOGE) gained 3% on Thursday following Nasdaq-listed Bit Origin's (BTOG) announcement that it plans to raise up to $500 million from the sale of its shares and convertible debt to launch a DOGE treasury.

Bit Origin plans to establish $500 million Dogecoin treasury

Singapore-based crypto miner Bit Origin has set its sights on a Dogecoin treasury, with plans to raise up to $500 million to launch a reserve focused on the memecoin, according to a press release on Thursday.

The firm revealed that it has entered into agreements with investors to raise $400 million from the sale of its Class A ordinary shares and up to $100 million in debt offerings to establish its Dogecoin reserve.

Bit Origin stated that it has completed an initial closing of $15 million under its convertible debt facility and will use part of the proceeds to begin acquiring Dogecoin.

"Bit Origin is evolving beyond mining infrastructure to engage directly in the value and utility of digital assets," said Jinghai Jiang, CEO and Chairman of Bit Origin.

The company plans to explore mining, payment applications and other yield-bearing services within the Doge ecosystem. Bit Origin also shared its optimism for Dogecoin's integration into payment platforms such as X Money, citing low fees and transaction speed as major factors for the choice.

"We hope Doge's performance and community make it a natural fit for X Money, as Elon Musk advances his vision for X as a global super-app," Jiang added.

Bit Origin joins a growing list of public mining companies that have pivoted toward an altcoin-focused treasury, including BitMine, Bit Digital and Bit Mining.

The company, which is one of the first public firms to express interest in adopting Dogecoin as a treasury asset, plans to become one of the largest public holders of the memecoin.

The announcement triggered a 74% surge in the company's stock on Thursday due to its small market capitalization. Despite the rally, BTOG is down 42% year-to-date.

DOGE could stretch its rally to $0.26

DOGE is up 3% over the past 24 hours following the announcement, stretching its weekly gains over 16%.

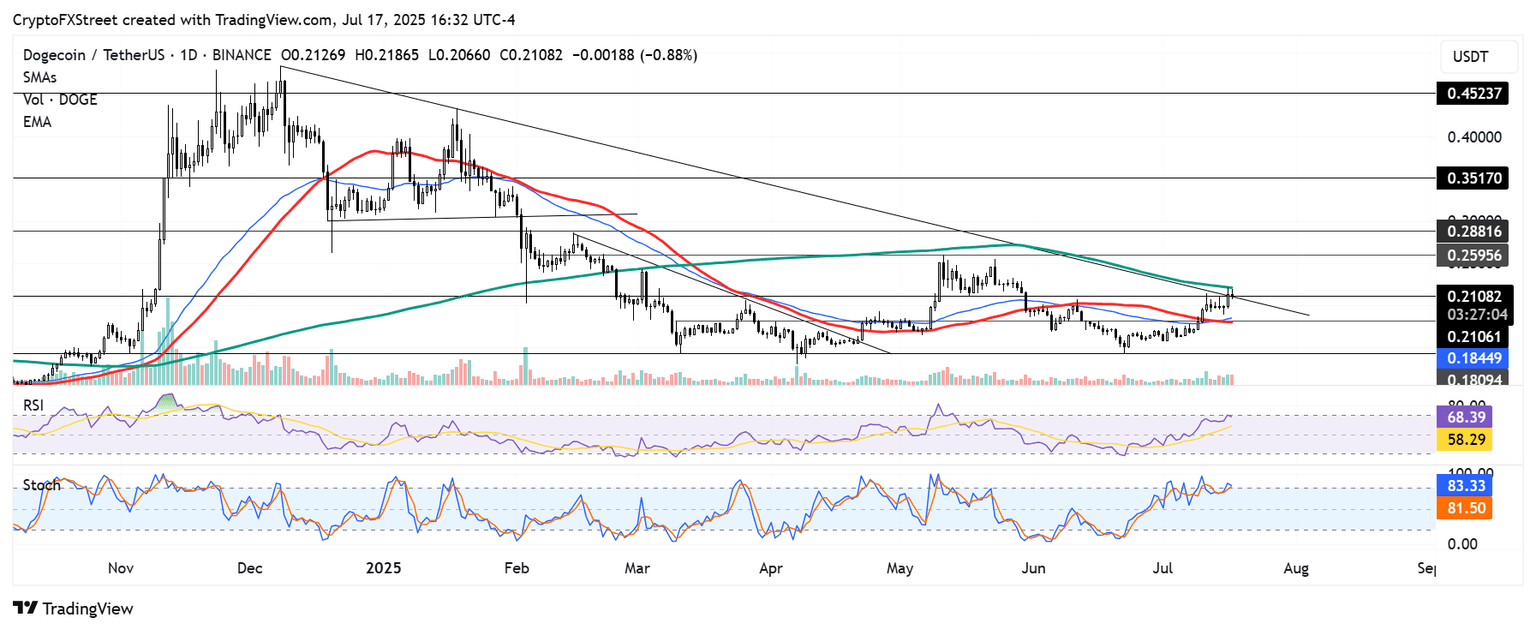

The number one memecoin is battling the convergence of several resistance levels comprising a descending trendline, the $0.210 level, and the 200-day Simple Moving Average (SMA). A firm move above these levels could see DOGE stretch its rally to test the $0.259 resistance.

DOGE/USDT daily chart

On the downside, DOGE could hold the $0.180 support level, which is strengthened by the 50-day SMA and Exponential Moving Average (EMA).

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are hovering near their overbought regions, indicating dominant bullish momentum but with rising potential of a pullback.

A daily candlestick close below $0.142 will invalidate the thesis.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi