Dogecoin Price Forecast: Why rising supply in profit could slow down DOGE’s rally

- Dogecoin settles above $0.2000, fueled by rising retail interest, particularly in the derivatives market.

- Dogecoin’s supply in profit soars to 86 billion DOGE, increasing the probability of sell-side pressure overshadowing demand.

- Technical indicators offer bullish signals as bulls seek support above the 200-day EMA in aid to extend Dogecoin’s uptrend.

Dogecoin (DOGE) extends recovery, breaking above the critical $0.2000 level on Monday, backed by rising retail interest. The 44% surge in the leading meme coin by market capitalization has pushed the network’s supply higher in profit, hinting at a potential pullback or slowdown in the rally if investors cash out for profit.

Dogecoin’s uptrend is steady, but fundamental risks could persist

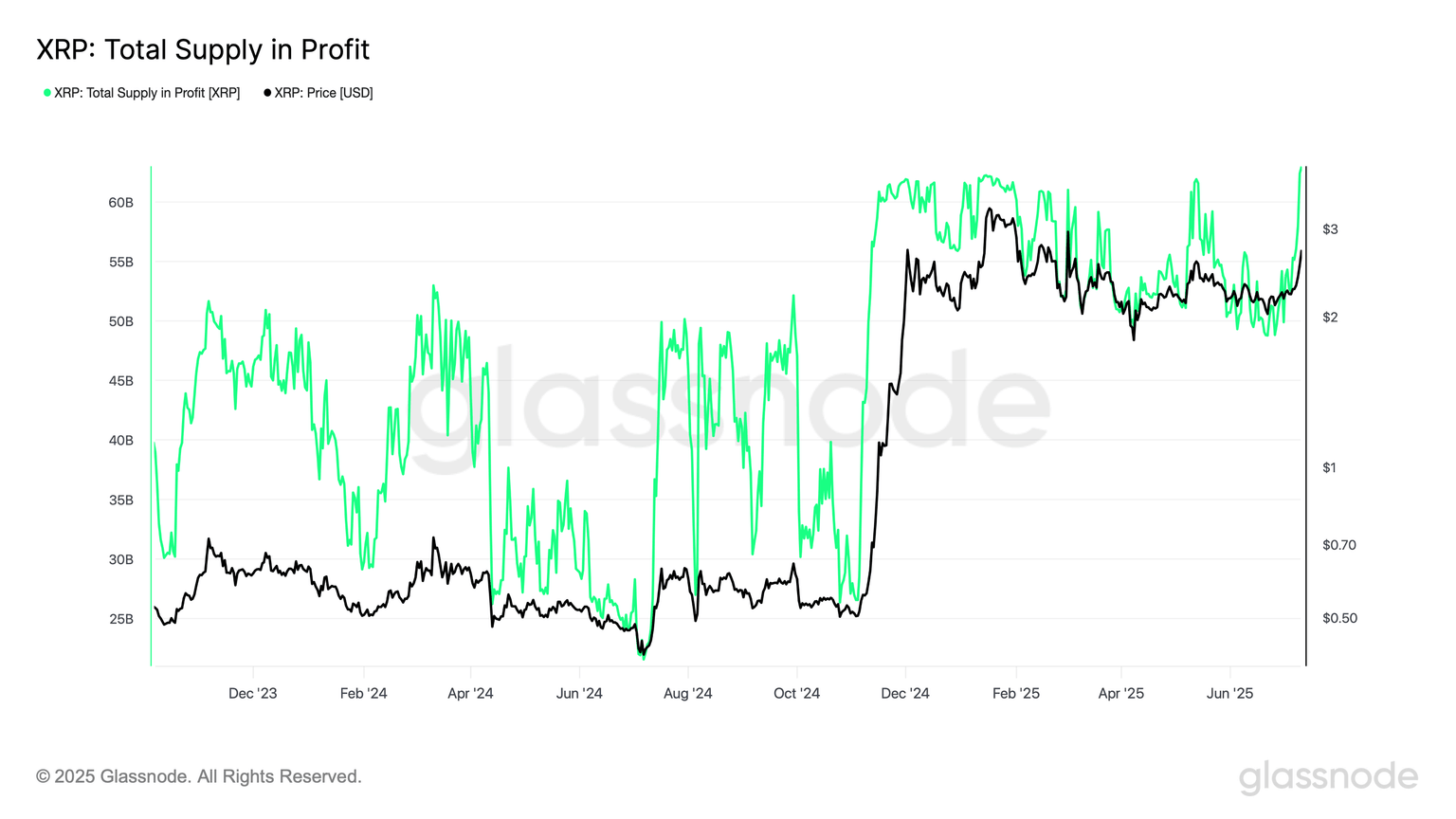

Dogecoin sits above the critical $0.2000 level while trading at $0.2060 at the time of writing. The steady price increase has seen the meme coin’s supply in profit expand, reaching approximately 86 billion, according to Glassnode.

As the Supply in Profit metric rises, more holders become profitable and, in turn, increase the risk of a pullback. Investors prefer to sell their holdings when in profit, as opposed to periods of unrealized loss.

Dogecoin’s supply in profit peaked at around 121 billion DOGE in May. This coincided with the increase in price from April’s tariff-triggered crash at around $0.1302 to $0.2597, the highest top in May.

The trend correction that followed this upswing found support at around $0.1429 in June before bulls tightened their grip, propelling the Dogecoin price to its current level.

Dogecoin Supply in Profit metric | Source: Glassnode

The Balance on Exchanges metric highlights a sharp increase in the number of DOGE tokens on exchanges to 23.5 billion from approximately 23.2 billion in mid-June.

Holders often transfer their assets to exchanges when intending to trade or sell, which predisposes the Dogecoin price to potential selling pressure.

Dogecoin Balance on Exchanges metric | Source: Glassnode

Considering the increase in the supply in profit and balance on exchanges, traders should move with caution, aware that the uptrend could encounter headwinds.

Technical outlook: Dogecoin seeks higher support

Dogecoin price sits above two key levels, including the pivotal $0.2000 and the 200-day Exponential Moving Average (EMA), currently at $0.2027. Based on the outlook of the Money Flow Index (MFI) indicator, which tracks the amount of money entering and leaving DOGE, risk-on sentiment backs the uptrend.

The Relative Strength Index (RSI), trending upward at 65, signals bullish momentum. However, its proximity to overbought territory calls for caution. Higher RSI readings above 70 suggest that the market is overheating, and a trend reversal could be on the horizon.

DOGE/USDT daily chart

Still, interest in Dogecoin remains relatively high, as evidenced by the futures contracts’ Open Interest (OI), which stands at $2.67 billion, up from June’s lowest OI value of $1.64 billion.

Dogecoin Futures Open Interest | Source: OI

Note that OI refers to the total value of all the futures and options contracts that have not been settled or closed. The persistent increase in OI means that traders are betting more on the Dogecoin price rising as opposed to falling in the short term.

That said, support at the 200-day EMA at $0.2027 is worth monitoring as it could serve as a springboard to another breakout targeting $0.3000. On the other hand, a decline below this level could result in a trend reversal toward June’s low of around $0.1429.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren