Dogecoin Price Forecast: DOGE could extend technical breakout, targeting $0.20 threshold

- Dogecoin is maintaining a bullish technical pattern breakout with a 20% move to $0.1955 as the target.

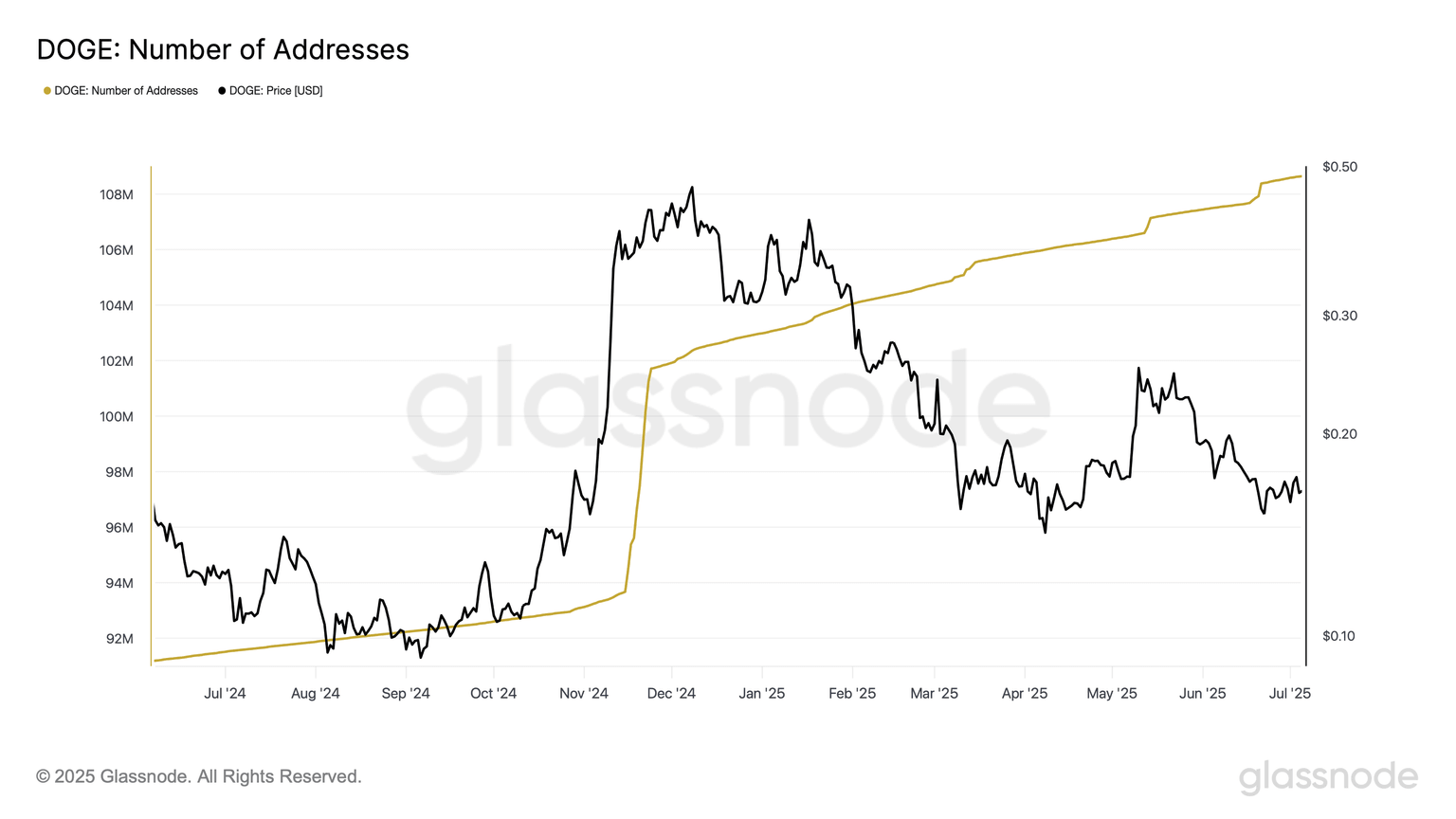

- Fundamental interest in Dogecoin remains steady, underpinned by a 5% increase in the number of addresses over the past six months.

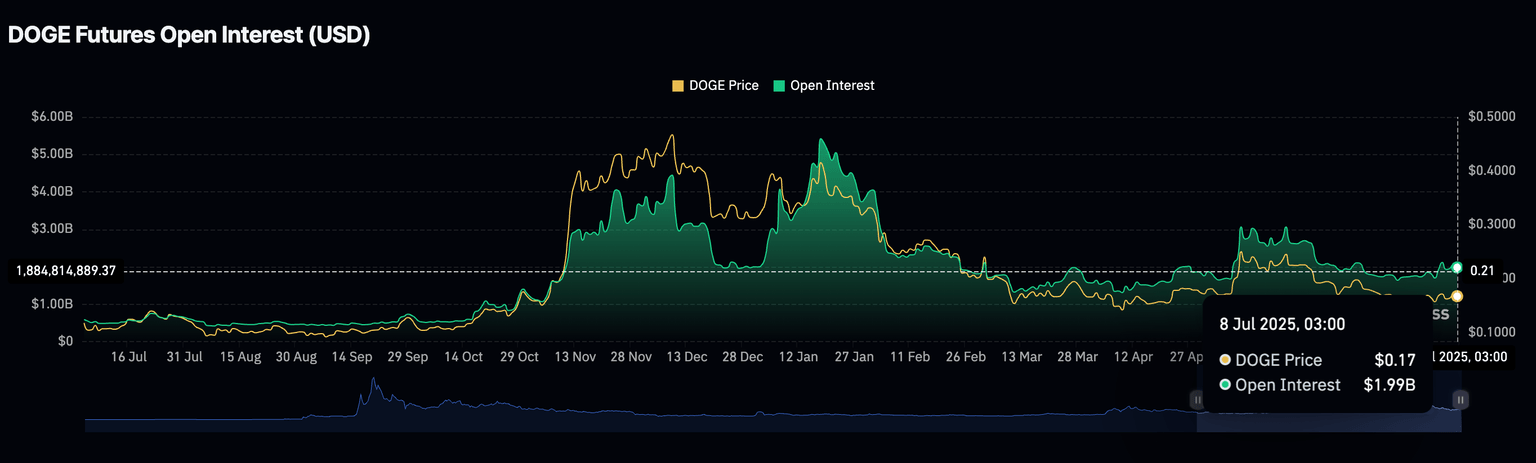

- Micro interest in Dogecoin subdued with the futures contracts’ Open Interest standing at $2 billion, down from the January peak level of $5.42 billion.

Dogecoin (DOGE) is steadying its recovery on Tuesday, following a technical breakout in the previous month. The leading meme coin hovers at around $0.1701 at the time of writing, showcasing the potential for further gains while aiming for the resistance level of $0.2000.

Dogecoin addresses hit new all-time high

The number of addresses on the Dogecoin network maintained a bullish outlook, reaching a new all-time high of approximately 108 million. According to Glassnode data, this growth represents a 5% increase from the January 4 level of around 103 million as of July 4.

Network growth indicates a rising interest in DOGE, which has a direct impact on the token's adoption. A 5% increase in addresses indicates that more users are joining the ecosystem, reflecting a surge in retail interest. Adoption has the potential to boost demand, driving risk-on sentiment, which is likely to result in steady price increases.

Dogecoin number of addresses | Source: Glassnode

Despite the surge in network activity over the past six months, speculative interest in the meme coin remains significantly subdued. Based on CoinGlass data, the Dogecoin futures contracts Open Interest (OI) sits considerably lower than levels seen at the beginning of the year.

The chart below shows OI standing at approximately $2 billion, down from roughly $5.42 billion on January 18. There was an attempt at recovery in May. Still, interest in Dogecoin derivatives faded with Open Interest, which refers to the value of all the futures and options contracts that have not been settled or closed, averaging $3 billion.

Dogecoin Open Interest data | Source| Coinglass

Downward pressure on Dogecoin’s price remains apparent, considering the total liquidations of $3.84 million over the past 24 hours. Long positions account for $3 million of the cumulative total, with approximately $837 million in short positions wiped out.

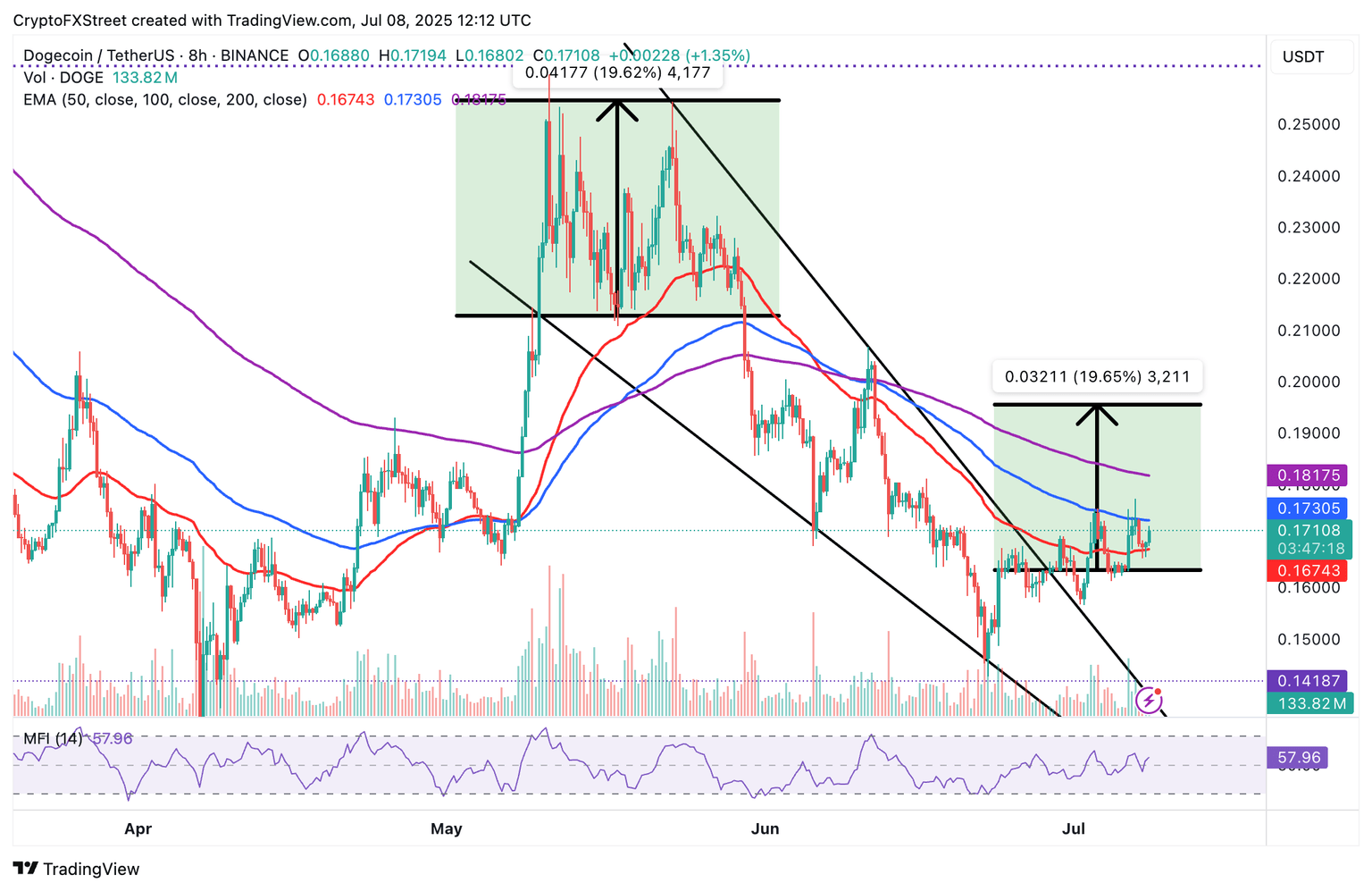

Technical outlook: Dogecoin nurtures wedge pattern breakout

Dogecoin bulls are attempting to uphold the recovery following the breakout of a falling wedge pattern in late June. This bullish pattern forms during downtrends, characterized by two converging trendlines that signal declining sell-side pressure.

The breakout, marked by Dogecoin’s price movement above the upper trendline, indicates a higher potential for an uptrend. Volume is a crucial factor in validating a wedge pattern.

A spike in trading volume helps bulls sustain the uptick in price toward a 20% breakout target of $0.1955. This target is determined by measuring the distance between the widest points of the pattern and then extrapolating above the breakout point, as shown on the daily chart.

DOGE/USDT daily chart

Following the breakout at $0.1634, DOGE climbed to $0.1753 before retreating to test the upper trendline at around $0.1565 on Wednesday.

The recovery that ensued as traders bought the dip propelled DOGE higher, but its upside remains capped under resistance, highlighted by the 100-day Exponential Moving Average (EMA) at $0.1730.

Key technical indicators, such as the Money Flow Index (MFI), which tracks the amount of money entering Dogecoin, are trending upward at 57. In other words, risk-on sentiment is present in the spot market, which could boost Dogecoin’s recovery potential.

Still, traders could temper their bullish expectations considering potential resistance at the 200-day EMA, which holds at $0.1817. In the event of a reversal from the current price level, the 50-day EMA at $0.1674 could serve as immediate support and prevent an extended pullback to the support level tested at $0.1565 on July 2.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren