Dogecoin price eyes recovery as whales scoop up DOGE

- DOGE transactions exceeding $100,000 climbed significantly in November, when compared to last month.

- The rising interest in DOGE is likely from institutional investors and whales, priming Dogecoin for a price recovery.

- DOGE could erase its weekly decline and make a comeback to the $0.087 local top.

The largest Shiba-Inu-themed meme coin in the crypto ecosystem has observed a spike in large volume transactions exceeding $100,000. Institutions and large wallet investors have likely fueled demand for DOGE throughout November.

Also read: Bitcoin price might hit $40,000 target if Tether whales support BTC gains

DOGE large volume transactions see notable spike in November

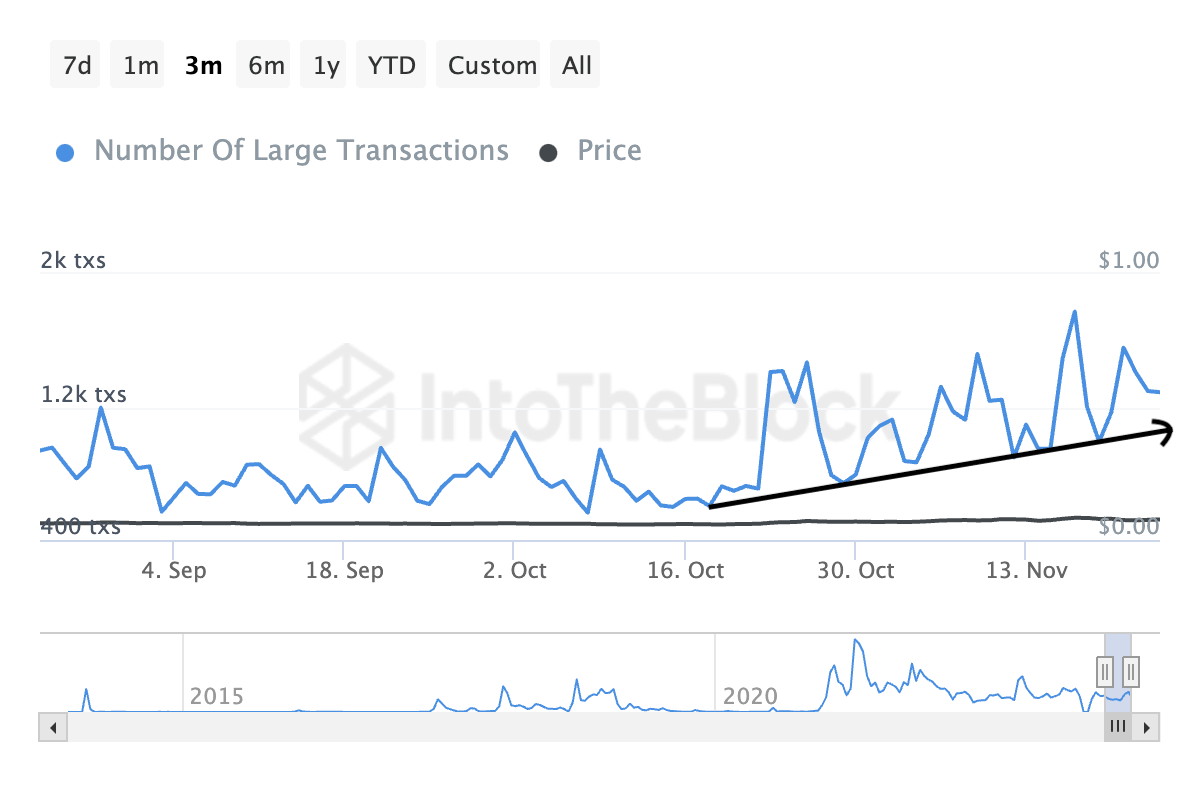

Based on data from crypto intelligence tracker IntoTheBlock, there is a notable surge in DOGE transactions, exceeding $100,000 in November. DOGE price rallied alongside the increase in large volume transactions in DOGE. In DOGE’s uptrend, the rising activity can be considered a sign of further gains in DOGE.

DOGE large volume transactions and price

Large volume transactions in November, exceeded those seen in October, as presented in the Santiment chart below.

Whale transactions $100,000 or higher in DOGE

Whales scoop of DOGE tokens

Since the beginning of October, whales in three segments, holders of 1 million to 1 billion DOGE tokens, consistently added to their holdings throughout October and November 2023. The consistent accumulation and DOGE’s price rise, fuel a bullish thesis for the meme coin’s recovery.

DOGE whale accumulation and price

DOGE price is $0.0787 at the time of writing. The meme coin noted a correction over the past week, price declined nearly 9%. A recovery in DOGE could erase recent losses and push the meme coin towards its bullish target of $0.087, the local top seen on November 17.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B13.00.01%2C%252025%2520Nov%2C%25202023%5D-638364956956118648.png&w=1536&q=95)

%2520%5B12.51.33%2C%252025%2520Nov%2C%25202023%5D-638364956304893813.png&w=1536&q=95)