DeFi platforms face scrutiny after $120 million Balancer hack

- Balancer said the hack affected only old pools that have been live onchain for several years.

- Many questioned the safety of DeFi platforms, considering Balancer had undergone several audits.

- The crypto market saw over $1 billion in liquidations following the hack, with Bitcoin and Ethereum noting losses.

Following a hack in which attackers stole over $120 million from its platform, Balancer, one of the oldest decentralized exchanges, issued a statement on Monday. The exchange claimed it couldn't pause the hack as it affected very old pools.

"Because these pools have been live onchain for several years, many were outside the pause window. Any pools that could be paused have been paused and are now in recovery mode," Balancer wrote in a Monday X post.

Balancer clarified that the attack was limited to its "V2 Composable Stable Pools and does not impact V3 or other Balancer pools."

According to crypto intelligence firm GoPlus Security, the hacker "exploited a rounding-down precision loss in Balancer Vault's swap calculations. Each calculation rounded down, affecting token prices. The batchSwap function amplified this vulnerability, allowing attackers to manipulate prices through crafted parameters."

Crypto community questions safety of DeFi platforms

The hack has sparked doubts across the crypto community over the security of DeFi platforms. Many questioned how the attacker succeeded despite Balancer's claim that it "has undergone extensive auditing by top firms, and had bug bounties running for a long time to incentivize independent auditors."

Crypto researcher Suhail Kakar noted in a Monday X post that "Balancer went through 10+ audits, the vault was audited 3 separate times by different firms [and it] still got hacked."

Ryan Sean Adams of the Bankless podcast also commented, "Balancer hack is a setback for DeFi. If it can happen to Balancer it can happen to anything."

Several blockchain platforms quickly responded to the hack with validators of Berachain halting the network and Sonic introducing a freeze functionality scheduled for an upcoming upgrade.

However, the move prompted many to question the decentralization and immutability of blockchains if validators can carry out such actions.

https://x.com/RyanSAdams/status/1985434780960506319

Liquid staking platform Stakewise updated users that it has recovered over $20 million of stolen funds from the hack via several transactions executed on its multisig wallet.

Despite actions taken by several protocols to limit the hack, the attacker has continued converting part of the stolen funds to ETH, according to smart money tracker Lookonchain.

Crypto market drops over 3%, sparks $1.2 billion in liquidations

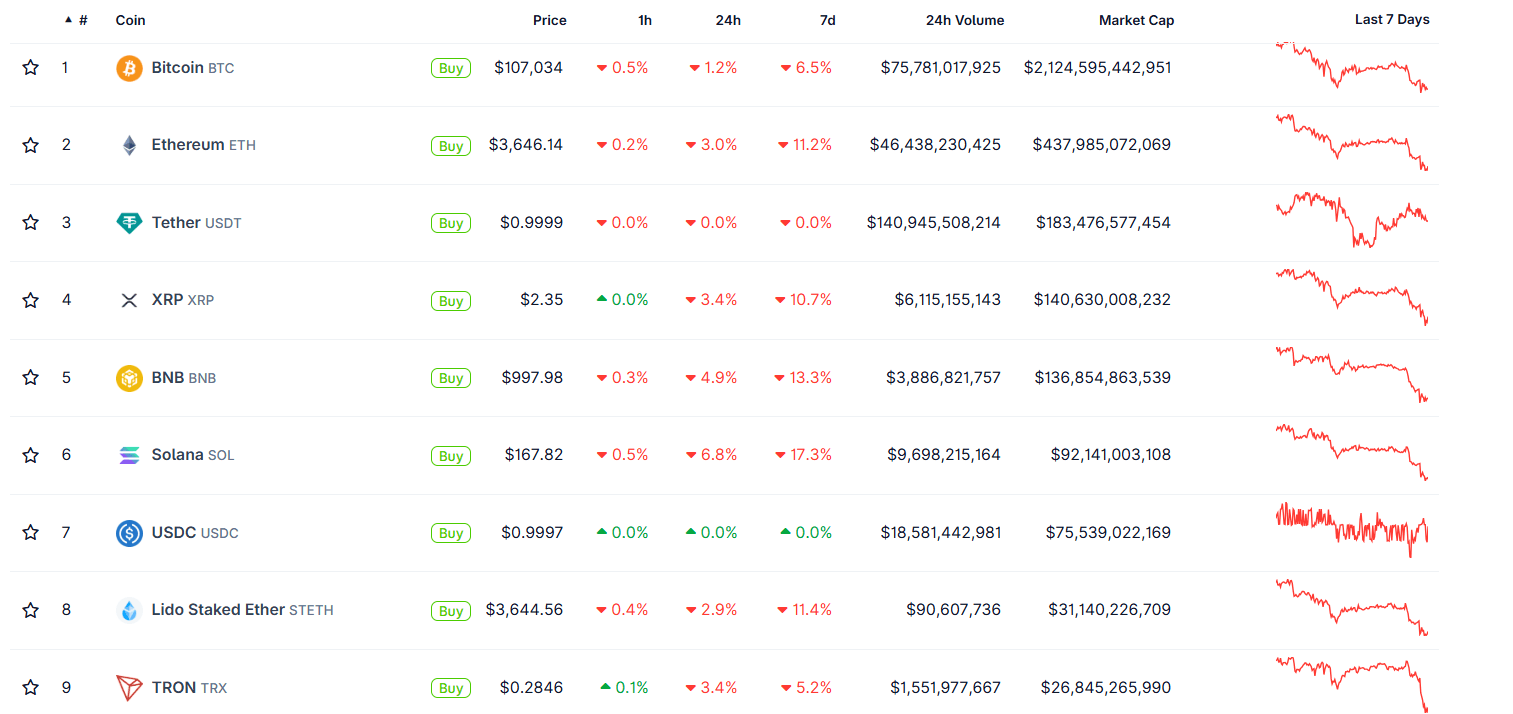

The crypto market has lost 3.2% of its valuation since the hack began, with top cryptocurrencies Bitcoin (BTC), Ethereum (ETH), XRP, BNB, and Solana (SOL) spearheading losses.

Top Cryptos. Source: Coingecko

On the derivatives side, liquidations skyrocketed to $1.23 billion, comprising $1.1 billion in long liquidations and $128.4 million in short liquidations, per Coinglass data.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi