Bitcoin, crypto market logs over $1 billion in long liquidations

- The crypto market has recorded more than $1.1 billion in long liquidations over the past 24 hours.

- While several traders closed positions at a loss, a Bitcoin OG returned to long Bitcoin and Ethereum.

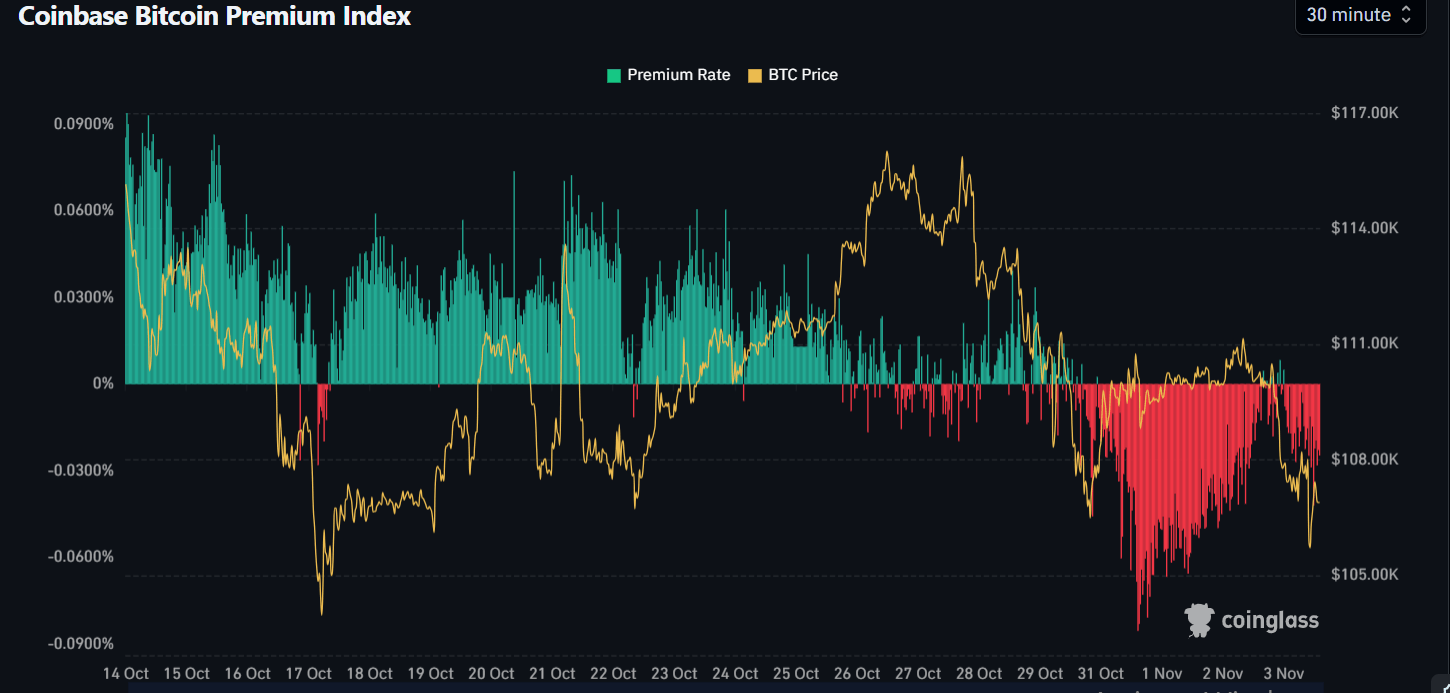

- US investors are likely to have spearheaded Bitcoin's decline, as the Coinbase Premium flipped back into negative territory.

The crypto market has recorded more than $1.20 billion in 24-hour liquidations from 319,433 positions on Monday, according to Coinglass data. The liquidation was spearheaded by over $1.1 billion in liquidated long positions with just $115.5 million in short liquidations.

The high liquidations followed a quick crash in Bitcoin (BTC) and Ethereum (ETH), from $108,000 to $105,000 and $3,700 to $3,500 within one hour, respectively. Within the same hour, both assets saw liquidations totaling over $100 million each. The largest liquidation order occurred on crypto exchange HTX, valued at $33.9 million.

The figure could be higher than reported, as crypto liquidation data from aggregators is often understated due to limited data feeds and API discrepancies across most exchanges.

A key trader, 0xc2a3, who previously boasted a 100% win rate, closed several positions in Bitcoin, Ethereum, and Solana (SOL) at a loss, according to smart money wallet tracker Lookonchain. The trader's net profit/loss on decentralized perpetual exchange Hyperliquid flipped from +$33 million to –$17.6 million.

Another popular trader, Machi Big Brother, was fully liquidated, recording a total loss of over $15 million.

However, after the decline paused, a key Bitcoin OG, who successfully timed the October 10 crash, opened $37 million worth of BTC and $18 million worth of ETH long positions on Hyperliquid, per Arkham data.

The October 10 crash saw cryptocurrencies log nearly $20 billion in liquidations. On October 30, the market also recorded over $1 billion worth of liquidated positions.

Why did the crypto market decline?

US investors are likely to have spearheaded the decline, as the Coinbase Bitcoin Premium Index hovered around -$30 during the plunge. The index was largely negative throughout the weekend, briefly reaching -$80 on Friday.

Coinbase Bitcoin Premium Index. Source: Coinglass

Bitcoin has recovered above $107,000, but is down 2.7% over the past 24 hours at the time of publication.

The top crypto's decline sparked a similar move across several altcoins, with ETH, XRP, BNB, and SOL experiencing losses of 6%, 7%, 8% and 10%, respectively.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi