Decentraland price gets firm rejection and is near support for a bounce

- Decentraland price was close to gains but gave it all up during the week.

- MANA received a double top rejection against a crucial cap on the topside.

- Bulls must watch this level to avoid being trapped in a meltdown.

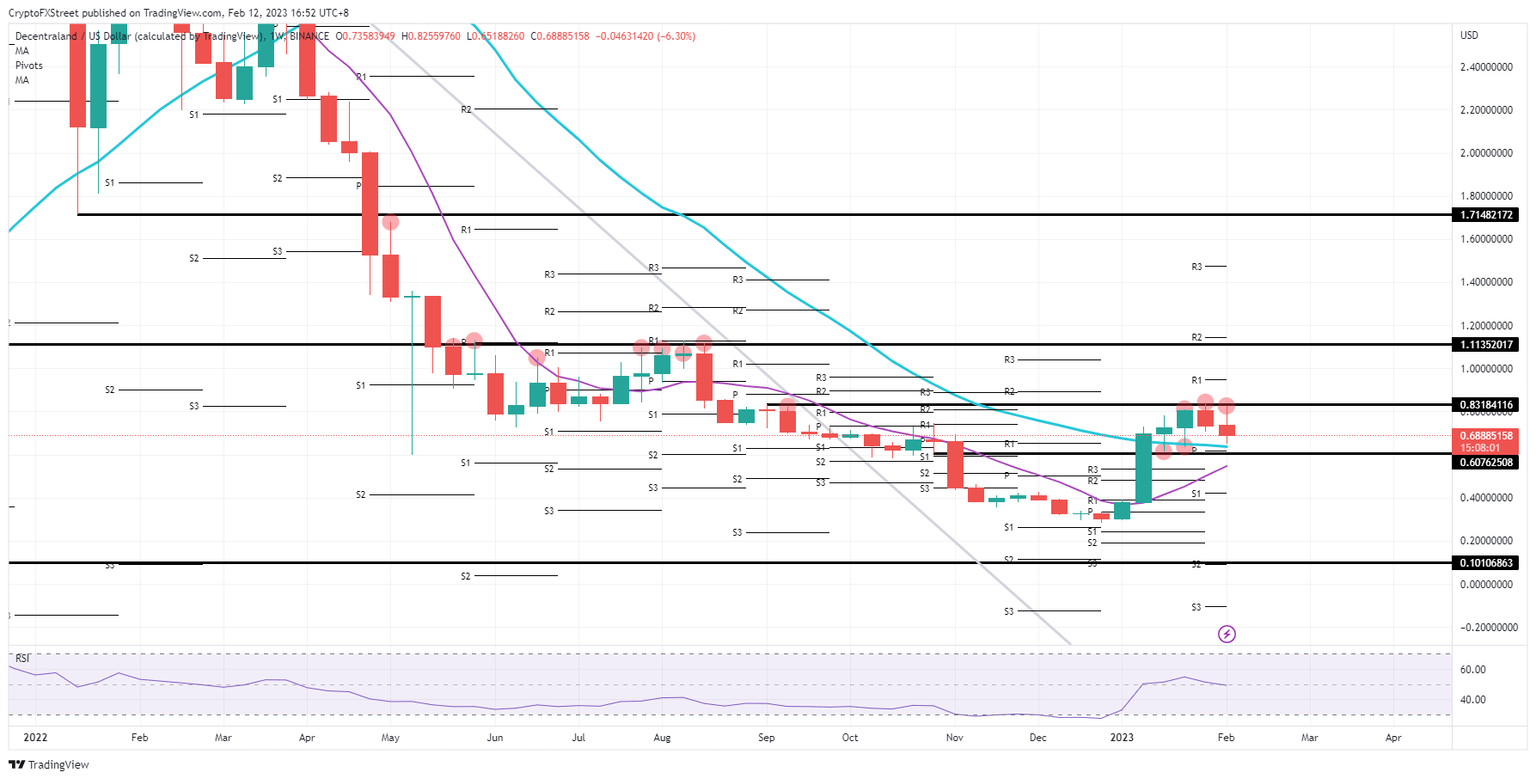

Decentraland (MANA) price was nearly booking 13% of gains this week as suddenly sentiment changed overnight in the markets. With bulls being pushed out of their position, bears could pull the sheet in their camp and trigger a near 6% decline. With the market on edge over the situation in Ukraine and the US inflation number on Tuesday, a line in the sand is drawn between a bounce and an implosion.

Decentraland price flirts with a price cut of 50% of its value

Decentraland price saw bulls pushing price action higher, trying to break $0.83 to the upside, a level that would not budge last week. Instead, bulls fell in a double top rejection, and a big fade materialized. Help came from a hawkish US Fed, some worrying economic data, energy prices bottoming out, and geopolitics in Ukraine being on the top headlines again.

MANA is near $0.60, where a historic pivotal level and the 200-day Simple Moving Average (SMA) reside. That double belt will be vital to upholding MANA above that area, as bears will be able to go in for new lows for the year. A bounce could be in the cards with a swing to the upside and $0.83 again as a profit-taking level in some low-hanging fruit trade setup.

MANA/USD weekly chart

Any of the above-mentioned tail risks: hawkish US Fed, some worrying economic data, energy prices bottoming out and geopolitics in Ukraine; could be enough to act as a catalyst for a break below that crucial support. Bears would see a huge area open up, and the price target to the downside would become $0.3. That means price action in Decentraland will be cut in half and tank near 50%.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.