December brought just sellers

The weekend has brought the weakness to the crypto markets again. During these two days, Bitcoin has lost close to 7%, and, overall, the crypto market lost close to 5%. In the last 24 hours, Ethereum (+0.8%) seems to recover a bit, and ALGO (+5.67%), Energy (+15.25%), and Vechain (+23.2%) seem not to care where the market goes.

In the Ethereum token sub-sector, many tokens felt the shift of sentiment, such as Link(-9.42%) and BAT (13.15%), but there were big climbers as well, such as LA (+40%), MOF( +36-6%), or CEL (+28%).

Fig 1 - 72H Crypto Market Heat Map

The market capitalization of the crypto sector went below $200 billion again to $198.37 billion and the traded volume in the last 24hours to $25.1 billion (+4.66%). The dominance of the Bitcoin descended slightly to 66.06%.

Fig 2 - 72H Crypto Market Cap with Traded Volume

Hot news

IDAX Global CEO has disappeared with no known reason, carrying with him all the private keys of their cold wallets. IDAX's daily volume is about $700 million, and its customers currently are unable to use the deposit and withdrawal service.

The cryptocurrency exchange Huobi join as one of the first members of the Blockchain Services Network, an alliance created by the Chinese State Information Center (SIC).

South Korean Crypto Exchange Upbit has confirmed the theft of 342,000 ETH, worth $50 million. The company also told the remaining digital assets had been moved to cold storage.

The Indian government has announced that it is working on a national blockchain plan to help adopt the technology. This has raised the hopes of the Indian crypto community after the bill draft that proposed a 10-year jail term for citizens dealing with cryptocurrencies, which was not included in the winter season of the Parliament.

Technical Analysis - Bitcoin

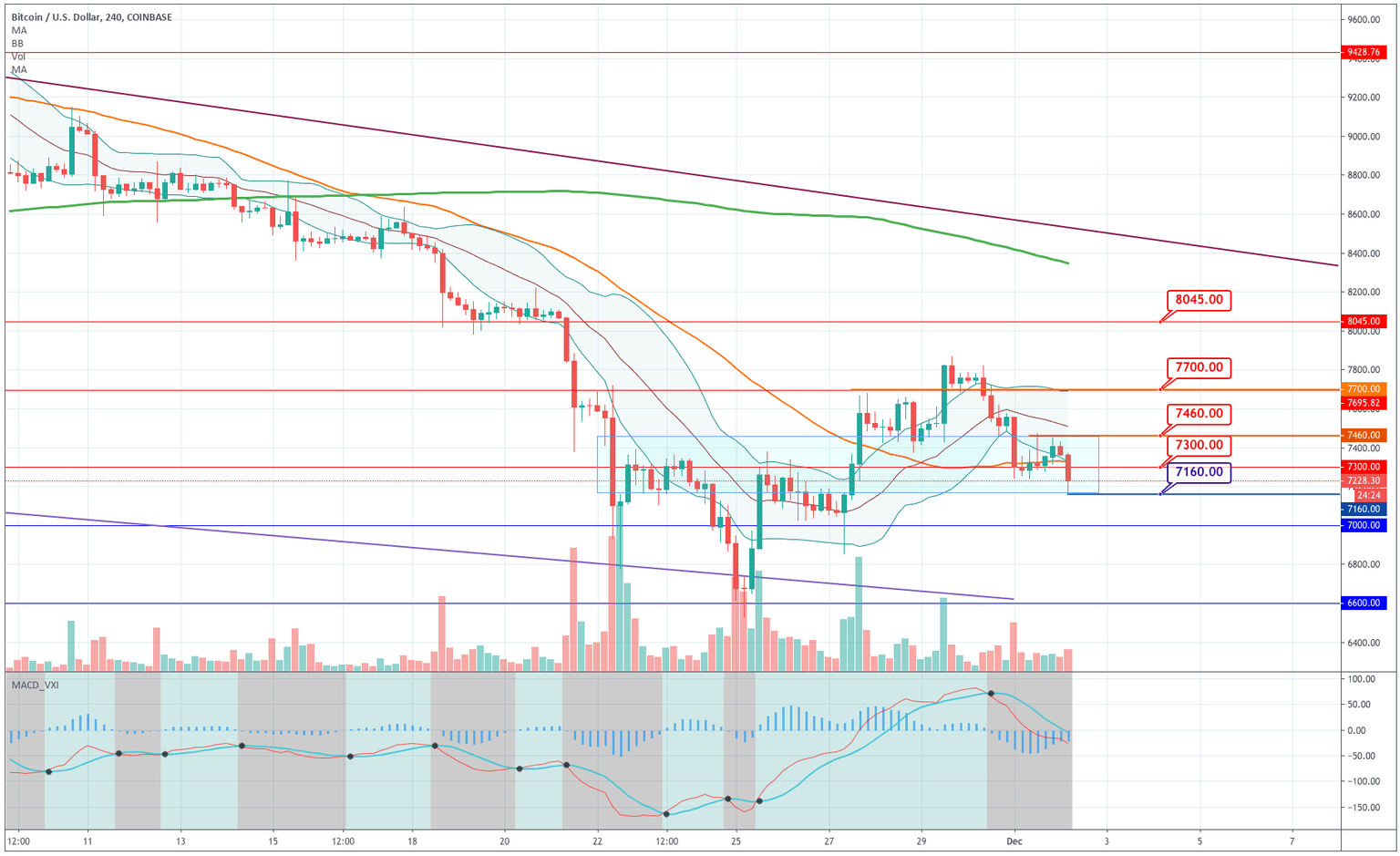

Chart 1 - Bitcoin 4H Chart

The negative news affecting IDAX and Upbit did not help for a December market rally. Bitcoin has been descending since it lost the $7,700 level, in a new wave of sales that has brought the price below its 50-period SMA again. BTC now moves below the -1SD Bollinger line, although the 7,200 level is bringing some support.

The levels to watch are $7,160 for downside moves and $7,460 for buyers.

|

SUPPORT |

PIVOT POINT |

RESISTANCE |

|

7,160 |

7,460 |

7,590 |

|

7,000 |

7,700 | |

|

6,850 |

7,860 |

Ripple

Chart 2 - Ripple 4h Chart

Ripple descended from its $0.233 top made in Nov. 29 and now is testing the $22 level in a movement that seems happening inside a horizontal channel. The present bias is negative, with the price below the -1SD line and the MACD pointing down. The critical levels to watch are the limits of the channel, $0.215, and $0.233.

|

SUPPORT |

PIVOT POINT |

RESISTANCE |

|

0.2200 |

0.2240 |

0.2270 |

|

0.2150 |

0.2330 | |

|

0.2100 |

0.2400 |

Ethereum

Chart 3 - Ethereum 4H Chart

Ethereum has also retraced last week's movement, and now the price acquired a negative bias that is pushing it below the $150 level, and into a sideways range. The cryptocurrency seems to have found support at $146, although we need to see it cross above $151.5 ( above the Bollinger mean line) to consider the retracement over.

|

SUPPORT |

PIVOT POINT |

RESISTANCE |

|

146.00 |

150.00 |

153.50 |

|

143.00 |

156.00 | |

|

140.00 |

160.00 |

Litecoin

Chart 4 - Litecoin 4H chart

Litecoin has a similar price action to Ethereum. The price bounced off near $50 and now is testing $46. The price moves below the -1SD line, and the MACD turned to the negative side, so the bias is bearish. On the chart, we can see, also the price making lower highs. If the $46 price doesn't hold, it may be poised to visit $42 again.

|

SUPPORT |

PIVOT POINT |

RESISTANCE |

|

46.00 |

47.60 |

49.00 |

|

44.60 |

50.30 | |

|

42.70 |

51.90 |

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and