DASH is unstoppable, the coin increased by 32% and here is why

- Dash is one of best-performing altcoins out of top-20.

- There are several factors behind Dash stellar performance.

DASH has just had another stellar day. The coin hit $136.51, which is the highest level since July 2019. Despite the retreat towards $121.50 by press time, the coin is still nearly 36% higher since the beginning of the day. The coin now takes 12th place in the global cryptocurrency market rating with a market value of over $1 billion.

What's going on with DASH

The spectacular growth triggered a lot of speculations. Traders, investors and cryptocurrency experts try to figure out the factors that might have served as a trigger for such an eye-watering price momentum.

FXStreet reported recently, that Internet outages in Venezuela support DASH adoption in the crisis-stricken country as it can be sent and received via SMS service. However, it is not the only possible reason behind the growth.

Twitter users discuss Dash Evolution rollout that has brought some notable changes to the ecosystem.

Terry Langston noted:

Dash Evolution rolled out huge (3 yrs in development) Name-based transactions that r private/secure. Dash DAPI platform & Dash Decentralized Storage utilizes leverages Dash decentralized PoService & PoW infrastructure (game changer). Dash Investment Foundation New Board member.

Apart from that, he mentioned 51% attack innovation that was being adopted by large exchanges.

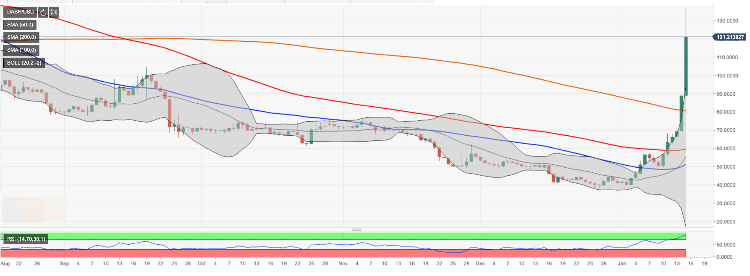

DASH/USD: technical picture

From the technical point of view, DASH is deeply overbought on all timeframes. It means that the coin is vulnerable to a correction, though it is not guaranteed considering a wild speculative market. The initial support is created by a psychological $100.00. Once it is broken, the correction may continue towards $80.50 reinforced by SMA200 daily. This area is likely to slow down the bears; however, a sustainable move lower will open up the way towards SMA100 daily at $59.60.

On the upside, DASH may retest the recent high of $136.50. The next resistance comes at $186.50, which is the recovery high of 2019.

DASH/USD daily chart

Author

Tanya Abrosimova

Independent Analyst