Cryptomarket falls as US Crypto Strategic Reserve hype fizzles into classic ‘buy the rumor, sell the news’

- Bitcoin, Ethereum, Solana, Ripple and Cardano continue their declines for the second consecutive day after their recent upsurge on Sunday.

- US President Trump’s announcement of the Crypto Strategic Reserve was turned into a short-term “buy the rumor, sell the news” event.

- Dr. Sean Dawson, Head of Research at Derive.xyz, told FXStreet that the market rally was short-lived as concerns about the lack of details in Trump’s proposal began to surface.

Bitcoin (BTC), Ethereum (ETH), XRP (Ripple), Solana (SOL), and Cardano (ADA) continue their declines for the second consecutive day on Tuesday after their recent upsurge on Sunday. US President Donald Trump’s announcement of the Crypto Strategic Reserve on Sunday was turned into a short-term “buy the rumor, sell the news” event. Moreover, Dr. Sean Dawson, Head of Research at Derive.xyz, told FXStreet that the market rally was short-lived as concerns about the lack of details in Trump’s proposal began to surface.

Trump Crypto Strategic Reserve hype fades

US President Donald Trump announced on his Truth Social platform on Sunday a US Crypto Strategic Reserve, including Bitcoin (BTC), Ethereum (ETH), XRP (Ripple), Solana (SOL), and Cardano (ADA), aiming to boost America’s crypto leadership.

Trump wrote: “A US Crypto Reserve will elevate this critical industry after years of corrupt attacks by the Biden Administration, which is why my Executive Order on Digital Assets directed the Presidential Working Group to move forward on a Crypto Strategic Reserve that includes XRP, SOL, and ADA. I will make sure the US is the Crypto Capital of the World. We are MAKING AMERICA GREAT AGAIN!”

The announcement caused cryptocurrency valuations to leap upward, with prices initially jumping as optimism soared regarding the possibilities of what this reserve could do for crypto’s long-term future. BTC, ETH, XRP, SOL, and ADA rose 9.53%,13.53%,34.13%,24.40% and 72.15%, respectively.

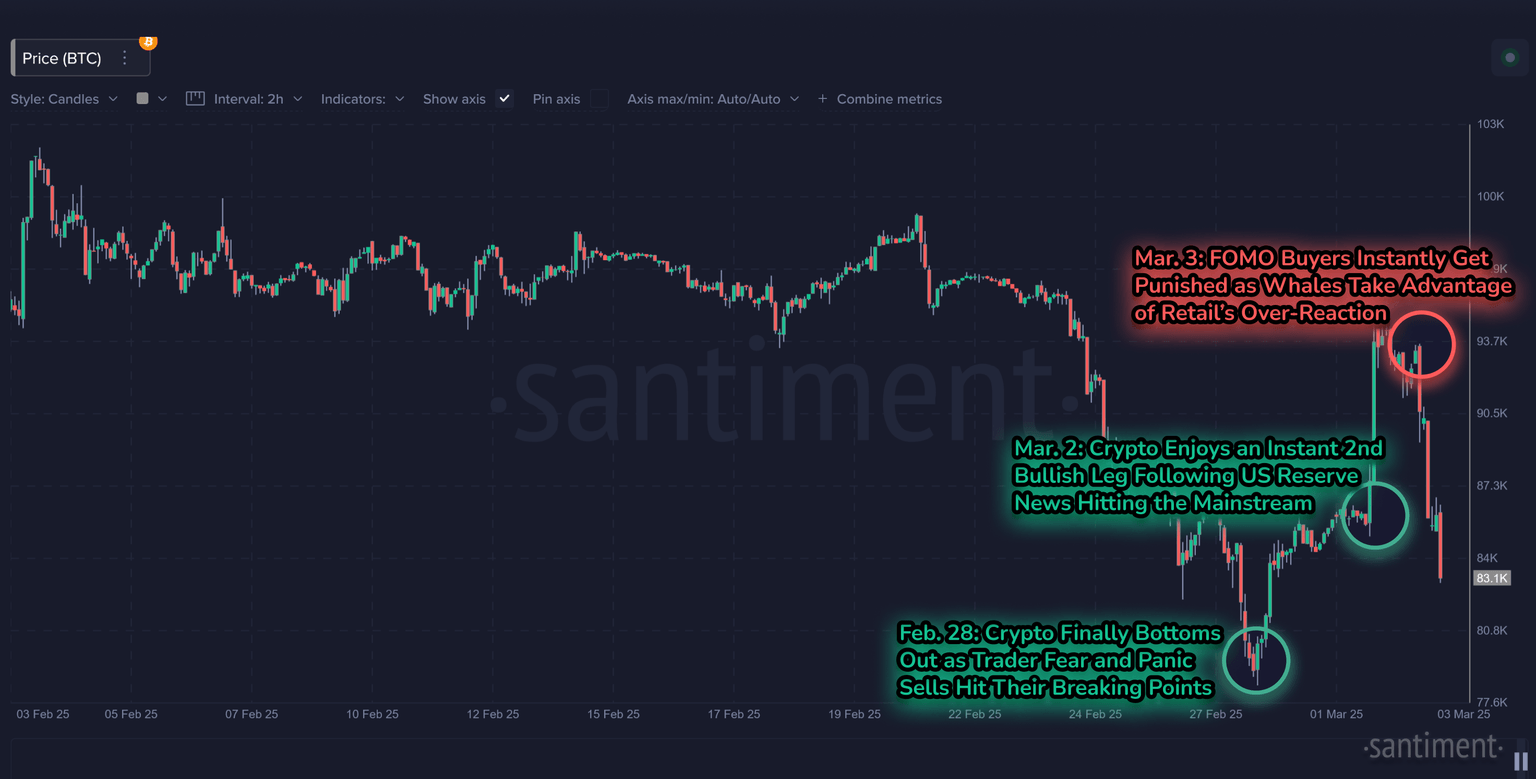

However, markets did a complete reversal at the start of this week on Monday and continued their correction during the early European session on Tuesday, as shown in the graph below.

Bitcoin price chart. Source: Santiment

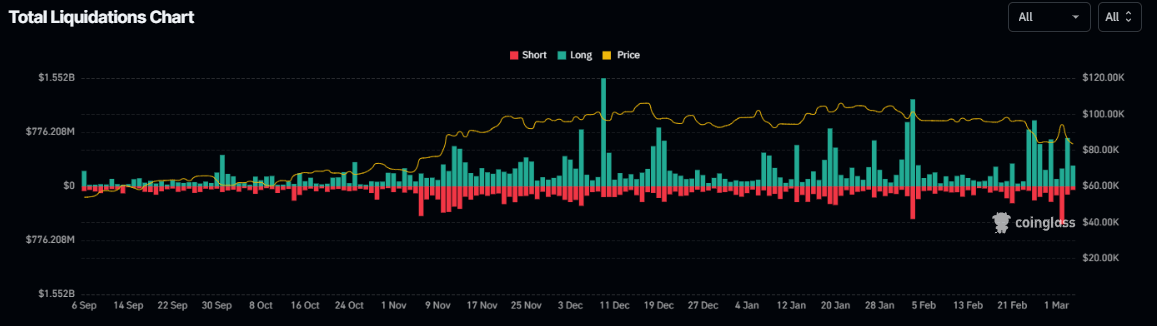

This price volatility since Sunday has triggered a wave of liquidation in the crypto market, wiping a total of $1.96 billion until Tuesday, according to the Coinglass liquidation chart.

Total liquidation chart. Source: Coinglass

In an exclusive interview with FXStreet, Dr. Sean Dawson, Head of Research at Derive.xyz, said, “The market experienced major volatility following President Trump’s announcement of a U.S. Federal strategic reserve.”

Dawson continued that the rally was short-lived as concerns about the lack of details in Trump’s proposal began to surface — moreover, concerns about including non-BTC assets like Cardano in the reserve.

“This market behavior highlights that while announcements like Trump’s strategic reserve can spark short-term excitement, the lack of clarity and follow-through can lead to rapid corrections. Volatility will likely remain high as traders navigate the uncertain year ahead.” Dawson told FXStreet.

An analyst, Brian, reports, “The government has not yet explained exactly how this reserve will work, how it will be funded, or how it will fit into the financial system.”

Brian continued that more details are expected to be shared at an upcoming White House Crypto Summit, where officials will explain their full plan for the reserve and what it means for the future of digital money in the US. But in the meantime, this latest media headline of Crypto Strategic Reserve has become nothing more than a short-term “buy the rumor, sell the news” event.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.