Cryptocurrency Market Update: Crypto massacre threatens Bitcoin’s $9,000 support

- Bitcoin heads towards $9,000 following bloodshed in the cryptocurrency market.

- Josh Rager, analyst says that a Bitcoin price crash is not entirely a bad thing.

Cryptocurrencies across the board are navigating losses on Thursday during the European hours. Altcoins are the biggest losers probably because they were the biggest gainers last week. IOTA is the worst-hit after losing almost 5% of its value on the day. Other single-digit losers include Litecoin (-4.04%), NEO (-4.74%) and Ethereum Classic (3.15%).

Related content: Cryptocurrency Market News: Bitcoin decoupling from the S&P 500

Bitcoin market overview

Bitcoin price is trading 1% lower on the day after diving from $9,214.27 (intraday high). Unlike the altcoins, Bitcoin weathered down the declines quite smooth, trading an intraday low at $9,076.60.

The price is still teetering under $9,200 with very slim chances of correcting higher on the day. If anything, the path of least resistance is downwards, a situation that could put more pressure on the support at $9,050 and $9,000 support areas respectively.

Technically, Bitcoin bearish dominance will continue in the near term. All indicators highlighted the possibility of the breakdown refreshing levels under $9,000. Additional support is expected at $8,900 and $8,800. Both of these zones functioned as support in June. Therefore, buyers have a fighting chance to hold above the same zones as they plan their next move towards $10,000.

Analyst welcomes Bitcoin crash

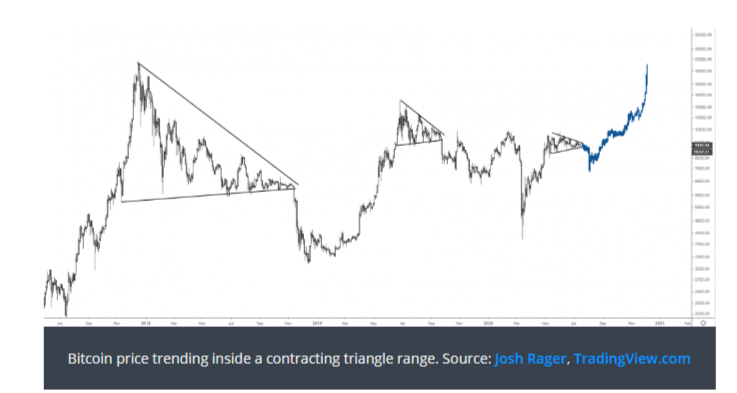

According to Josh Rager renowned trader and analyst, Bitcoin’s trading in a $250 range is likely to culminate in bloodshed. Using the chart below, Rager compared the latest Bitcoin price action to those going back to 2017.

Three triangle patterns stood out showing Bitcoin at the peak before breakdowns took over. However, Bitcoin bounced back upwards in all the three dumping occasions. In his opinion, BTC/USD impending crash would result in another massive rally insinuating that a dump from current price levels is not entirely a bad idea.

We can see since 2017, multiple rallies followed by compressions that led to pullback, followed by another rally. This time could be different. But I have a strong conviction that BTC price does at least a fake-out below the current compression before a potential rally to [a] new [all-time high].

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

-637304886876303092.png&w=1536&q=95)