Cryptocurrency Market Update: Bitcoin to breakout from tight range – Binance CEO Changpeng Zhao

- Bitcoin stability continues to rule the market but Zhao believes a breakout is coming soon.

- Altcoins offering alternative investment opportunities as Bitcoin price snoozes.

- Altcoin perpetual futures trading market hits $5 billion across all exchanges.

The CEO of Binance, the leading cryptocurrency exchange by the number of users and adjusted trading volume, Changpeng Zhao told Bloomberg on Monday that Bitcoin will soon get out of the range between $9,000 and $9,500. However, he admitted that Bitcoin has shown great resilience and stability.

Zhao commonly known as CZ reckoned that he is not sure of the factor that was going to propel Bitcoin from the tight range. He, nonetheless, added that time is of the essence, and coupled with the fiat money coming into the ecosystem, BTC will eventually breakout.

While Bitcoin continues to extend its stability, an increase in volume among altcoins is being witnessed. This has been attributed to various factors including traders diversifying their positions, developments among altcoins such as Cardano and IOTA as well as the social news surrounding assets like Dogecoin.

At the time of writing, Bitcoin is trading at $9,185. Over the last few weeks, the price has been raging between $9,000 and $9,500. Some people are starting to call the crypto, ‘the largest stablecoin.’ However, technical analysis allows for tight trading ranges that give way to breakouts as described by CJ.

Read more: Bitcoin Price Forecast: BTC/USD triangle breakout eyes lift-off to $10,000

Altcoin perpetual futures trading

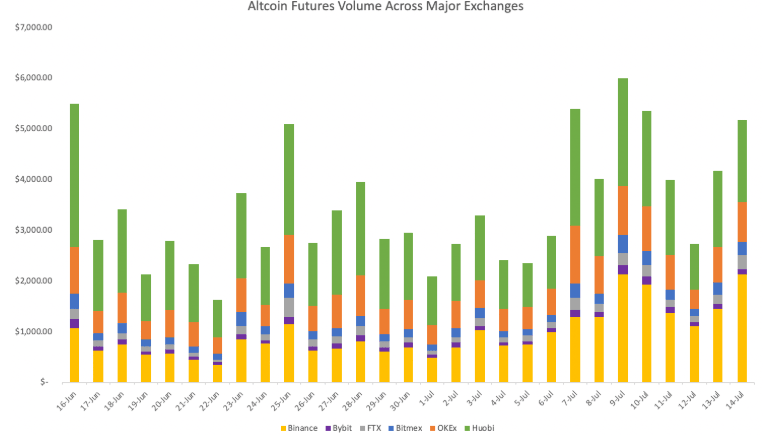

Binance also released a timely report on Binance futures and particularly the altcoin perpetual futures trading. The exchange reported that investors are paying more attention to altcoins to the extent of triggering an altcoin season while Bitcoin dominance dwindles. At the moment, Bitcoin dominance is at its lowest since February 2020.

“The renewed altcoin interest has caused a surge in trading volume on perpetual contracts across major exchanges. Since July 1st, total Altcoin perpetual futures volume across major exchanges has grown from $2 billion to $5.1 billion, a 150% increase.”

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren