Cryptocurrency Market News: Bitcoin stalls, DeFi craze spikes while Chainlink hits new all-time high

Here is what you need to know on Thursday, August 13, 2020.

Markets:"

The cryptocurrency market is a mixture of red and green. Bitcoin is leading the bearish ‘gang’ while some selected altcoins such as Cosmos, Chainlink and Maker keep flying the bullish flag high above the crypto horizon.

Bitcoin price recovered from the dip to $11,100 but bulls could not sustain gains above $11,600. In other words, the hurdle at $11,600 is still intact. On the other hand, BTC/USD has retested the support at $10,500 and is trading at $11,550.

Ethereum is trading slightly in the green by 1.25% on the day. Like Bitcoin, the cryptoasset recovered from the support at $370 but failed to maintain the momentum to break the barrier at $400. Currently, Ether is valued at $391 while containing the gains accrued in the last 24 hours above the short term support at $390.

Ripple managed to reclaim its third position from Tether (USDT), the largest stablecoin in the industry. Recovery has not been substantial owing to the fact that the highest traded price level on the day is $0.2859. XRP/USD is slightly in the red while exchanging hands at $0.2822. The high volatility coupled with a bullish trend in the short term could easily pull XRP towards the hurdle at $0.30.

As aforementioned some altcoins are soaring to new levels such as Chainlink which hit a new all-time high ($17.00) and made it to the fifth-largest digital asset in the market. Other double-digit gainers in the last 24 hours include Tezos (12.74%), Cosmos (16.89%), IOTA (11.99%), Maker (13.98%), Algorand (27.88%), Band Protocol (19.39) and Swipe (30.56%).

Chart Of The Day: LINK/USD 4-hour chart

-637328970376990675.png&w=1536&q=95)

Market:

Chainlink has surged massively this week to topple Bitcoin Cash from the fifth spot in the market. LINK is the native token of the decentralized oracle network, Chainlink. The cryptoasset now has a market capitalization of $5.82 billion compared to Bitcoin Cash’s $5.32 billion. At the time of writing, LINK is trading at $16.62 after a shallow retreat from the new all-time high at $17.00.

LINK has had an incredible year, rising from $1.80 to the current market price level. Crypto analysis platform, Messari attributes the surge to the growth of the DeFi ecosystem because Chainlink price feeds continue to play a key factor in the sector.

Read more: Chainlink Price Prediction: LINK/USD clocks new all-time highs, eyes glued on $20

Industry:

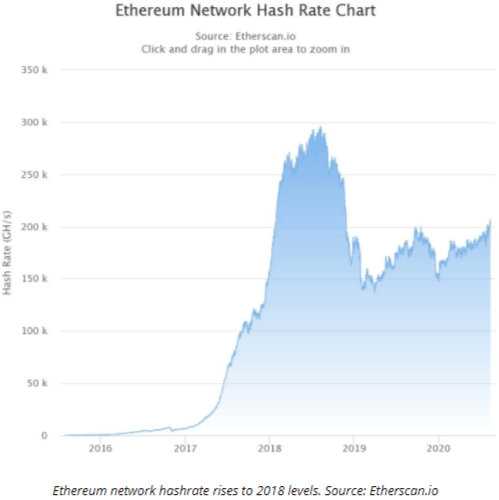

Decentralized finance (DeFI) has been an incredible run this year. The impact of the rally in the ecosystem continues to impact Ethereum in terms of increasing hashrate and gas fees. According to recent data by Glassnode, an on-chain analysis platform, Ethereum network hashrate has soared to break a 20-month high. The same metric is confirmed by Etherscan. The surge in the hashrate usually indicates a network’s heath level. Traders are using the hashrate metric to gauge the potential of Ethereum extending the bullish momentum to higher levels.

The increase in the use of DeFi projects is said to be impacting the Ethereum network resulting in the high hashrate as the network clogs. Transaction costs, referred to as gas fees have been surging too amid heightened activities in DeFi. The increase in gas fees has positively impacted miner revenues that have hit an all-time high according to researchers at Glassnode.

Miner revenue from fees on Ethereum has skyrocketed in the past two months, reaching an all-time high of around 18% (30d moving average). Conversely, this has brought the Fee Ratio Multiple (FRM) to lows never seen before on Ethereum. Created by Teo Leibowitz , the Fee Ratio Multiple (FRM) is defined as the ratio between the total miner revenue and transaction fees. FRM indicates how secure a chain is once block rewards disappear.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren