Cryptocurrencies Price Prediction: XRP, TAO & Bitcoin – American Wrap 01 July

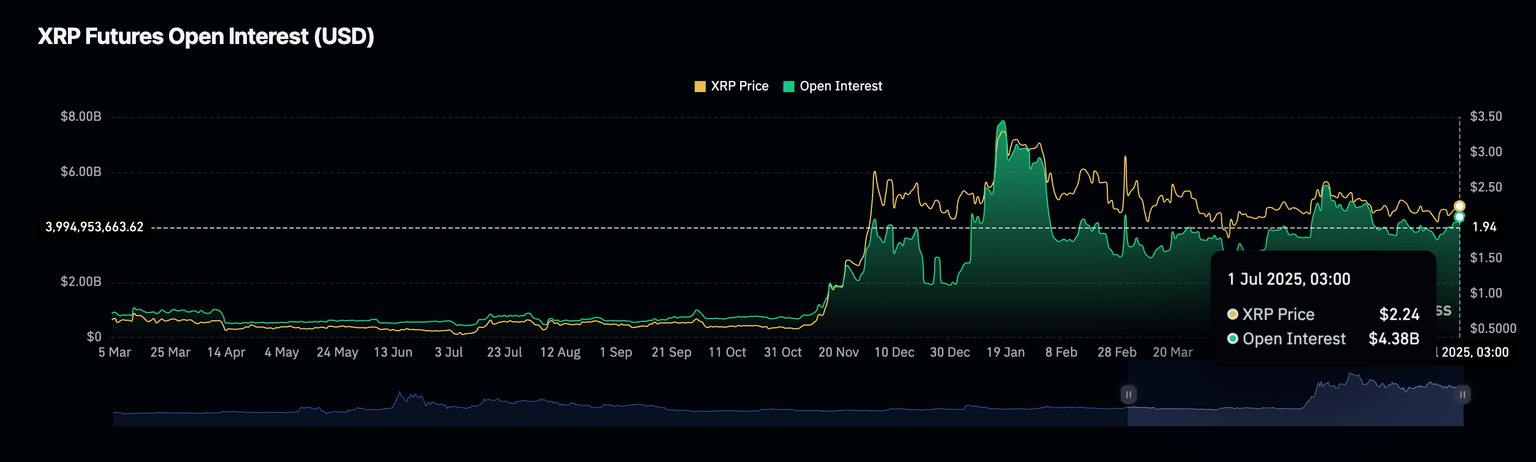

Could XRP price rebound on high spot ETF approval odds

Why AI token Bittensor’s development activity surged 3,600% in June despite 22% price drop

Bittensor (TAO), the largest Artificial Intelligence (AI) token by market capitalization, upholds a bearish bias after facing rejection at $352 on Sunday. TAO is trading at $324, with intraday losses exceeding 3% on Tuesday.

Bitcoin eases lower, but a breakout to record highs could be coming

Bitcoin is edging below 107K on Tuesday after the price ran into resistance at 108.8 K. However, with institutional and corporate demand still strong, combined with an encouraging Q3 post-halving seasonality tailwind, BTC could be on the verge of retesting 110 K and fresh record highs.

Author

FXStreet Team

FXStreet