Cryptocurrencies price prediction: XRP, BONK & SoFi – American Wrap 11 November

Why BONK could be poised for a breakout

As I look deeper into BONK Coin’s current setup, it’s hard not to notice what could be forming into a strong breakout opportunity. BONK has experienced a sharp pullback, dropping more than 66% from its highs earlier this year. While this kind of decline often shakes out weak hands, it also creates potential for renewed momentum if the right technicals align. Right now, BONK is approaching a critical level — a downsloping trendline that connects its high from September 13th through its highs in October, extending to where it currently sits.

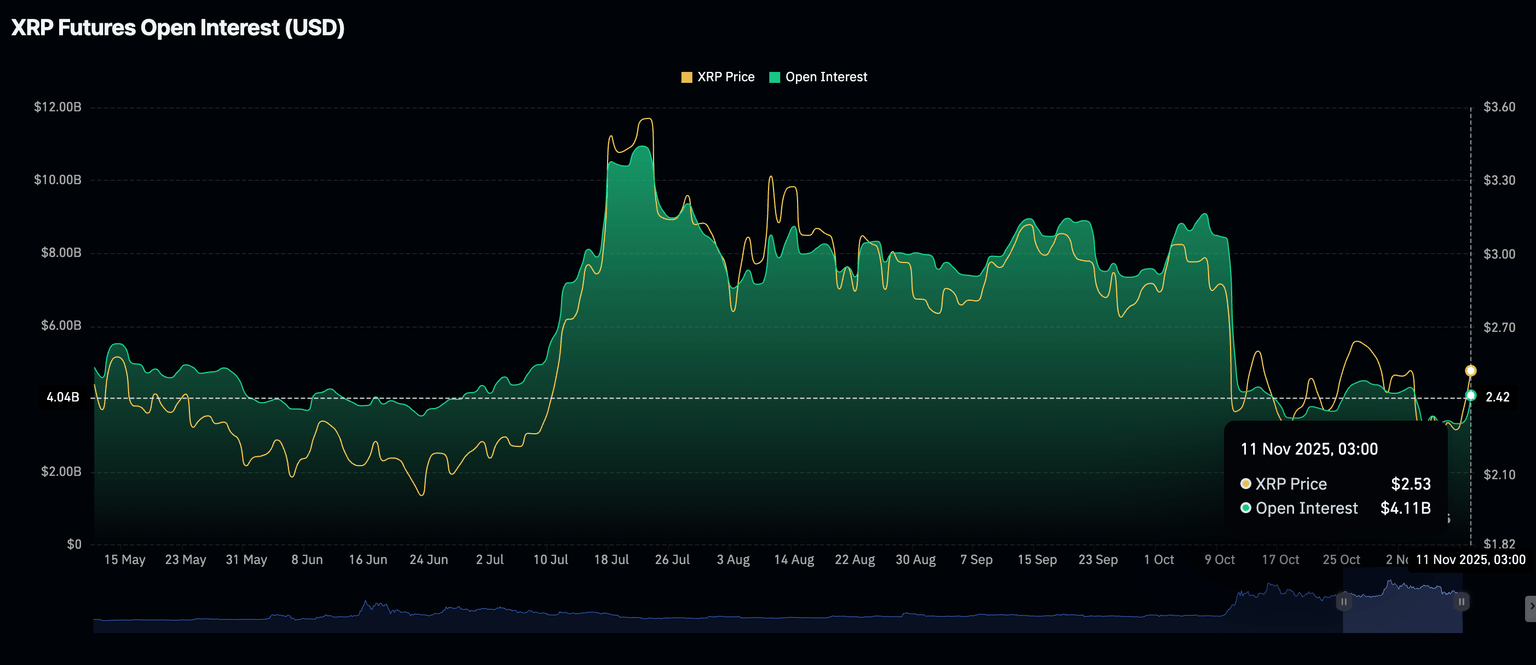

Ripple Price Forecast: XRP recovery cools despite increasing derivatives volume, Open Interest

Ripple (XRP) has pulled back to $2.43 at the time of writing on Tuesday, after rising for two consecutive days. The minor sell-off from an intraday high of $2.57 reflects a bearish outlook in the broader crypto market, as investors book early profits.

SoFi launches crypto trading, citing ‘Bank-level confidence’ as key edge

SoFi has become the first nationally chartered consumer bank in the U.S. to launch in-app cryptocurrency trading, adding bitcoin, ethereum, and solana access to its growing suite of financial services.

Author

FXStreet Team

FXStreet