Cryptocurrencies Price Prediction: Ripple, Chainlink & Vechain – American Wrap 26 January

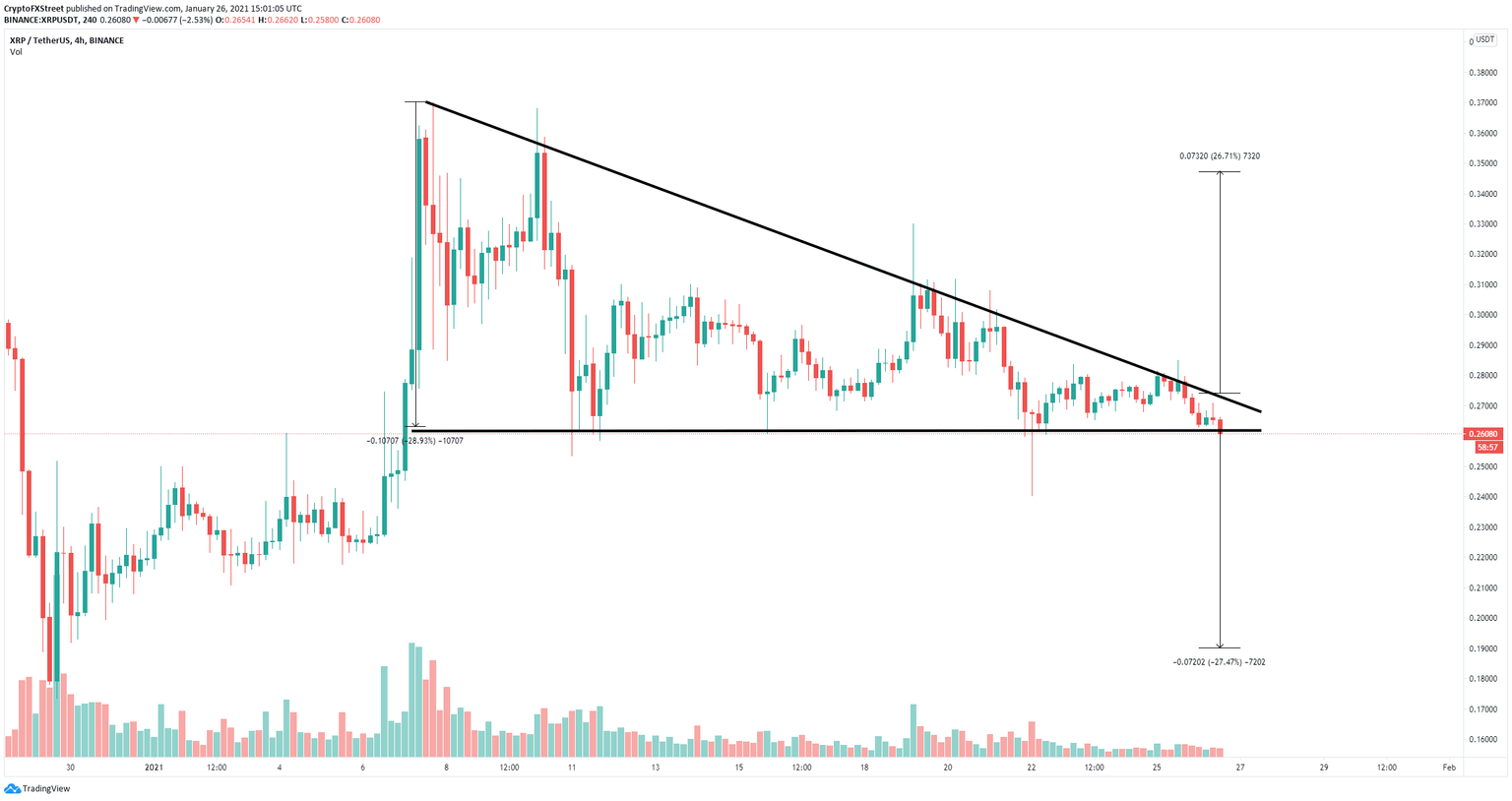

Ripple Price Prediction: XRP is on the edge of a massive fall below $0.20

Over the past two months, XRP’s total market capitalization has fallen from a high of $32 billion on November 24, 2020, to only $12 billion currently. The biggest reason for this drop was the SEC suing Ripple for the sales of unregistered securities. XRP is close to losing its fifth position in market capitalization ranking to Cardano.

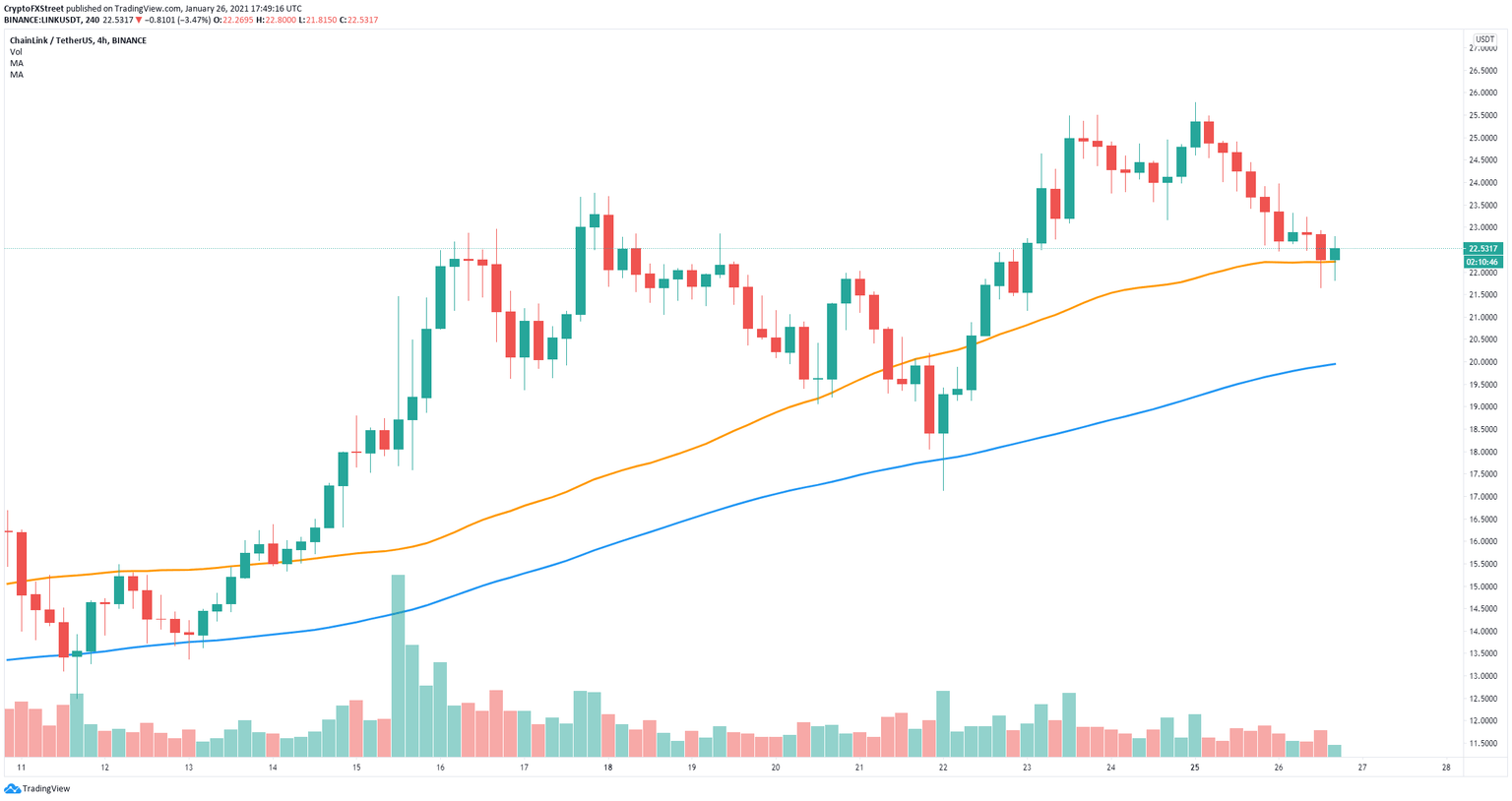

Chainlink price aims for $26 as it hits a new all-time high in trading dominance

Chainlink has been one of the best performing coins in 2020 and is trying to do the same in 2021. The digital asset has reached a market capitalization of $10 billion positioning itself rank seven.

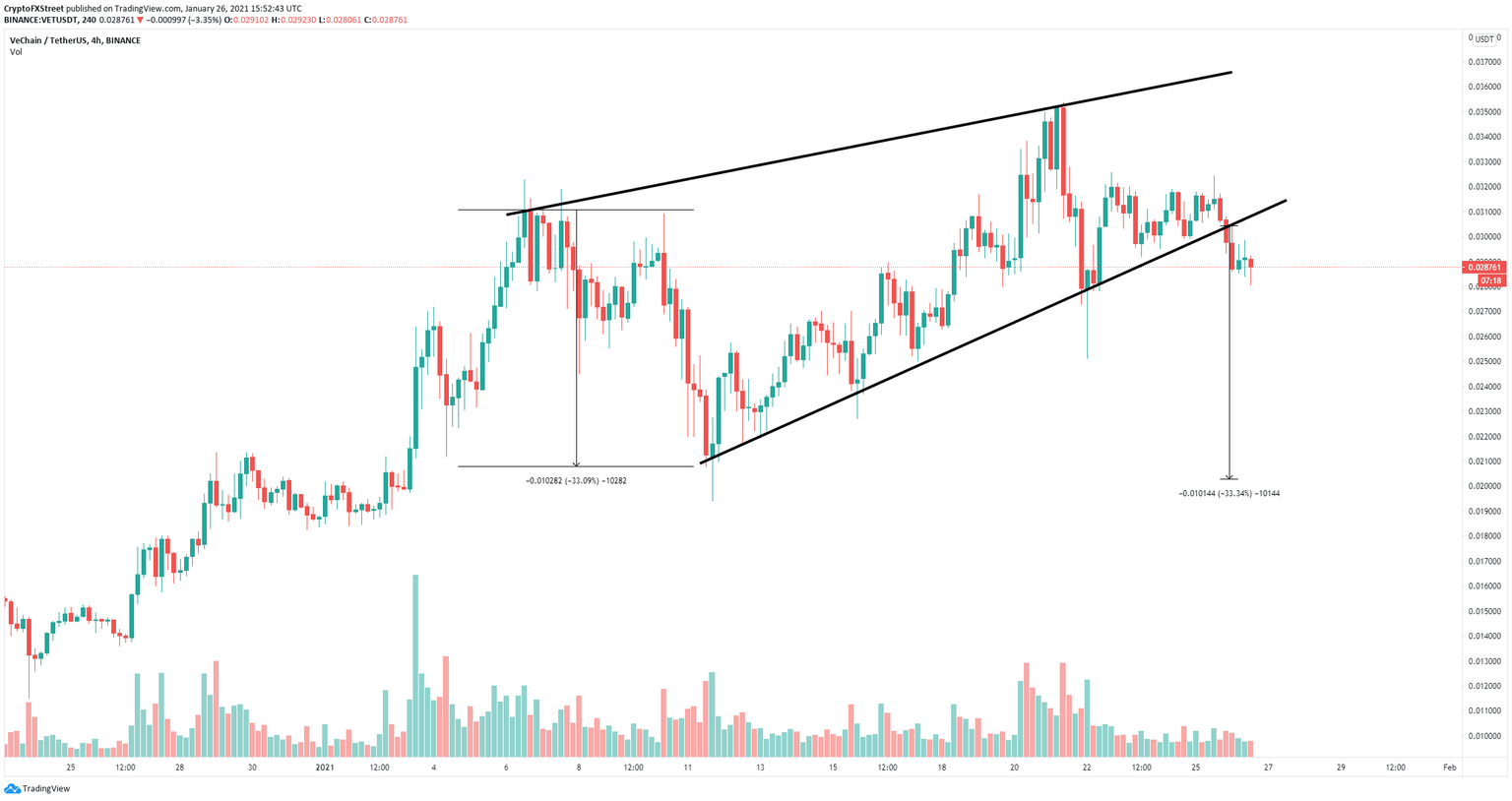

Vechain price can dive to $0.02 as bears take control of the short-term trend

Vechain has been trading inside a rising wedge since January 7. The digital asset saw a 100% price increase since the beginning of 2021 peaking at $0.035. However, bears have taken control of the short-term trend and aim to drive Vechain price towards $0.02.

Author

FXStreet Team

FXStreet