Vechain price can dive to $0.02 as bears take control of the short-term trend

- Vechain price has lost a crucial support level and bears have taken control.

- The digital asset could fall as much as 30% in the long-term.

- VET bulls could push the asset for a brief period of time before another leg down.

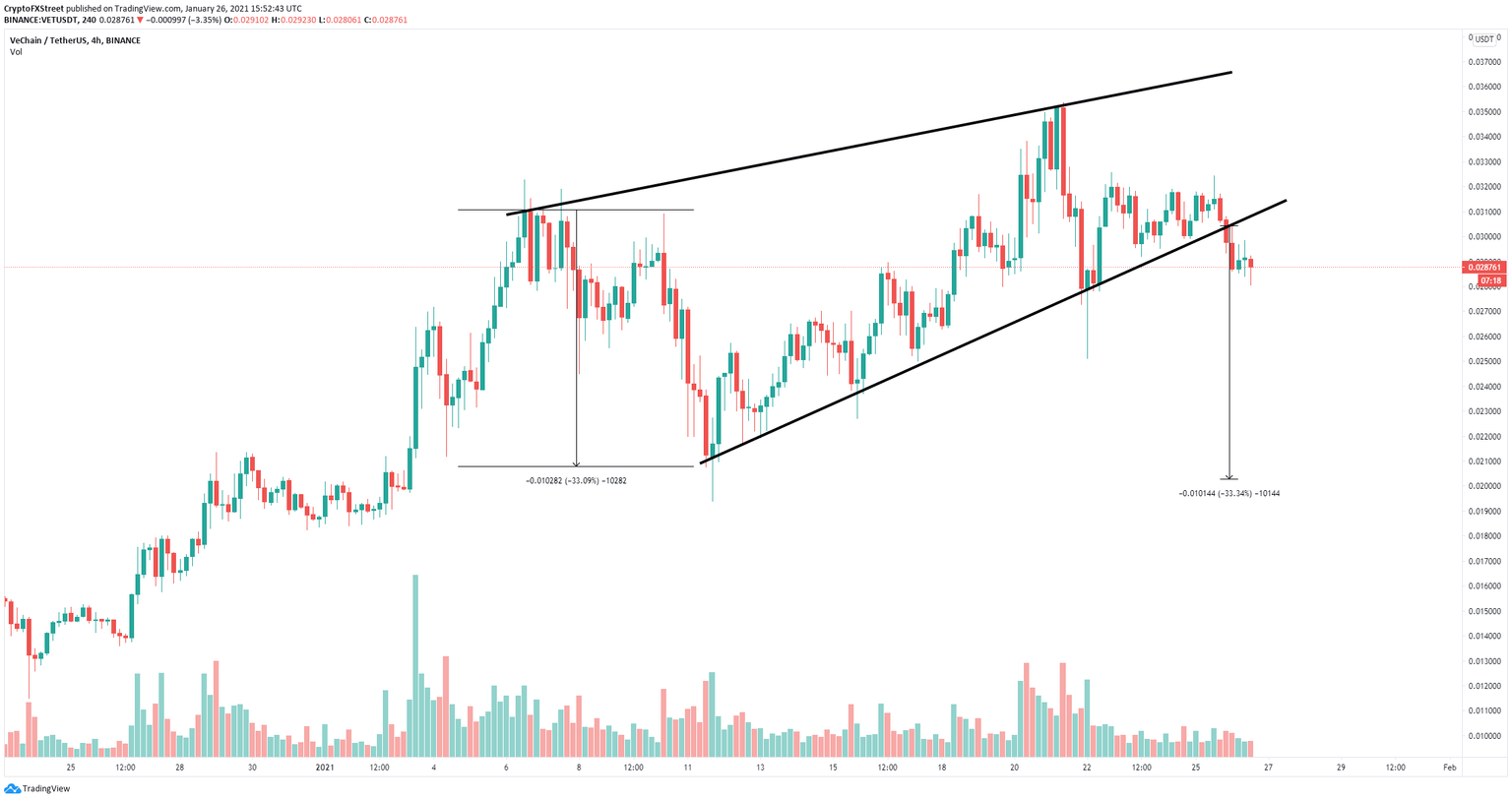

Vechain has been trading inside a rising wedge since January 7. The digital asset saw a 100% price increase since the beginning of 2021 peaking at $0.035. However, bears have taken control of the short-term trend and aim to drive Vechain price towards $0.02.

Vechain price can fall to $0.02 but there is some support on the way down

Vechain has established an ascending wedge pattern on the 4-hour chart, which broke bearish on January 25. The breakdown has a price target of $0.02 in the long-term, determined by using the maximum height of the wedge.

VET/USD 4-hour chart

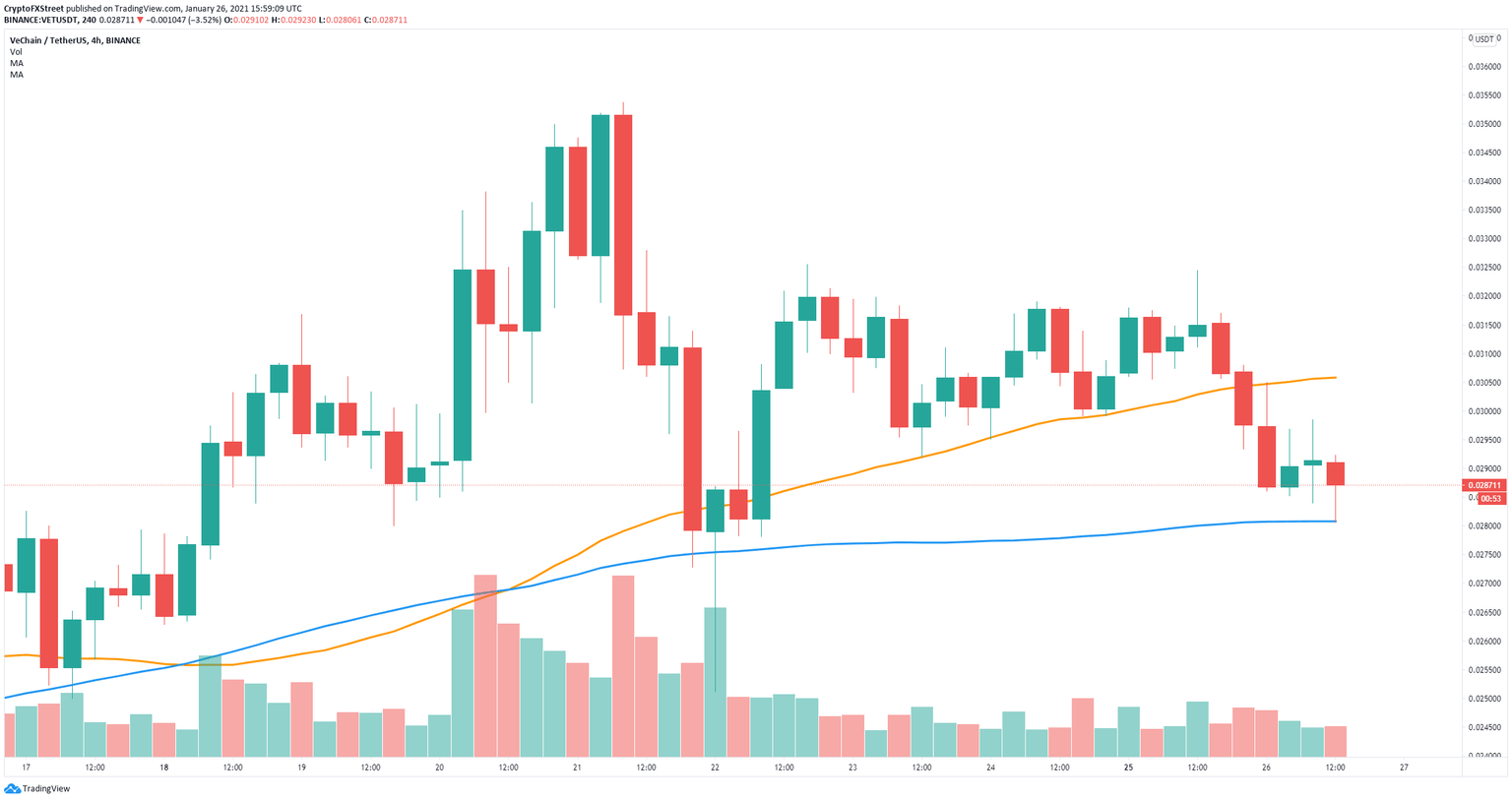

However, bulls have defended another significant support level at 0.028, which is the 100-SMA on the 4-hour chart. This could help them push Vechain price towards the 50-SMA at $0.03.

VET/USD 4-hour chart

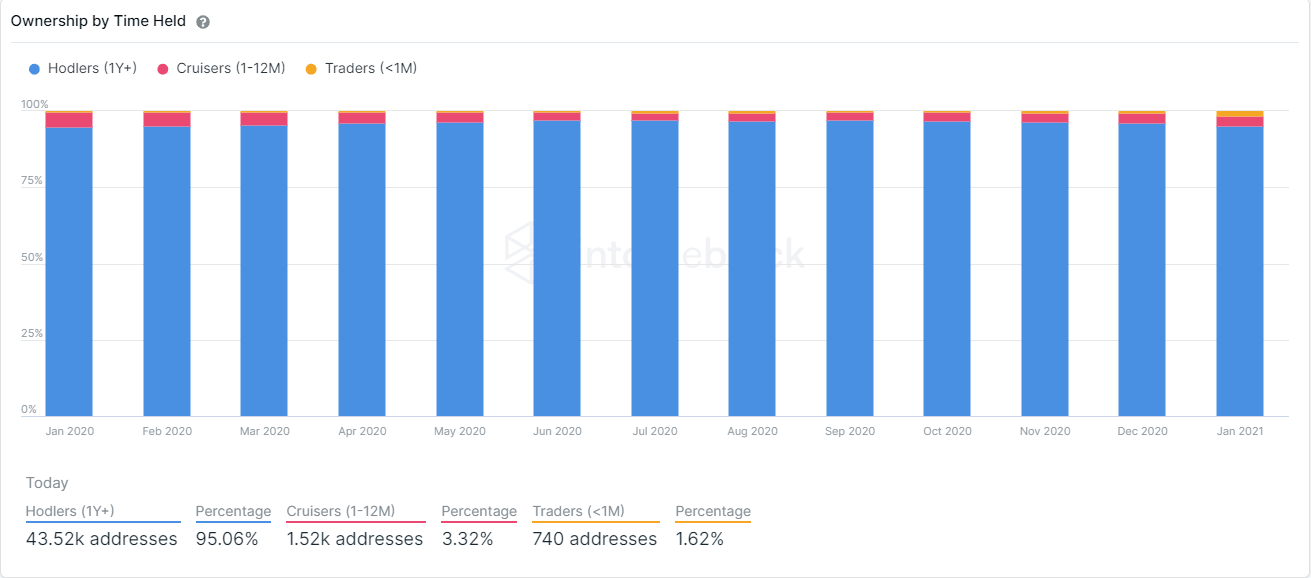

In the same time, Vechain has faced an increase in volatility, which can be attributed to a significant spike in traders that entered the Vechain network. In December 2020, the number of traders, which are defined as investors that hold VET for less than one month, was only 322 addresses (0.7%).

VET Holders chart

In January 2021, the number of traders has increased to 740 addresses representing 1.62% of investors. At the same time, the amount of Hodlers, which have been holding VET for more than one year, decreased in the past month by 1%.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.