Cryptocurrencies Price Prediction: Polkadot, Solana & Terra — Asian Wrap 21 June

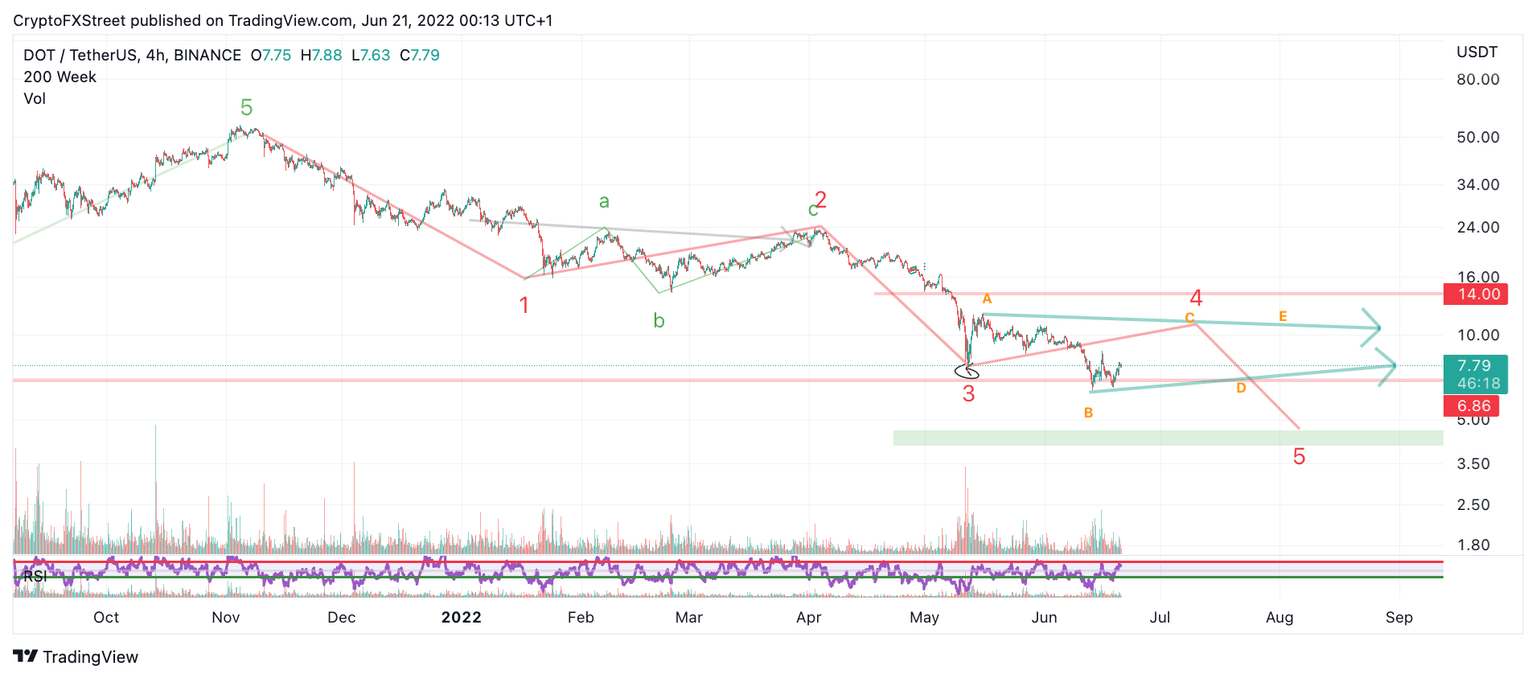

Polkadot price is on pace for $4, but a pullback is expected for these reasons

Polkadot price is still in a significant downtrend unless $16.42 is touched. One more decline is possible to create the fifth wave down. The volume profile shows bullish re-entrance into the market while bitcoin has been signaling multiple market bottom indicators. Invalidation of this downtrend idea is a breach above wave A at $11.47.

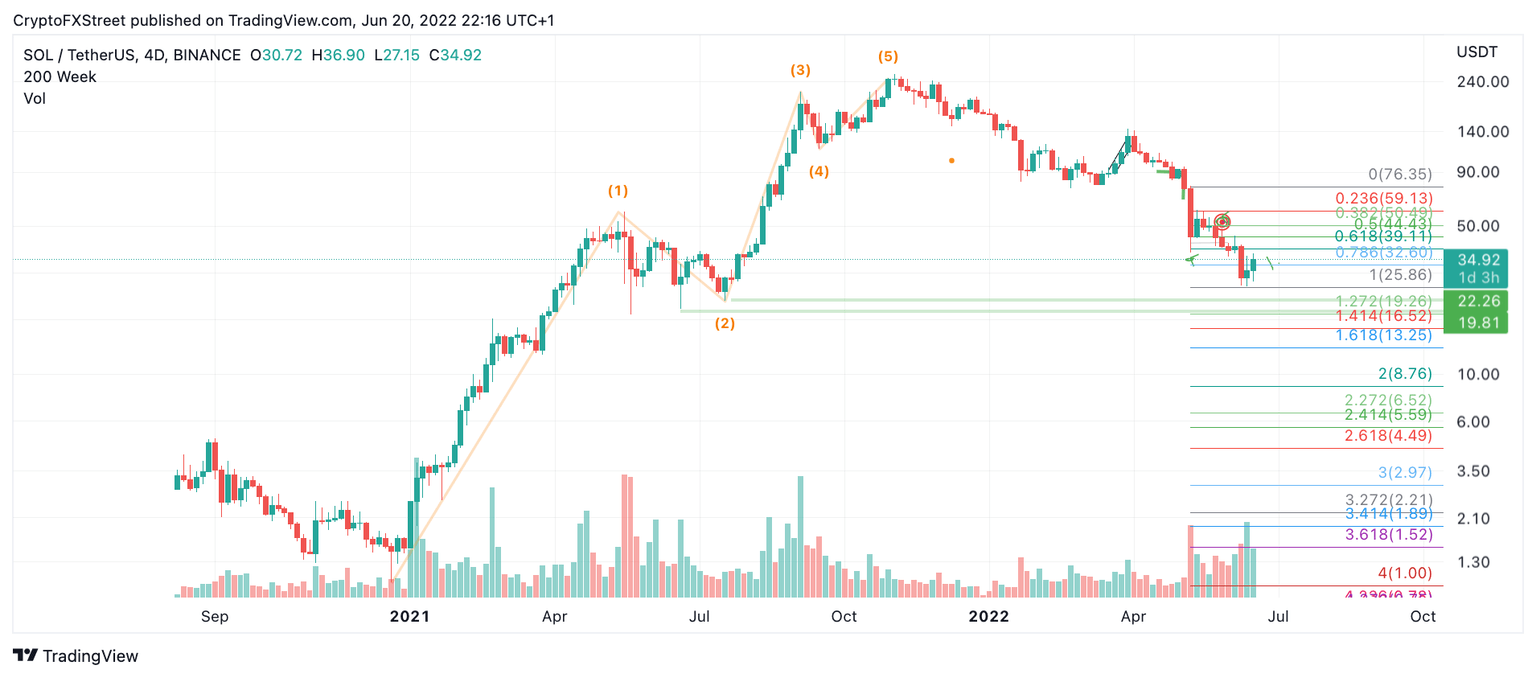

Solana price is rekt unless this level gets broken

Solana price is still suppressed within the $30 region as the 3rd week of June's trading session commences. Over the weekend, the price action traded mostly sideways as neither the bulls nor the bears could produce a confident rally.

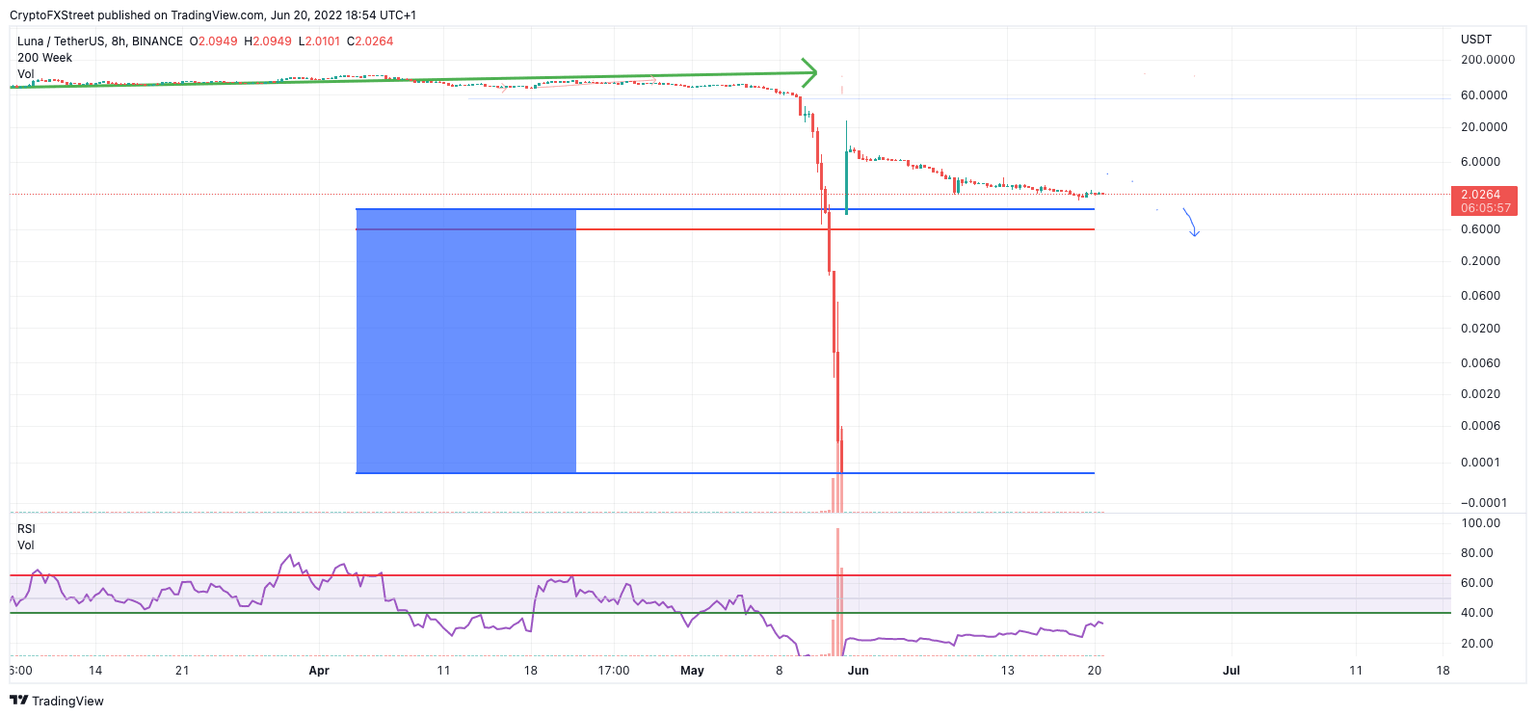

Why is nobody talking about the VPOC at $0.59 when discussing Terra's LUNA price?

Terra’s LUNA price has a fixed range indicator hinting at a $0.59 target which could be the reason why bears have not yet released their shorts. Terra's LUNA price is floating on hope and hope alone. Writing a bearish thesis for a community of devout investors, developers, and fans is never enjoyable.

Author

FXStreet Team

FXStreet