Cryptocurrencies Price Prediction: Injective, Bitcoin & Crypto – European Wrap 3 July

Injective extends gains as Testnet goes live amid rising demand for tokenized stocks

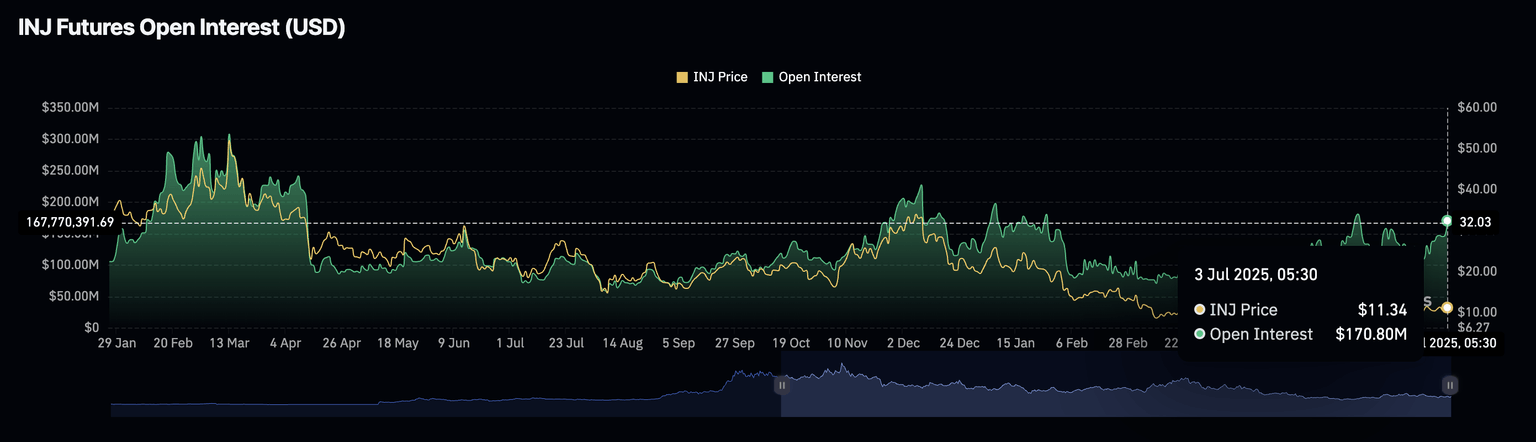

Injective (INJ) rises 5% at press time Thursday, following the 11.50% surge from the previous day on the back of Injective Protocol's Testnet going live. Amid the rising buzz around tokenized stocks, the Testnet launch boosted the optimism around the future of the platform and its token, with Open Interests in the derivatives market hitting a 30-day high of $170 million. The technical outlook supports an extended rally as trend momentum shifts to bullish.

Bitcoin Price Forecast: BTC near its all-time highs ahead of US NFP

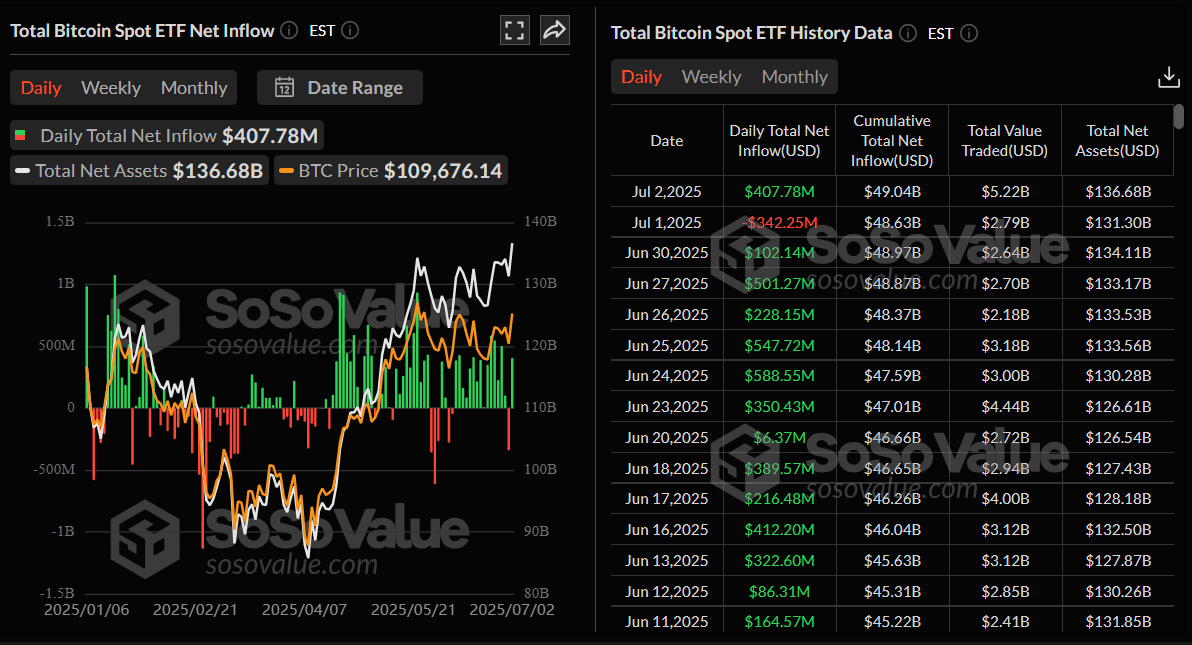

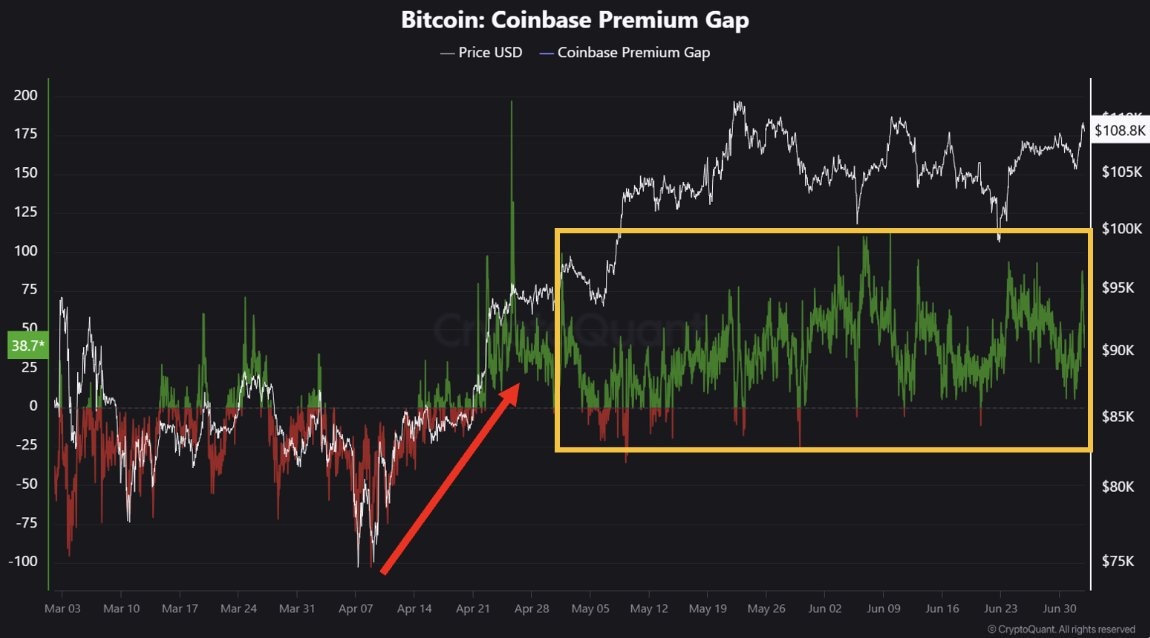

Bitcoin (BTC) price climbs above $109,000 at the time of writing on Thursday, breaking out of its recent consolidation range and moving closer to its all-time highs. The breakout comes amid improving macroeconomic conditions and renewed risk appetite following the announcement of a US-Vietnam trade agreement. Traders now await the US Nonfarm Payrolls (NFP) report on Thursday, which could provide key insights into the Federal Reserve’s (Fed) interest rate trajectory.

Crypto Today: Bitcoin uptrend anchored by institutional demand as Ethereum, XRP extend gains

Cryptocurrencies are generally ticking higher on Thursday, anchored by steady market sentiment. Bitcoin (BTC) leads the recovery after breaking above the $109,000 resistance. Altcoins edge higher, with Ethereum’s (ETH) price stepping above $2,600. Meanwhile, Ripple (XRP) flaunts a renewed bullish structure, above the previously stubborn hurdle at around $2.20.

Author

FXStreet Team

FXStreet