Cryptocurrencies Price Prediction: Ethereum, Polkadot and Bitcoin – European Wrap 11 January

Ethereum Weekly Forecast: ETH price embarks on an uphill battle to $3,600

Ethereum price has continued its decline over the last week after dipping below a crucial psychological level. But short-sellers beware – this downswing may be a necessary prerequisite to set the scene for a bullish recovery to play out. The new week holds out the tantalizing promise, therefore, that a shift in trend may be happening favoring bulls.

Polkadot price presents a risky long opportunity as DOT hints at a 26% advance

Polkadot price is at a point in its journey where bulls are waiting to make a comeback. DOT needs to reclaim one crucial barrier to shift the odds against bears. Doing so, could trigger a rally that retests a weekly resistance barrier.

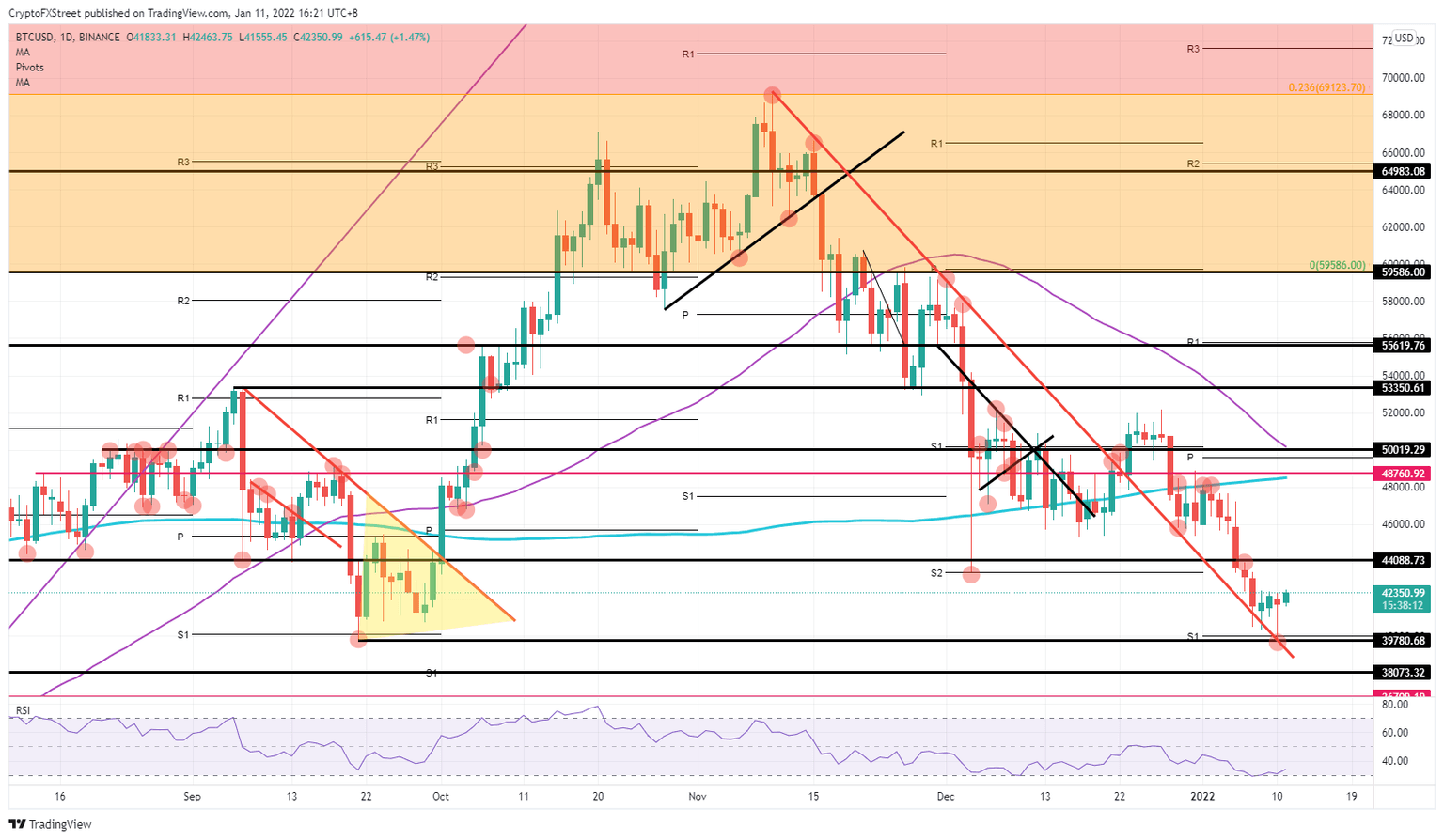

Bitcoin bulls turn the tide as investors target a 20% recovery

Bitcoin (BTC) saw sellers squeeze out their final drop of gains on Monday after demand briefly dipped below $40,000. This level is in line with the low of the September 21 decline last year and BTC price bounced off the monthly S1 support level and a longer-term red descending trend line. Expect a turnaround from here, with demand switching to the buy-side with risk-on back on the front foot.

Author

FXStreet Team

FXStreet