Cryptocurrencies Price Prediction: Ethereum, Bitcoin & Crypto – European Wrap 30 December

Ethereum long-term holders climbed in 2024 as Bitcoin holders fell

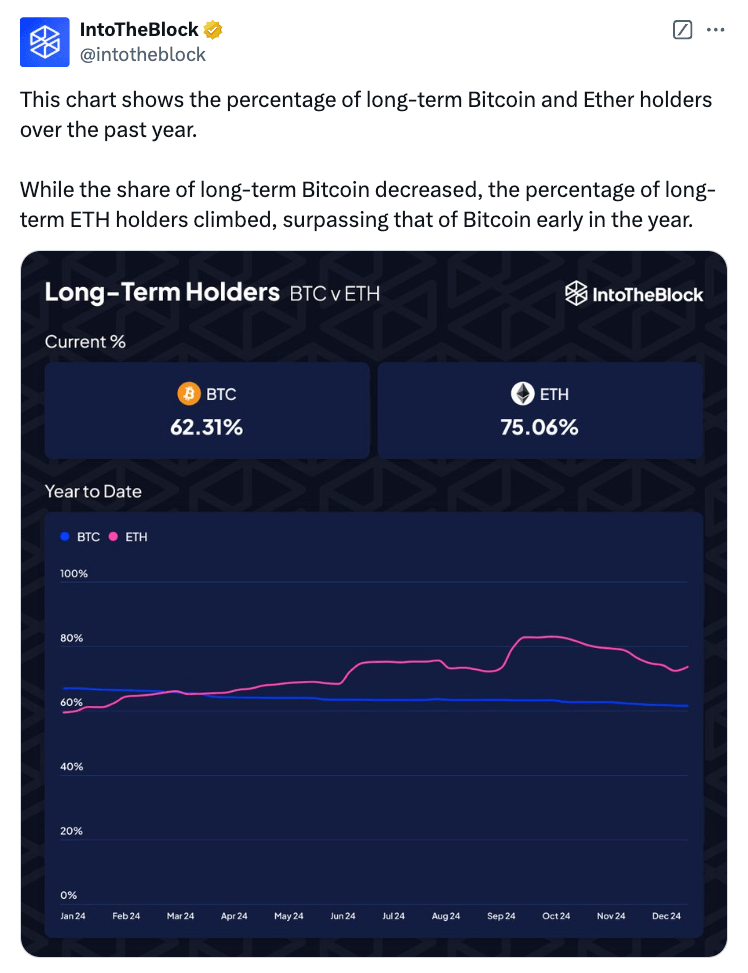

The number of long-term Ether holders steadily increased throughout 2024, while the number of Bitcoin holders fell over the last year amid rising confidence in ETH heading into the new year.

In a Dec. 30 post to X, citing data from its platform, IntoTheBlock shared that the total percentage of Ether (ETH $3,421.51) who had held their tokens for the long haul had risen from 59% in January to 75% by the end of 2024.

US Bitcoin reserve adoption faces doubts

Experts remain skeptical about the US adopting Bitcoin as a financial reserve, citing political and economic hurdles despite bold predictions from advocates.

The possibility of the United States adopting Bitcoin as a financial reserve remains highly uncertain, with prediction markets showing fading confidence. Experts highlight political and economic challenges, while skeptics doubt its feasibility under Donald Trump’s administration. Despite growing support from advocates, significant hurdles stand in the way of Bitcoin becoming part of the US financial strategy.

The crypto market teeters on the brink of correction

The cryptocurrency market has lost 1.4% in the last 24 hours, falling to $3.29 trillion. Over the past 10 days, the market has mostly stayed in the $3.3-3.4 trillion range, pulling back to late November levels where positions were also shaken out. Here is the classic 61.8% retracement level from the early November rally to the mid-December high.

Author

FXStreet Team

FXStreet