Cryptocurrencies Price Prediction: Bitcoin, XRP & Cryptos – American Wrap 26 February

Top 3 buy zones for Bitcoin as buy signal flashes on BTC price chart

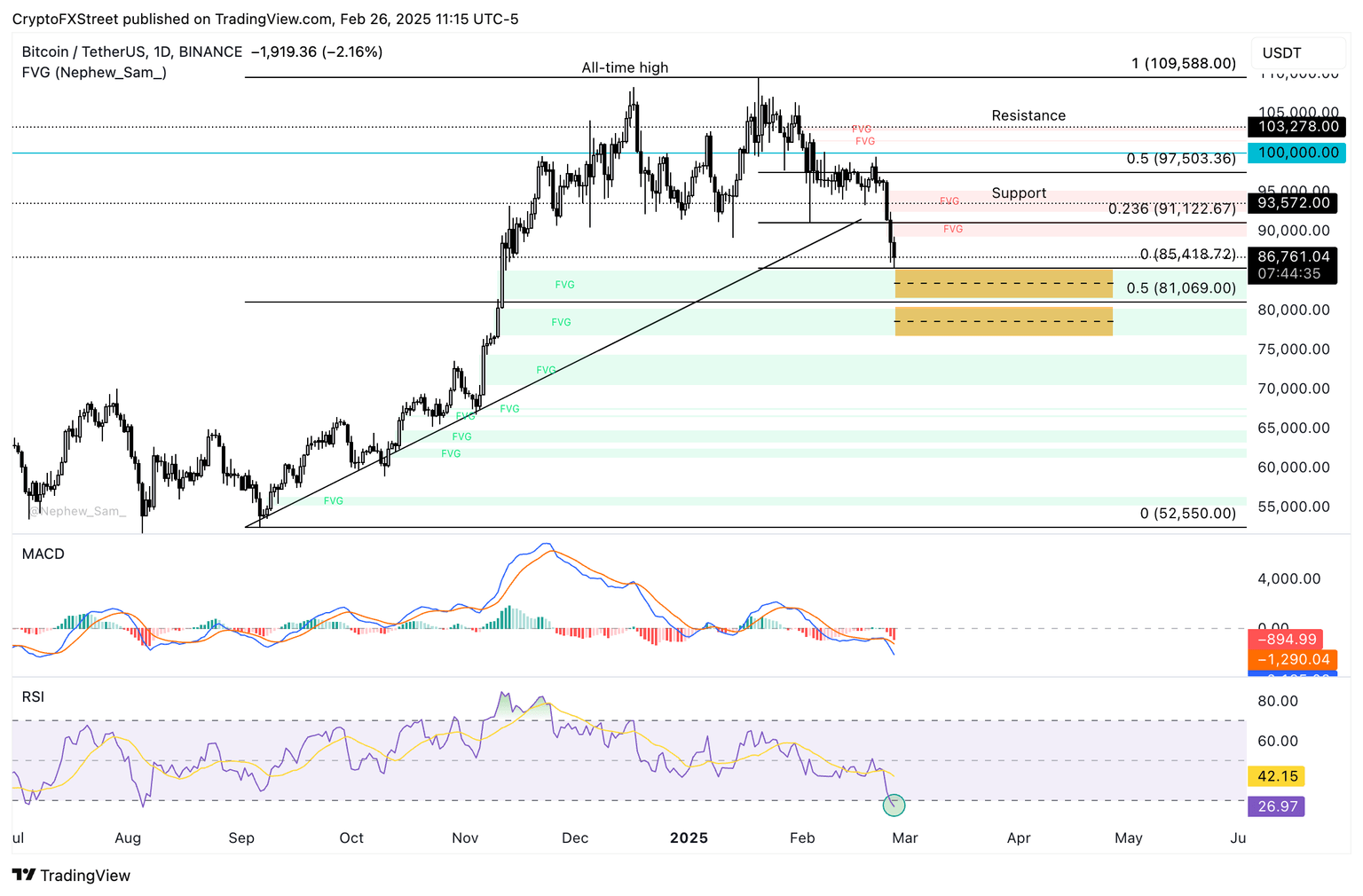

Bitcoin (BTC) hovers around the $87,000 level on Wednesday after traders faced massive liquidations following the largest cryptocurrency’s crash under the $90,000 support level. echnical indicators on the daily price chart generate a buy signal while crypto traders remain fearful, according to the Crypto Fear & Greed Index.

XRP keeps rally hope alive as price holds 38.2% Fibonacci level, DOGE uptrend ends

Payments-focused cryptocurrency XRP is down but not out, whereas the outlook for dogecoin (DOGE) appears grim, based on an analysis of Fibonacci retracement levels.

Bitcoin Price Forecast: BTC is 20% down from its ATH, trading below $89,000

Bitcoin (BTC) price hovers around $88,800 on Wednesday after reaching a low of $86,050 the previous day. US Bitcoin spot Exchange Traded Funds (ETF) supported BTC's price correction, recording the highest single-day outflow of $937.90 on Tuesday. A K33 report highlights how Micro Strategy's latest purchase of BTC was not well-received by the market while it processed a resurgence in concerns over US President Donald Trump’s tariffs.

Author

FXStreet Team

FXStreet