Cryptocurrencies Price Prediction: Bitcoin, Injective & XRP – European Wrap 1 March

Gaming tokens surge, in spillover effect from Bitcoin price rally: GALA, SAND, ENJ, BEAM, APE

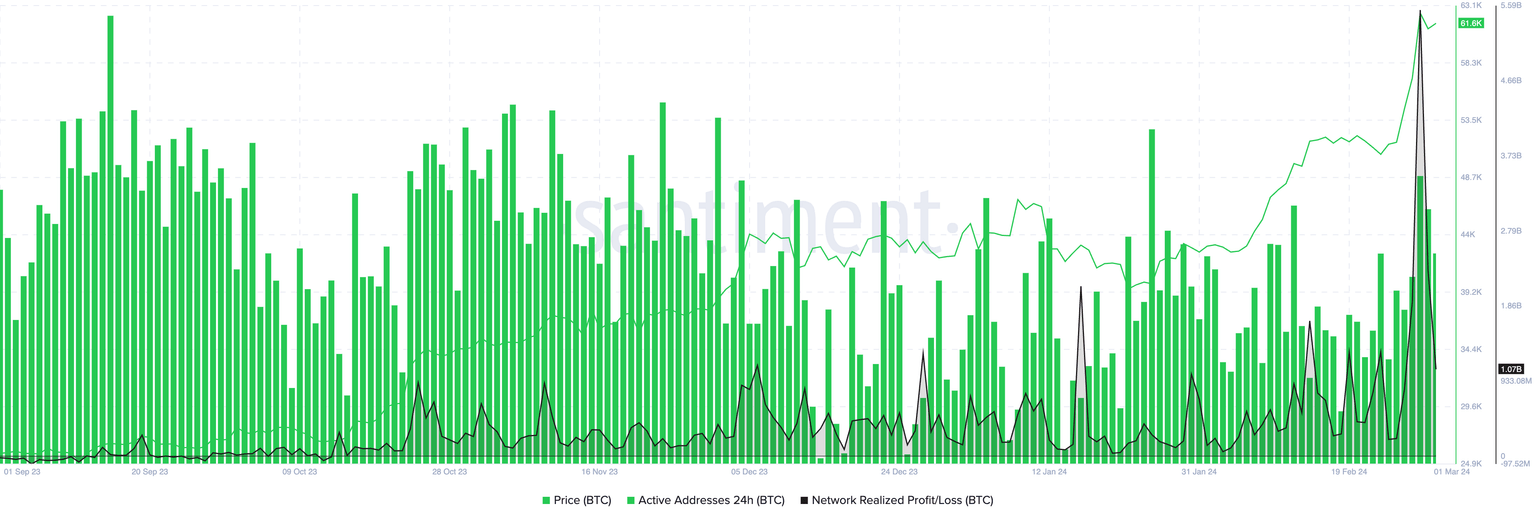

Prices of several gaming tokens increased sharply on Friday, a surge that can be broadly attributed to the overall recent growth in cryptocurrency markets but more specifically to the recent Bitcoin (BTC) price rally to a local top of $64,000.

Profit-taking by BTC holders peaked on Wednesday, making it likely that these investors have realized gains and rotated these profits into other sectors in the market such as gaming tokens. Gaming tokens such as GALA (GALA), The Sandbox (SAND), Enjin Coin (ENJ), Beam (BEAM), and ApeCoin (APE) have noted a price increase between 2% and 9% on Friday.

Injective price could retest $50 as INJ bulls try to overcome critical resistance level

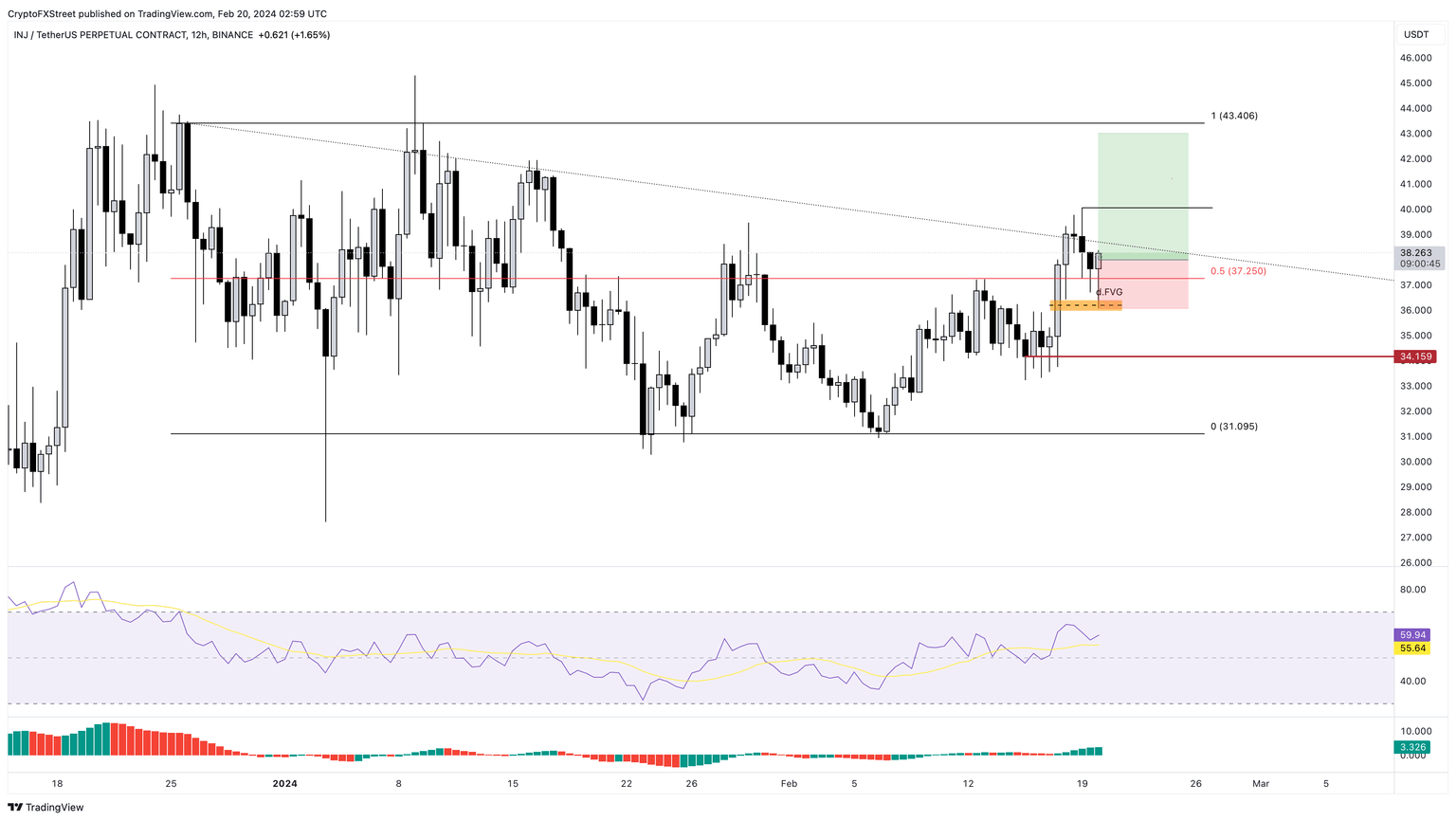

Injective (INJ) price has been coiling up in a tight range for more than two months. But the recent developments suggest INJ is readying for a massive volatile breakout rally in the next two weeks.

Injective price set up the $31.09 to $43.40 range in early 2024 and has been trading inside it for more than two months. In this tight range, INJ has produced lower highs, which can be connected using a trend line, revealing a declining resistance level. This hurdle was breached on February 27 as INJ rallied 13% to retest the range high at $43.40. This positive development is likely to lead to a breakout in the near future, which could result in handsome gains for investors.

XRP price jumps to $0.62 while Ripple faces pressure from two legal battles

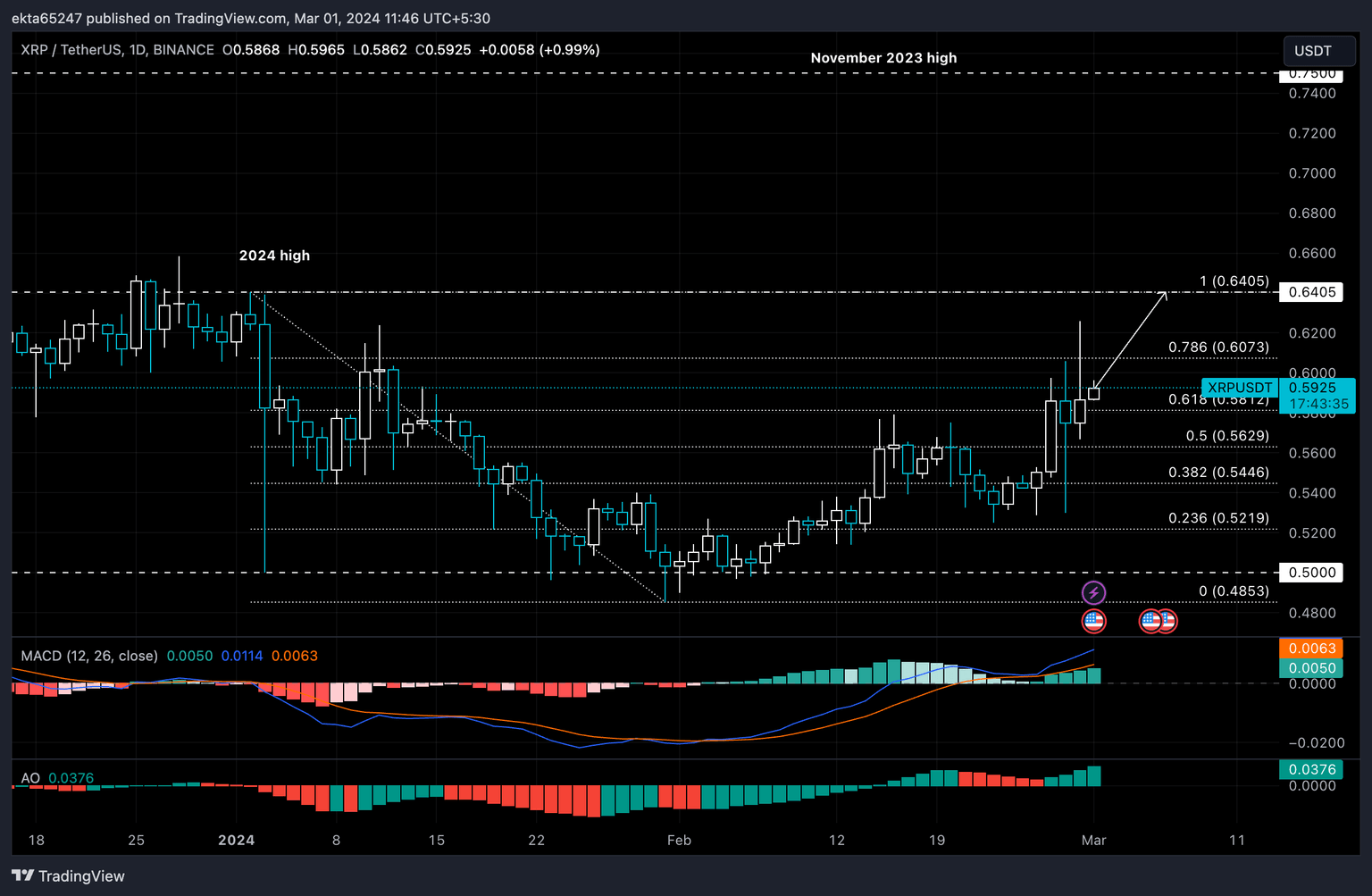

XRP price inched closer to its 2024 high, rallying past the $0.62 level on Thursday. The altcoin was hit by a correction, however, which pulled it back down to the $0.59s early Friday. Ripple, a cross border payment remittance firm is currently embroiled in a legal battle with the Securities and Exchange Commission (SEC) and a class action lawsuit filed by XRP holders.

XRP price is on track to break past its yearly high of $0.64, if the positive momentum is sustained. The altcoin rallied to a local top of $0.62 on Thursday, before correcting to $0.59 on Friday.

Author

FXStreet Team

FXStreet