Cryptocurrencies Price Prediction: Bitcoin, Bitcoin SV and Stellar Lumens – European Wrap 25 February

Bitcoin price ready for another upswing as the Fed publishes new preconditions for a digital dollar

On Wednesday, the Federal Reserve released a document that outlined new preconditions for the launch of a central bank digital currency (CBDC). Several people were listed as authors of the paper, including Jess Cheng, Paul Wong, and Angela Lawson. Read more...

Bitcoin SV price tumbles as Craig Wright faces new legal dispute

Bitcoin SV price has seen massive spikes in buying pressure followed by equally extreme selling pressure. Now, BSV stands at a make-or-break point as the main figure behind the project faces another legal battle. Read more...

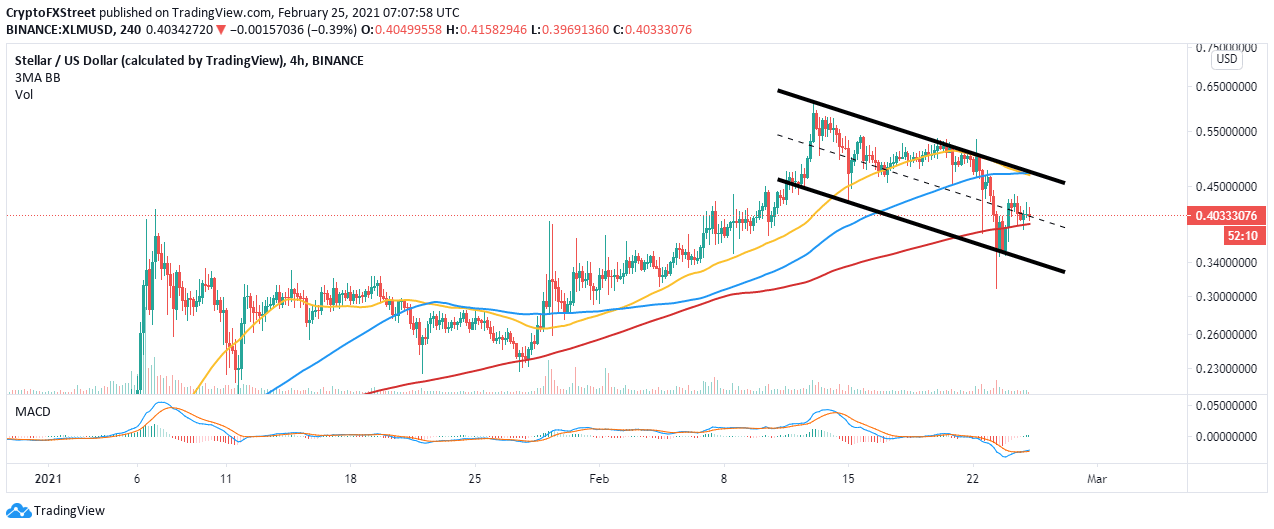

XLM Price Prediction: Stellar on the launchpad ready for liftoff to $0.6

Stellar has not been able to recover from the rejection at $0.6, the yearly high. Besides, the acute losses across the market this week were a big blow for the bulls. XLM tumbled to $0.3 before making a recovery above $0.4. As technicals start to improve, Stellar is looking forward to an upswing back to $0.6. Read more...

Author

FXStreet Team

FXStreet

%2520-%25202021-02-25T092243.924-637498315520986026.png&w=1536&q=95)