Cryptocurrencies Price Prediction: Bitcoin, Binance Coin and Solana – European Wrap 29 November

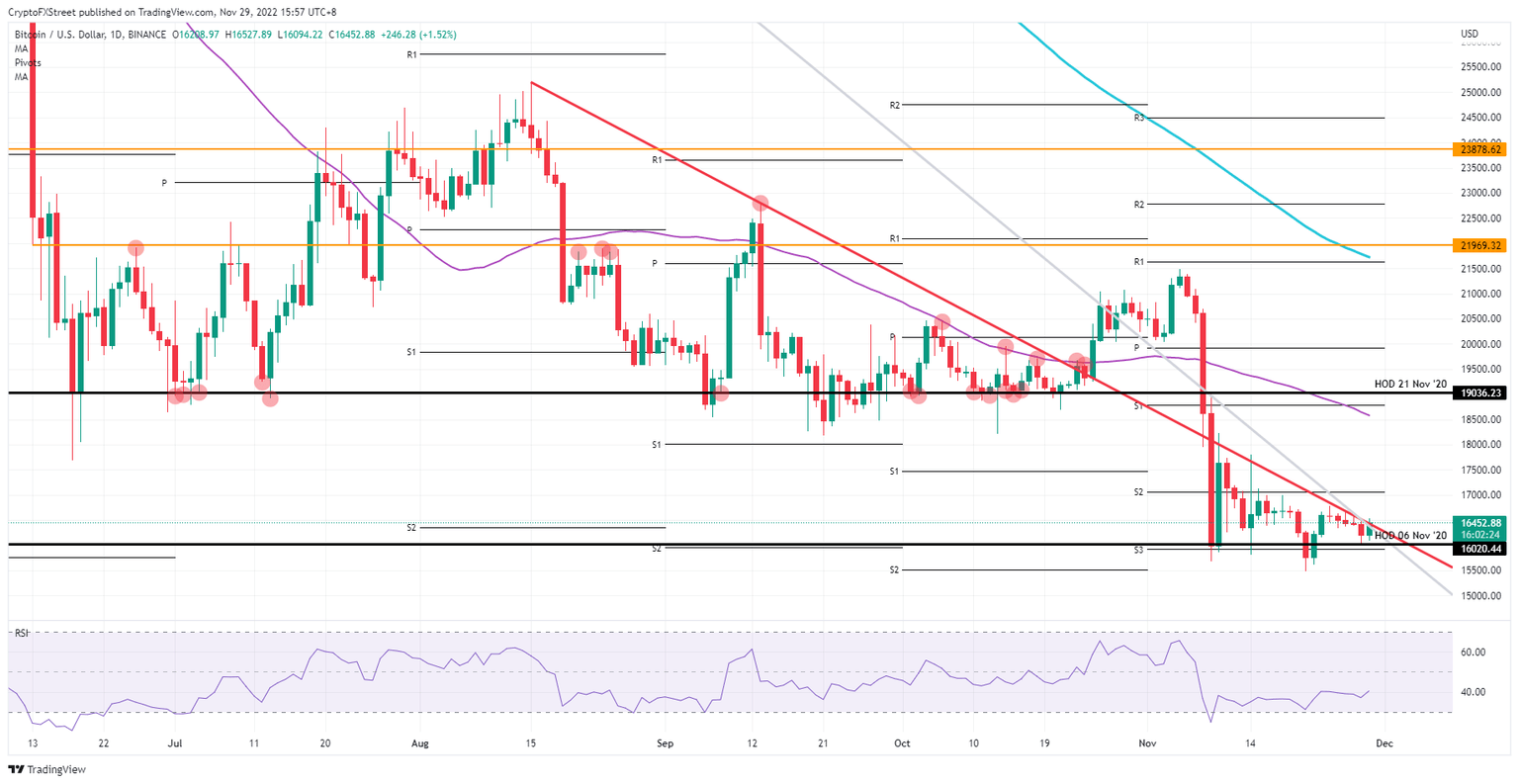

Bitcoin price hears jingle bells rolling in

Bitcoin (BTC) price is popping higher this Tuesday morning in the ASIA PAC session as Chinese markets spurt higher. After the social unrest over the weekend and on Monday, markets are taking a 180-degree turn as the Chinese government comes with more easing policy guidance and commits to speed up the vaccination rate. On the back of these measures, markets are rallying as another supply chain glut is to be avoided, and inflation forces should decrease a bit further, triggering a rally in BTC that could continue into Christmas.

Binance price shows promising support that could bring $400 onto quote board

Binance (BNB) price rallies firmly in the ASIA PAC trading hours as China flips 180 degrees with commitments from the government to reopen further and speed up the vaccination rate. This cuts short the social unrest and puts the sponge over any further escalation and disputes.Furthermore, the world can release a sigh of relief as inflation now can continue to ease as no real inflation shocks are on the horizon, and Fed chair Powell can communicate that a less aggressive tone is needed to get inflation back to 2%, making it a white Christmas after all.

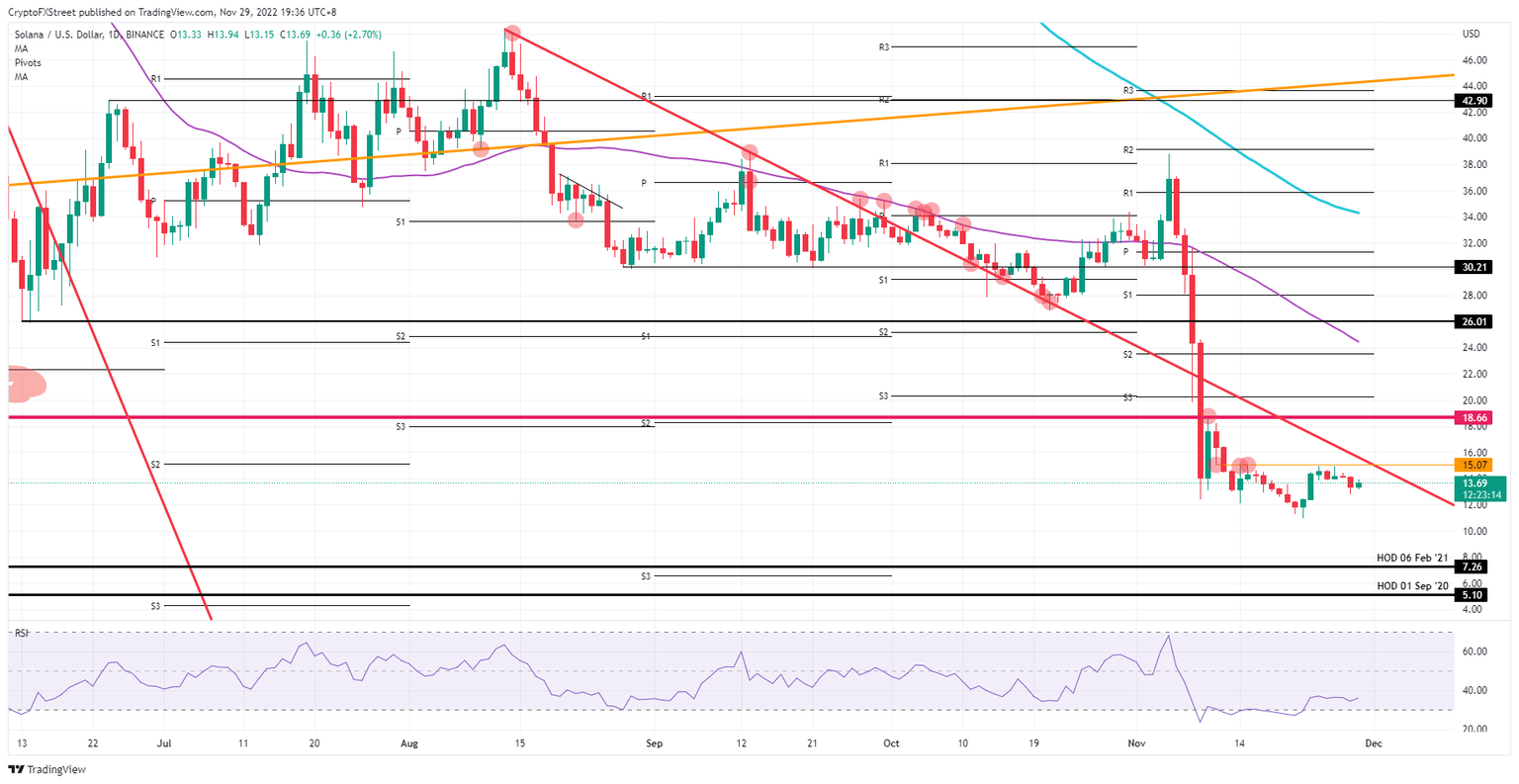

Solana price set to gear up for Dominica coming online with cryptocurrency

Solana (SOL) has been flirting with $10 to the downside and since last week was able to trade away from that low price tag. The Commonwealth Dominica is set to join El Salvador as a country that adopts cryptocurrencies as a legal form of payment. Next to the local currency, people can use Dominica Coin (DMC) for daily use, which should boost the usage of several other cryptocurrencies such as SOL.

Author

FXStreet Team

FXStreet