Cryptocurrencies Price Prediction: Binance Coin, Ripple & Cardano — Asian Wrap 21 November

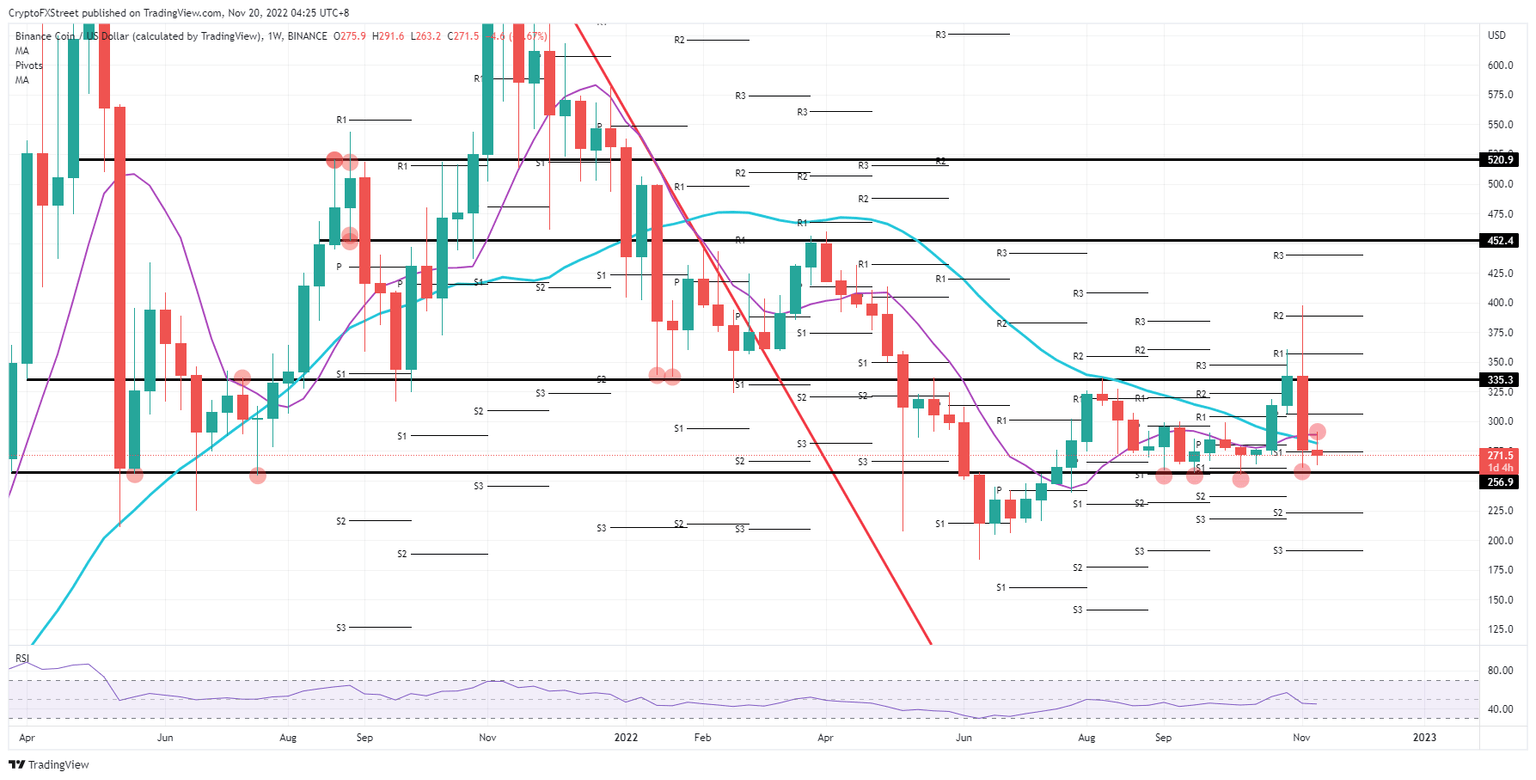

Binance Coin price sees traders trying to avoid re-entry of the bear zone

Binance Coin (BNB) price action took another leg lower after, from a purely technical point of view, receiving a firm rejection on its topside while trying to recoup the losses from last week. For now, the price action remains underpinned.

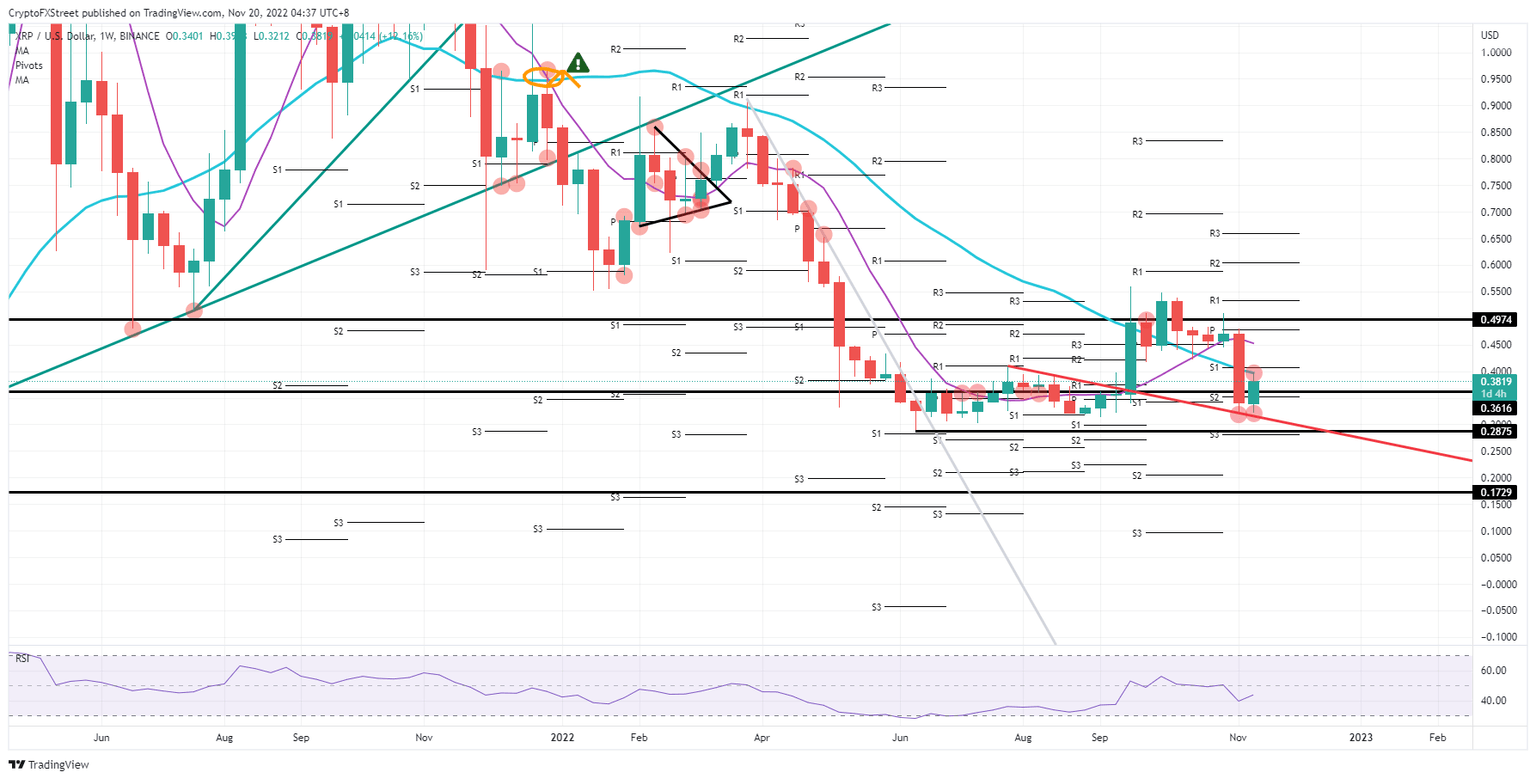

XRP is a beacon of light in the crypto winter and could be proven an outlier next week

Ripple (XRP) price is seeing bulls sticking to their guns after adventurous bulls came in and bought the dip near the low of the current low of November last week. Although XRP recovered a bit at the beginning of this week, as more headlines came out on the aftermath of FTX, the polish missile impact was the key trigger that flipped price action to the downside and bruised the bullish recovery sentiment.

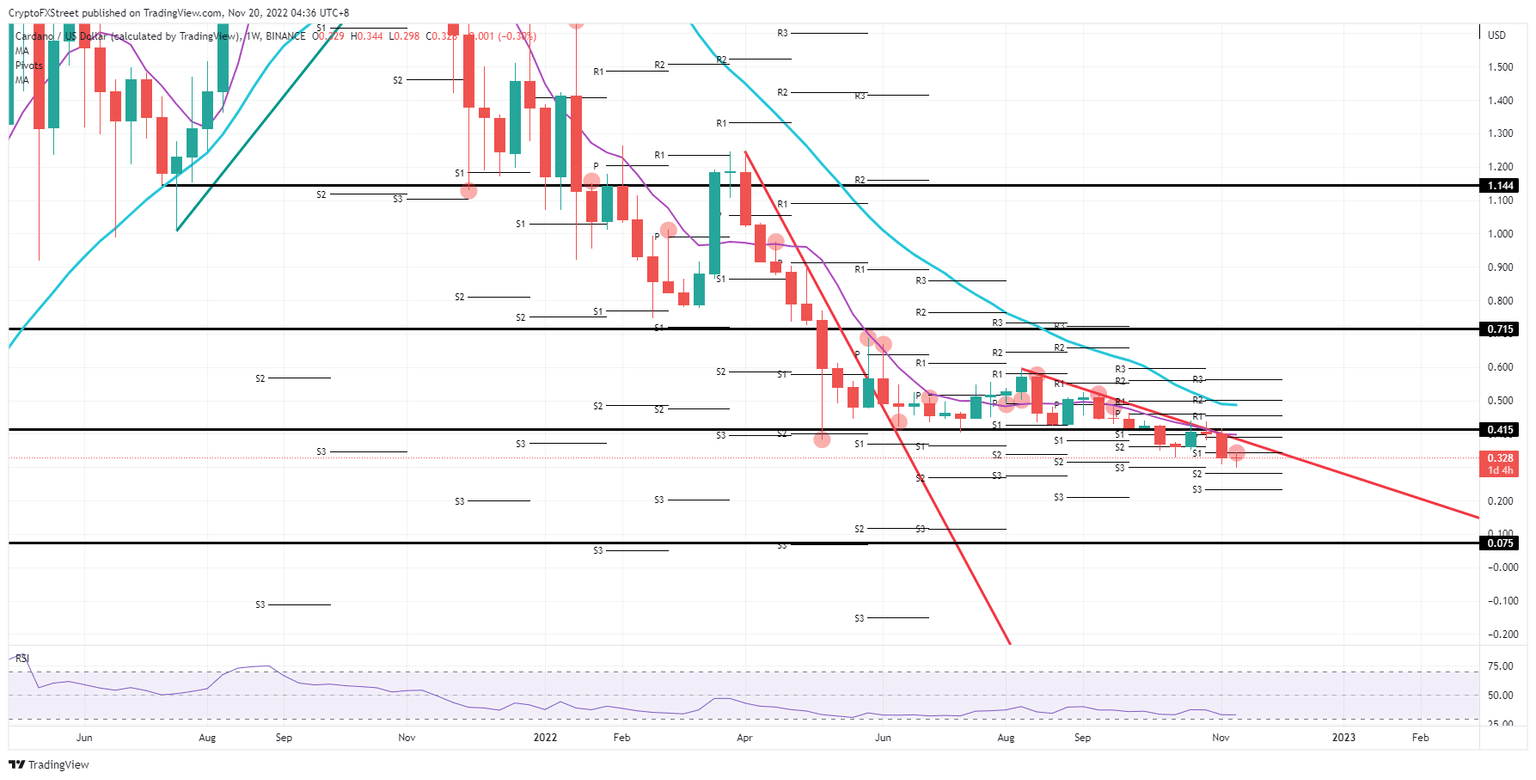

Cardano is drifting off too far as traders turn their backs for now

Cardano (ADA) price is on the brink of a big collapse as price action almost comes to a halt, with traders unable to claw back after the purge from last week. It is almost becoming a perfect storm as the number of bearish elements exceeds the number of bullish positives in ADA.

Author

FXStreet Team

FXStreet