Cryptocurrencies Price Prediction: Axie Infinity, UniSwab & Shiba Inu — Asian Wrap 05 Jan

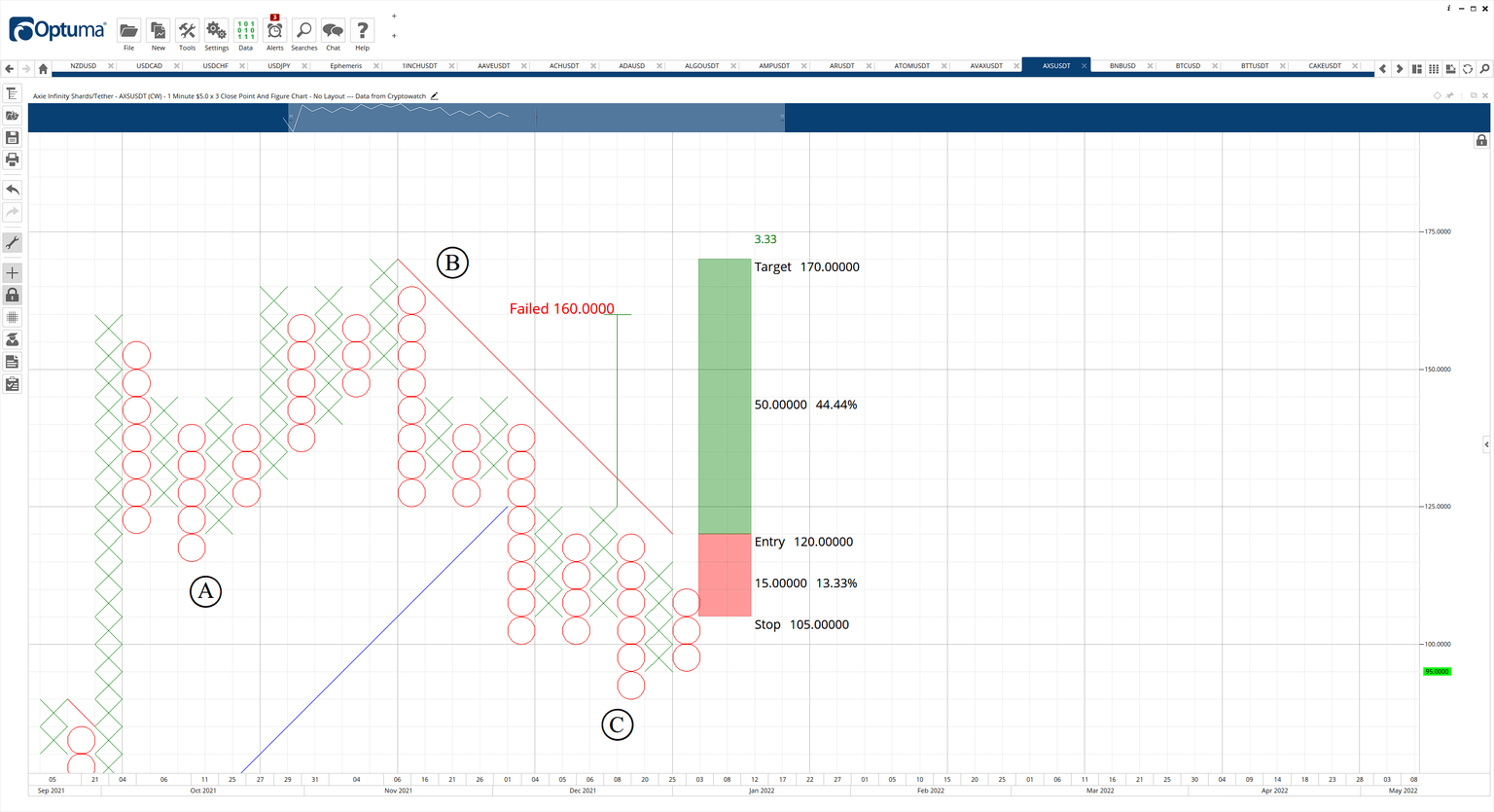

Axie Infinity Price Prediction: AXS readies for rebound to $170

Axie Infinity price appears to have stabilized between the $90 to $100 value areas. Additionally, strong buying and shorting signals exist on the $5.00/3-box reversal Point and Figure Chart. Axie Infinity price could rally by more than 40% to hit $170. Bulls have vigorously defended AXS from further downside pressure.

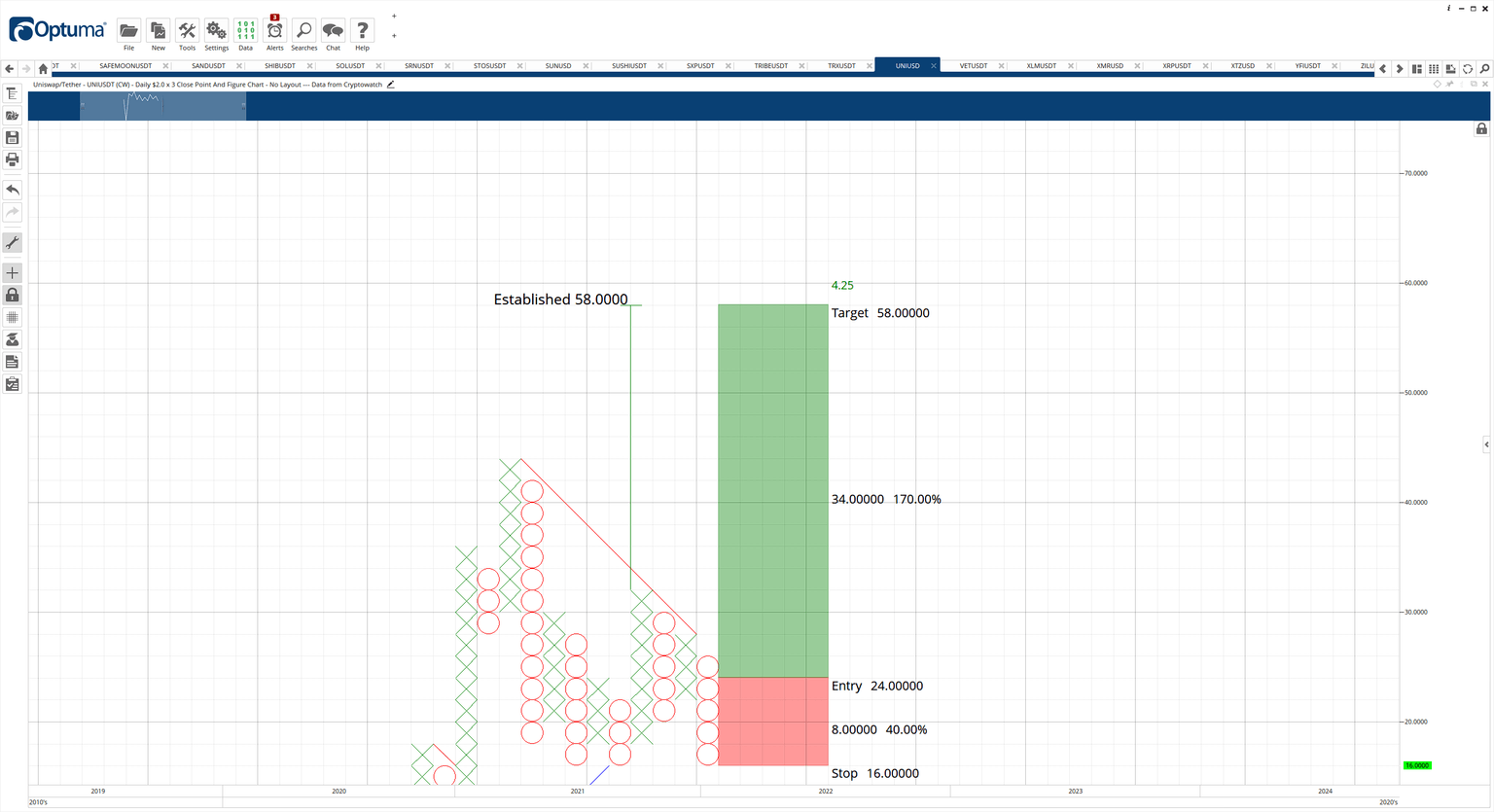

Uniswap presents strong buy opportunity before UNI rallies towards $58

Uniswap price action is setting up short-sellers for one nasty bear trap. Despite the presence of a possible triple-bottom breakout, a move lower would only further enhance the bullish reversal that is coming up.Downside risks are limited to the near term and are easily invalidated.

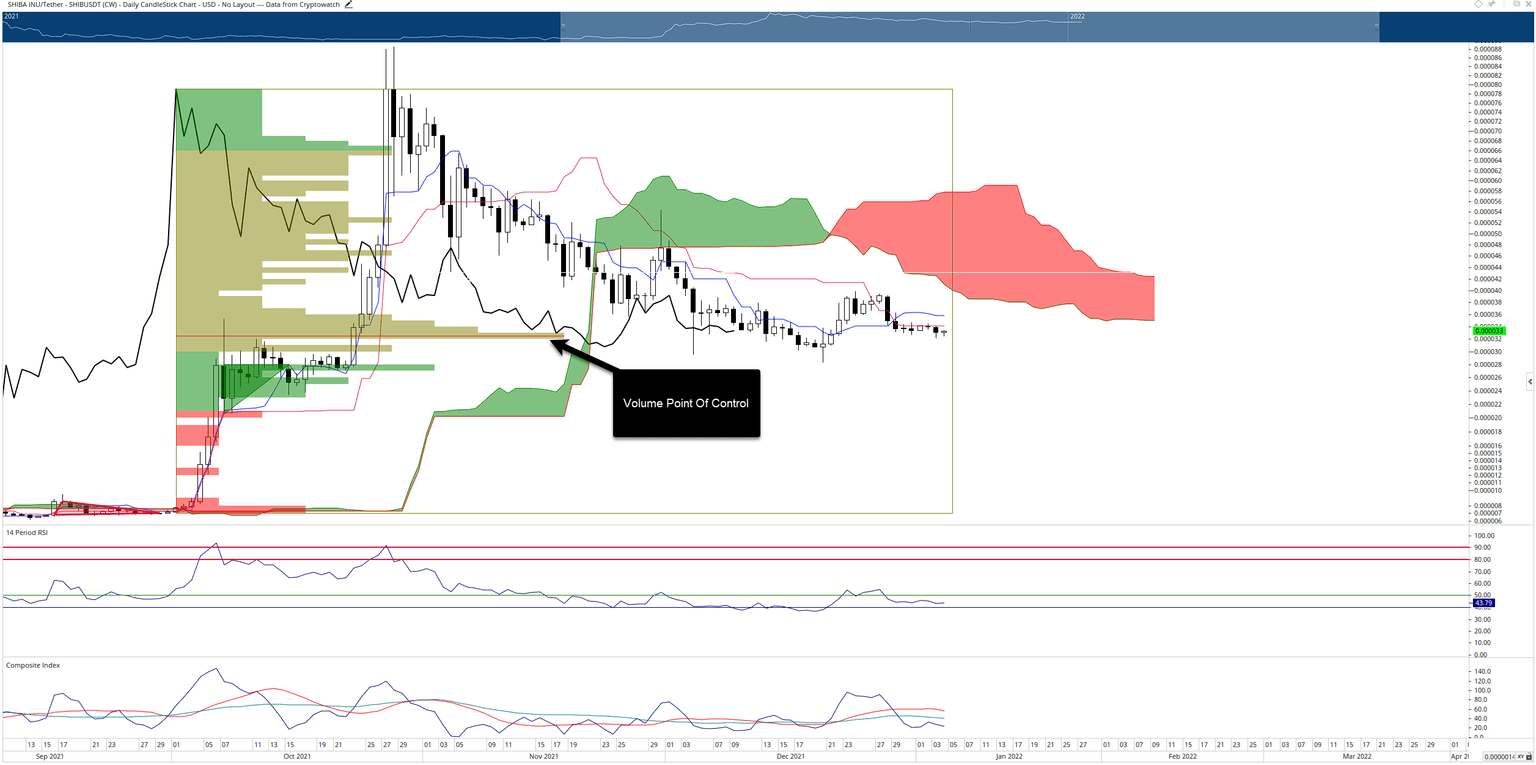

Shiba Inu continues to present a buying opportunity before SHIBA gains over 100%

Shiba Inu price has been stuck in a very, very constricted trading range over the past seven trading days, but throughout December, SHIBA formed a strong support zone and a new Volume Point Of Control – indicating a new uptrend may be imminent.

Author

FXStreet Team

FXStreet