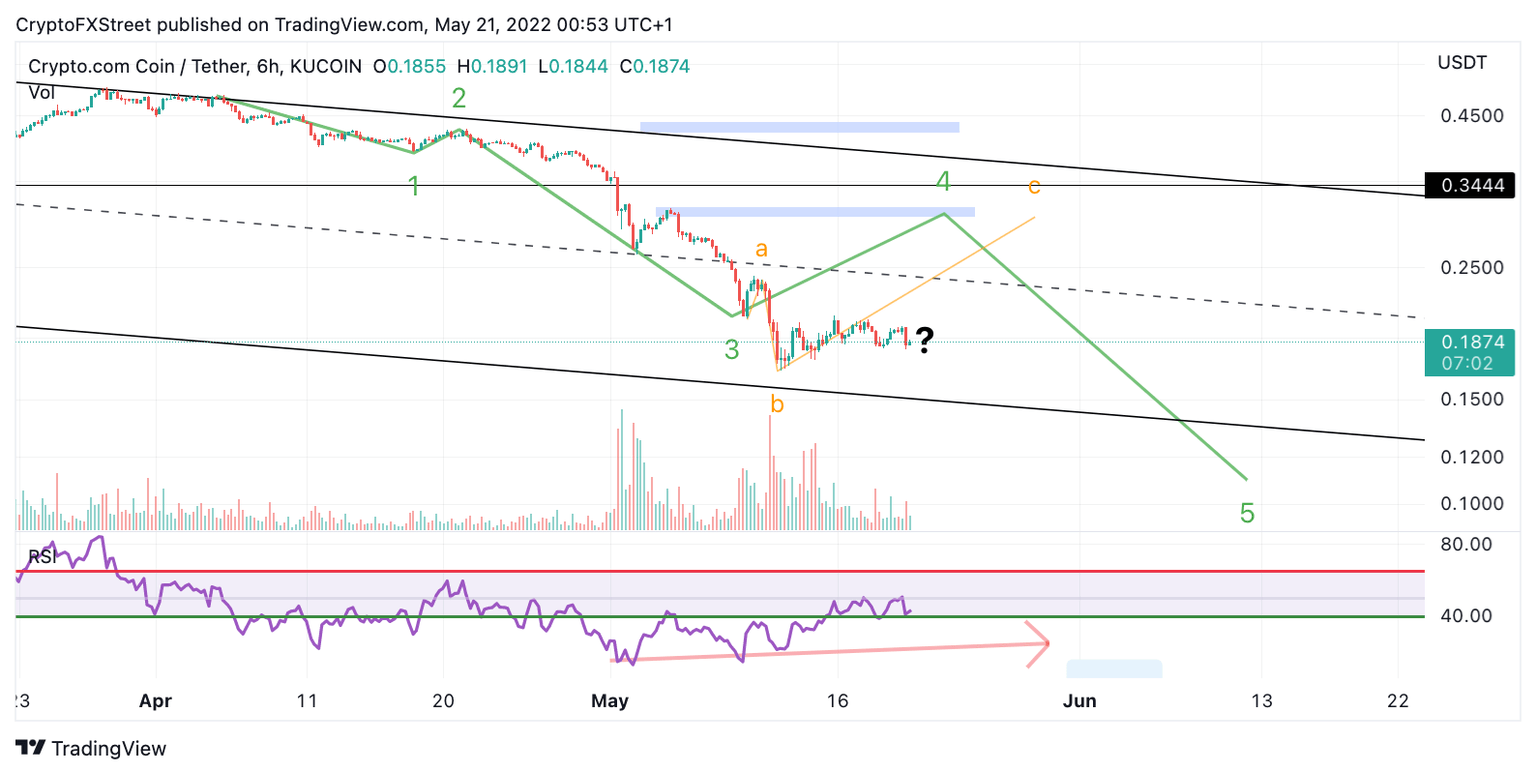

Crypto.com price proposes a recount as bears aim for $0.11

- CRO price consolidates a the bottom half of a parallel trend channel

- Crypto.com price action sideways nature spells for a decline

- Invalidation of the bearish trend is a breach and close above $0.21

Crypto.com price is in question as the the bulls are strugglinng to display bullish price aciton.

Crypto.com price proposes a recount

Crypto.com price has traders questioning whether the wave count is correct as the sideways price action distorts proportionally in terms of time. The consolidations that occurred within the steep decline from $0.44 were generally rapid. The Crypto.com price overloads the consolidation time ratios, which spells an for explosive rally. Will the bears conquer consolidation?

Crypto.com price hints at a possibility for a further decline as the bulls are providing support just above the lower half of the parallel channel. Usually, consolidations that take abnormal amounts of time to develop are building the strength to breach substantial trend barriers. If this scenario occurs, the bears could be sending the Crypto.com price into $0.11, a 40% dip from today’s price of $0.1885

Invalidation of the bearish downslide is a breach at $0.21. If the bulls can produce a battle within the $0.21 level, they could end up on top and. And as a result, re-claim the $0.24 price zone for a 30% increase from the current Crypto.com price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.