Crypto.com Price Prediction: Investors on edge as bears aim for new all-time lows

- Crypto.com price is down 12% on the month.

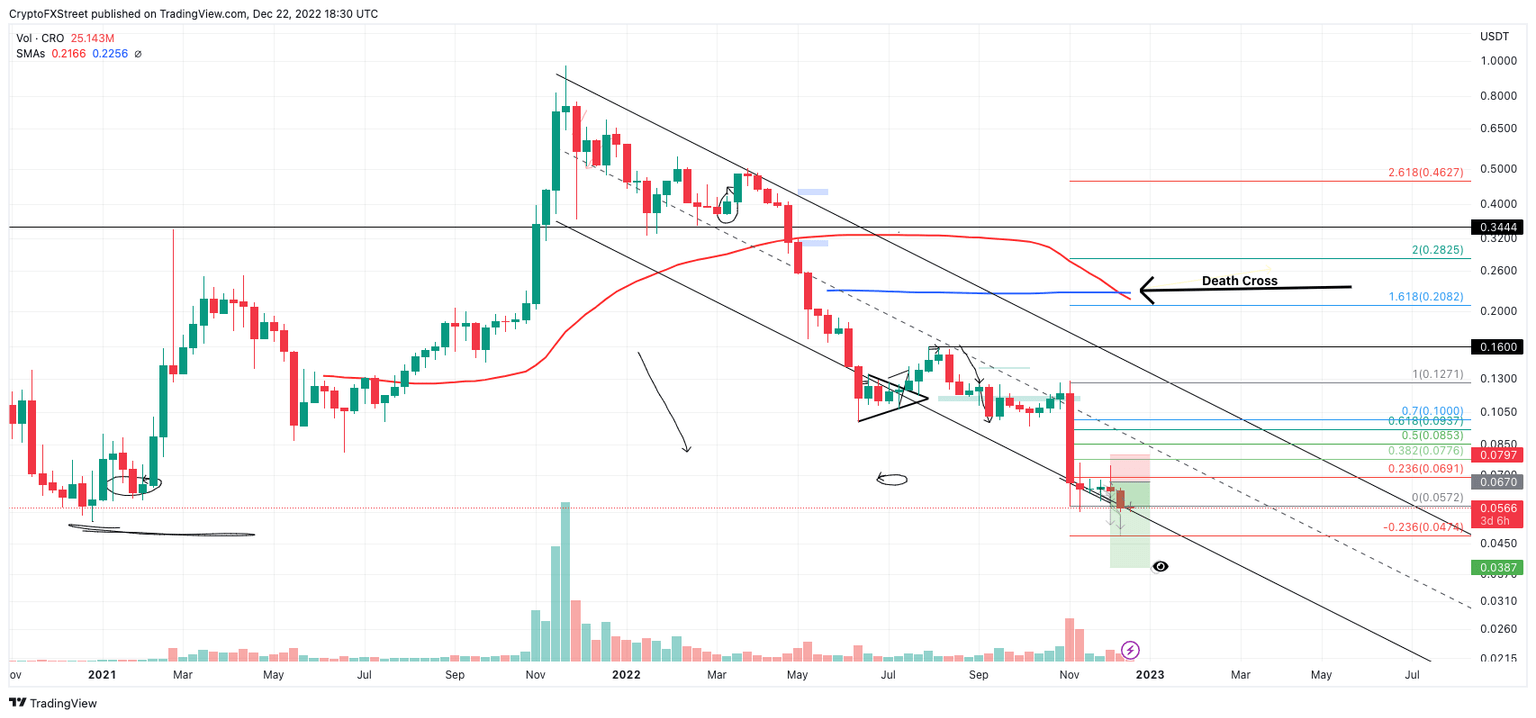

- A bearish cross has been spotted on the weekly time frame.

- The bulls will need to hurdle the $0.063 barrier to launch a counterattack.

Crypto.com price may be setting up for an end-of-the-year decline. CRO will need to display tremendous strength to alter the bearish bias.

Crypto.com price setting up for pain

Crypto.com price may be hanging on the edge of a cliff. On December 22, the CRO price is at a 12% loss of market value since the start of the month. The Ethereum-based cryptocurrency exchange token has hovered above a descending trend channel for several weeks. The bulls have produced short-lived countertrend spikes following each retest of the supportive barrier. At the time of writing, the technicals suggest the trend channel will soon face a much more significant challenge.

Crypto.com price currently auctions at $0.056. On the weekly time frame, the 50-week simple moving average has crossed over the 100-week variant, well above the current trading range. Although bearish crosses usually happen more frequently on smaller time frames, like the 4-hour and daily charts, the same concept of momentum and force can be applied on larger timeframes.

CRO/USDT 1-week chart

Thus traders may want to ease off their countertrend scalping strategies when engaging with CRO. On smaller time frames, a breach below the descending parallel channel at $0.055 could be the start of the anticipated decline. Invalidation of the bearish thesis will need a spike and consolidation above the previous weekly settling price at $0.0636. If the bulls are successful, an additional rally towards the November monthly high at $0.074 could occur. The Crypto.com price will rise by 30% if the bullish scenario plays out.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.