Crypto.com becomes the first crypto exchange to receive a Payment Institution license in Brazil

- Crypto.com, in the last few months, has also received licenses in many other countries, including Singapore and France.

- Crypto.com recently released its Proof of Reserves, confirming a 1:1 reserve of its customer assets.

- CRO price is losing ground and could end up registering a 7% crash if bearish cues persist.

Crypto.com is pushing its presence in the world by obtaining regulatory approvals and licenses from authorities. The exchange's success in being able to do so despite the recent FTX debacle speaks volumes about its credibility. However, the impact on Crypto.com price is yet to be known.

Crypto.com in Brazil

While Crypto.com has been operating its Visa Card services in Brazil since November 2021, the crypto exchange recently received the authorities' approval to become a licensed payment institution as well. Crypto.com, in an announcement on Thursday, confirmed that it had secured a Payment Institution License (EMI) from the Central Bank of Brazil.

This will allow Crypto.com to continue offering regulated fiat wallet services for customers in the country. Commenting on the same, the CEO of Crypto.com, Kris Marszalek, stated,

"Brazil and the entire LATAM market is a significant region in the pursuit of our vision of cryptocurrency in every wallet…We look forward to continuing working with regulators and authorities throughout the region in advancing cryptocurrency and blockchain technology."

This was echoed in the outlook of the General Manager of Crypto.com LATAM, who said that the Latin American region is a major driver in crypto adoption.

Crypto.com added Brazil to its list of countries it has received blessing to operate in over the last few months. The exchange also gained approvals from relevant authorities in Singapore, France, the UK, Dubai, South Korea and Canada for various services.

The exchange has also maintained its users' confidence during the FTX collapse-induced fear in the crypto market. Publishing its Proof of Reserves earlier this month, Crypto.com reassured that the customer funds for multiple assets are reserved 1:1, with USDT holding the highest reserve ratio of 106%.

Crypto.com price on a downfall

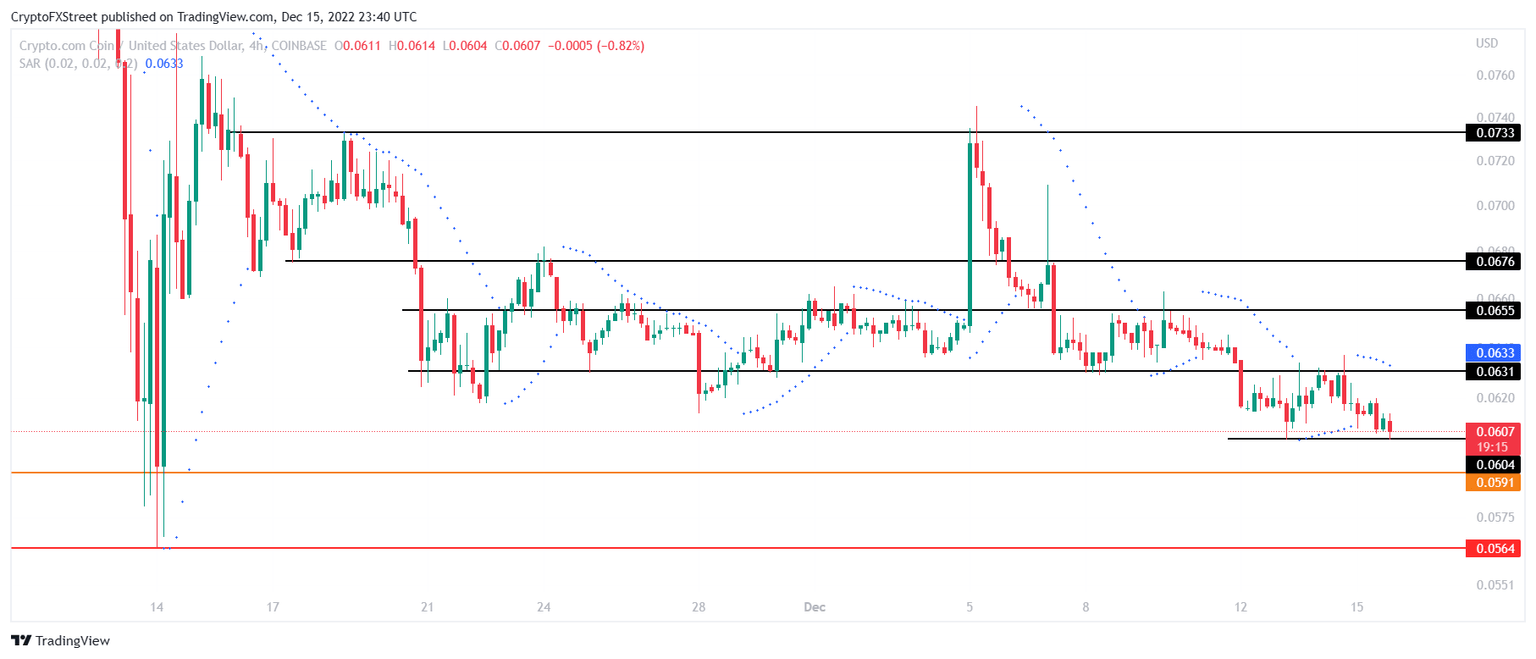

Despite an improvement in market conditions, Crypto.com price failed to note any positive momentum as the token traded at $0.0607. Nearing its immediate support level at $0.0604, CRO might end up observing a 7% crash if the decline continues.

The Parabolic Stop and Reverse (SAR) is also highlighting an active downtrend with the presence of the indicator above the candlesticks. The indicator is used to gauge the direction of the trend based on the positioning of its dots.

Thus if the Crypto.com price observes no buying pressure, it could lose the support at $0.0604 and tag $0.0591. Should the cryptocurrency fall below this critical support, CRO price would end up tagging the lows of $0.0564.

CRO/USD 4-hour chart

However, if the tides change and Crypto.com price rallies, a retest of the $0.0631 resistance level is likely. Further bullish pressure could push CRO toward $0.0655.A daily candlestick close above the level would invalidate the bearish thesis, setting the altcoin up for a rally to $0.0676.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.