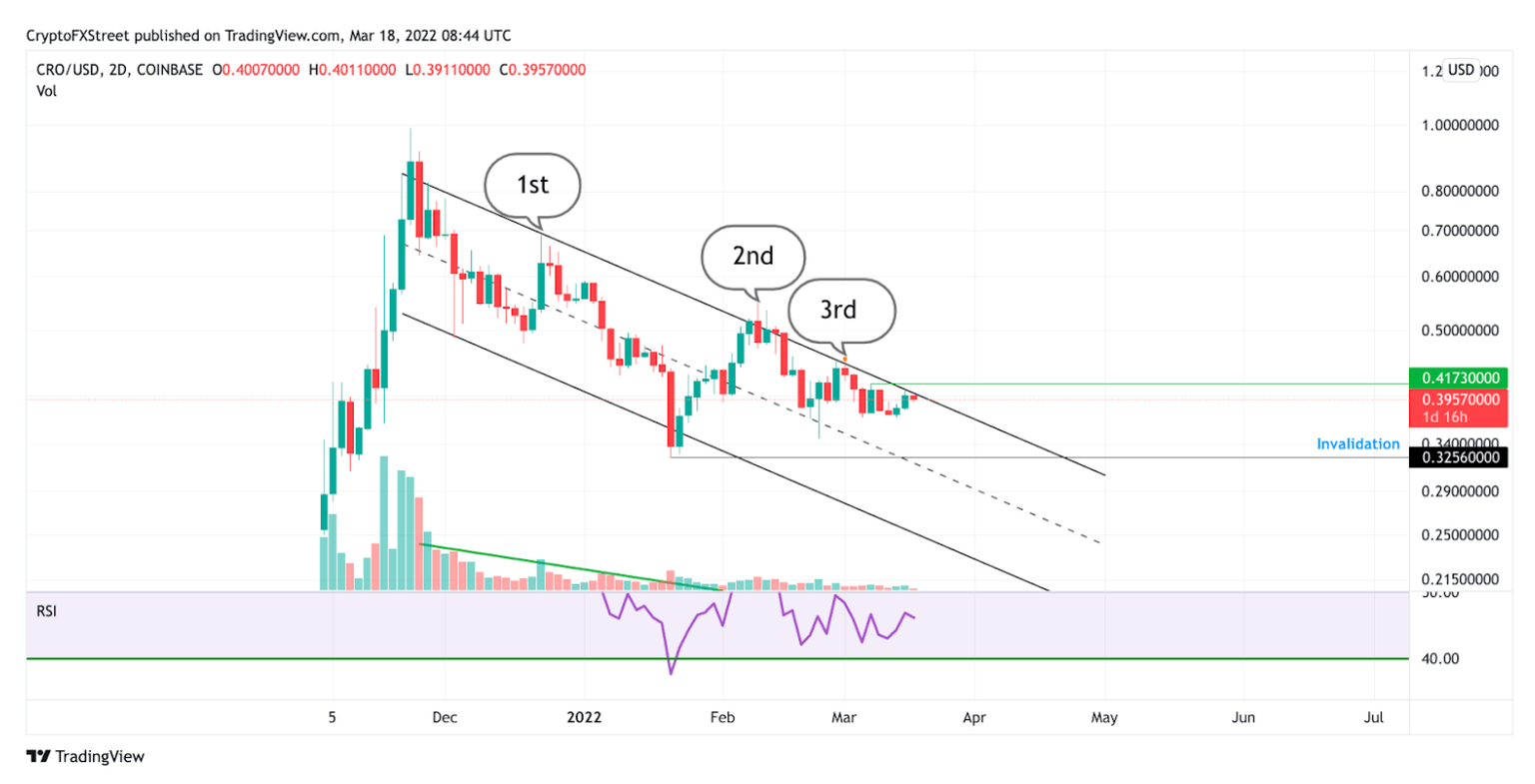

Crypto.com price is 5% short from a bullish breakout to $0.55

- Crypto.com price is currently trading at $0.40.

- CRO shows no signs of bearish strength on the daily chart.

- A dip below $0.34 would invalidate the bullish thesis.

Crypto.com price looks like it is ready for a bull run, according to the 2-day chart. Bulls only need to push CRO just a trim higher before sidelined investors flood the gates.

Crypto.com price floats just below pending buy orders

Crypto.com price is still looking very bullish as the current 2-day candlestick is hovering only 5% below the top of the declining trend channel. If bulls can break past $0.43, CRO price will likely see a breakout towards $0.47 and $0.55, up to 40% above the current price. That being said, traders should consider adopting a buy-stop approach to catch the potential breakout.

CRO price best-case scenario for an early entry will be a change in the volume profile. As of now, the sell-off from the all-time high does look highly bullish as the selling volume has tapered off tremendously. The first green candle at the trendline with a turn in volume will be the key for entry.

CRO//USD 2-Day Chart

On the contrary, bears still have the potential to send Crypto.com price lower. If bears can manage to keep the price suppressed this week, then there is a possibility that a "sweep of the lows" event can occur at $0.345 and $0.32, up to 17% below the current price.

Author

FXStreet Team

FXStreet