Crypto Today: Bitcoin hovers above $60,000, Ethereum dips below $2,500, XRP tests crucial support

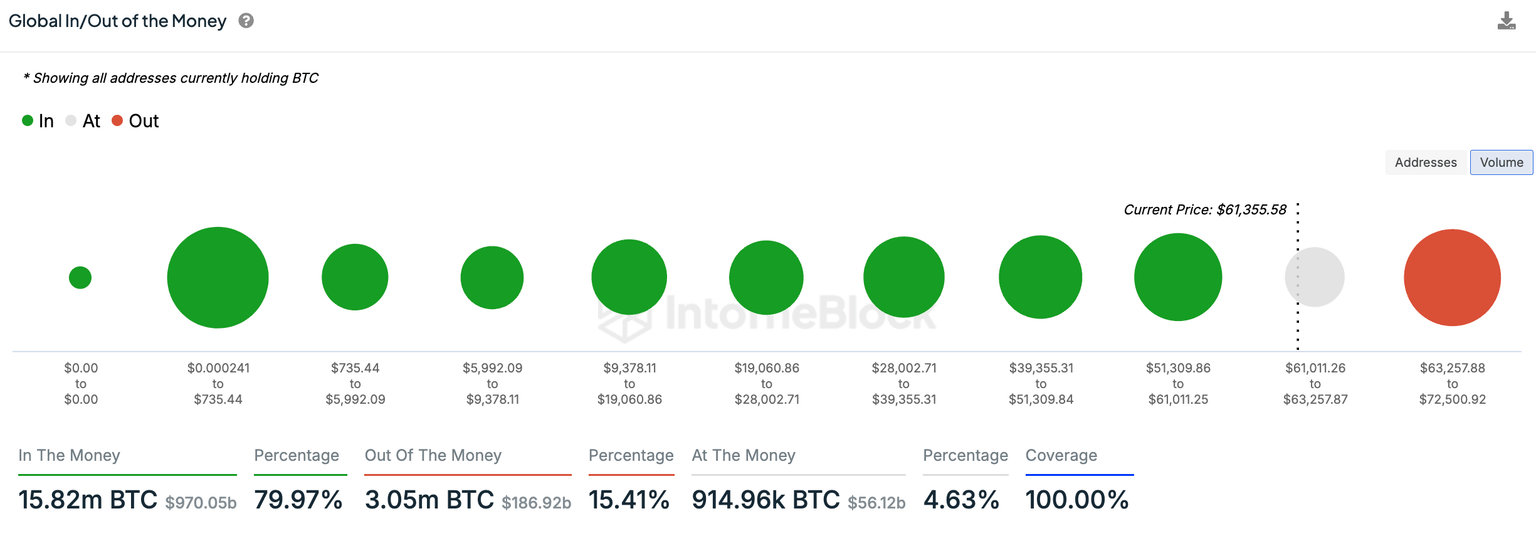

- Bitcoin dips below the $61,000 level where 5.42 million wallet addresses accumulated 2.41 million BTC.

- Ethereum loses key support and approaches to $2,400 on Wednesday.

- XRP corrects over 2%, down to $0.5845 at the time of writing.

Bitcoin, Ethereum and XRP updates

- Bitcoin and Ethereum Spot Exchange Traded Funds (ETFs) in the United States observed net outflows on Tuesday. According to data from Farside Investors, $242.6 million in capital left BTC ETFs while ETH ETFs lost $48.6 million.

- BTC and ETH are likely faced with a drop in institutional demand as Bitcoin ends its eight day long net positive flow streak on Tuesday.

- Bitcoin dips under the $61,000 level, trades at $60,814 at the time of writing.

- Ethereum drops below the key psychological barrier at $2,500 and trades at $2,433 at the time of writing on Wednesday.

- XRP tests support at $0.5946 and hovers around $0.5800.

Chart of the day: Lido DAO (LDO)

Lido erases 3.53% of its value on the day. The Ethereum staking token ranks among one of the cryptocurrencies that yielded most negative returns for traders on Binance. LDO trades at $1.093 at the time of writing.

LDO could sweep liquidity in the Fair Value Gap (FVG) between $1.034 to $1.021. If the staking token extends its decline it could dip to the August 4 low of $0.894.

The Moving Average Convergence Divergence (MACD) indicator is nearing a bearish cross, signaling that the underlying momentum in LDO price trend has turned negative.

The Relative Strength Index (RSI) edges sharply lower and reads 44.91 in the daily chart. RSI marked overbought conditions of 70 on Friday and dipped under the neutral level since then.

LDO/USDT daily chart

If Lido closes above the 10-day Exponential Moving Average (EMA) at $1.539, it could invalidate the bearish thesis. In that case, LDO could rally towards the resistance at $1.636, the 23.6% Fibonacci retracement level of the decline from the January 10 peak of $4.038 to the August 4 low of $0.894.

Market updates

- Justin Sun, founder of TRON, withdrew 21.66 million USDT from Binance on Wednesday. Colin wu, Asian journalist interprets this move as Sun’s sale of EIGEN token airdrops. On-chain data shows Sun’s six different wallet addresses received 5.374 million EIGEN tokens and these assets were transferred to Binance.

孙哥所属地址在 1 小时前从币安提出了 2166 万枚 USDT,这意味着孙哥领取的 537.4 万枚 EIGEN 空投已以 $4.03 的均价全部售出。

— 余烬 (@EmberCN) October 2, 2024

孙哥所属的 6 个地址在前天晚上领取了 537.4 万枚 EIGEN 空投,昨天中午 EIGEN 允许转移后,孙哥将这些 EIGEN 转进 HTX,然后又立即从 HTX 转到了币安 (图2)。… https://t.co/Q8AA6CusdP pic.twitter.com/R0HSSTZxeQ

- Binance announced that the exchange will remove and stop trading Fusionist (ACE), Filecoin (FIL), Optimism (OP), Tellor Tributes (TRB)’s trading pairs: ACE/FDUSD, FIL/BNB, OP/BNB, and TRB/FDUSD, on Friday The exchange cited poor liquidity and low trading volume as the reason for the delisting.

- Bitcoin miners’ revenue in September hit its lowest level in the past year. September revenue was $816 million, revenue from transaction fees was $13.86 million in the same timeframe.

Industry updates

- 5.42 million wallet addresses that accumulated 2.41 million BTC between $51,039 and $61,011 are currently profitable, according to data from IntoTheBlock.

Bitcoin’s Global In/Out of the Money

- Dogecoin on-chain activity shows that whale activity remains high on the DOGE network, and profit-taking may not have ended.

Dogecoin whale and on-chain activity

- BlackRock’s Bitcoin Spot ETF IBIT hit $1 billion in trading volume on Tuesday. This marks a key milestone for the ETF that has been hit a few times in June and August 2024.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.