Crypto Today: Bitcoin, Ethereum slide lower alongside declining inflows to exchanges

- Bitcoin and Ethereum correct on Tuesday, dropping more than 2% each.

- Data from OKX and Binance show a slowdown in retail activity, lower than past bull markets and even the 2019-2020 bear market.

- XRP dips under $0.6200 support, trades at $0.6111.

Bitcoin, Ethereum and XRP updates

- Bitcoin Spot ETFs observed eight consecutive days of positive flows. Typically, consecutive inflows signal sustained institutional demand for the asset. According to data from Farside Investors, Bitcoin ETFs noted $61.3 million in inflows on Monday.

- Ethereum hovers around $2,500 on Tuesday. Ethereum ETFs noted an outflow of $0.8 million on Monday. The altcoin continues to correct, breaking under Saturday’s low of $2,524 at the time of writing.

- XRP faces a correction even as Ripple announces tentative approval of a Dubai financial license. The altcoin dips under the $0.6200 support level and trades at $0.6111 at the time of writing.

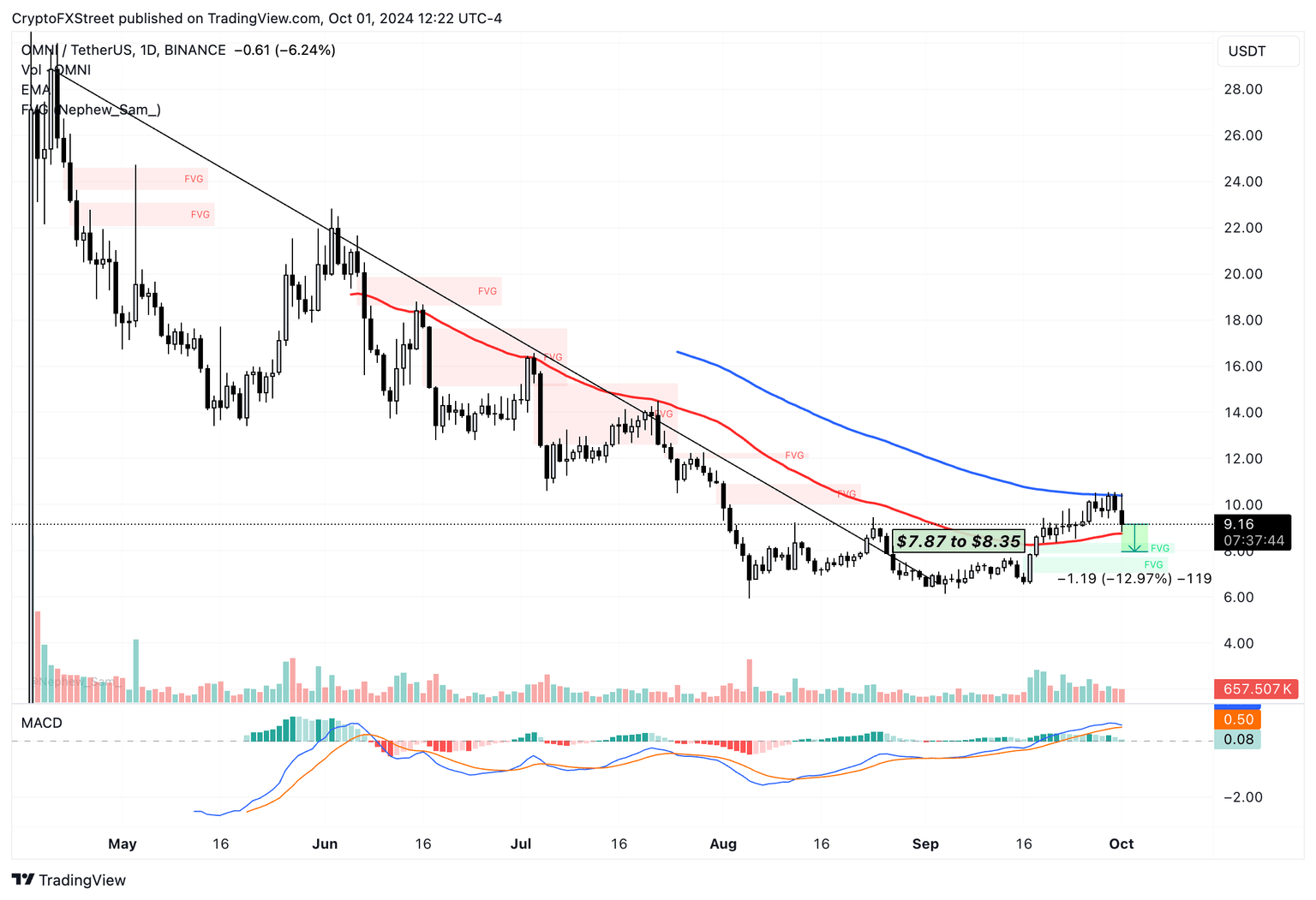

Chart of the day: Omni Network (OMNI)

OMNI ended its multi-month downward trend on September 3 when the asset closed above $6.57. The token is likely to extend its decline by 12% and sweep liquidity in the Fair Value Gap (FVG) between $7.87 and $8.35. OMNI is currently trading below the 50-day Exponential Moving Average (EMA) as seen in the OMNI/USDT daily chart.

OMNI/USDT daily chart

If OMNI sees a daily candlestick close above the 50-day EMA at $10.39, it could invalidate the bearish thesis for the asset.

Market updates

- Crypto exchange flows data from OKX and Binance show that the inflows to centralized exchanges are lower than both past bull markets and the bear market of 2019-20. While lower inflows typically mean there is reduced selling pressure on assets across exchange platforms, it also signals a decline in activity and demand among traders.

Bitcoin inflows to exchanges

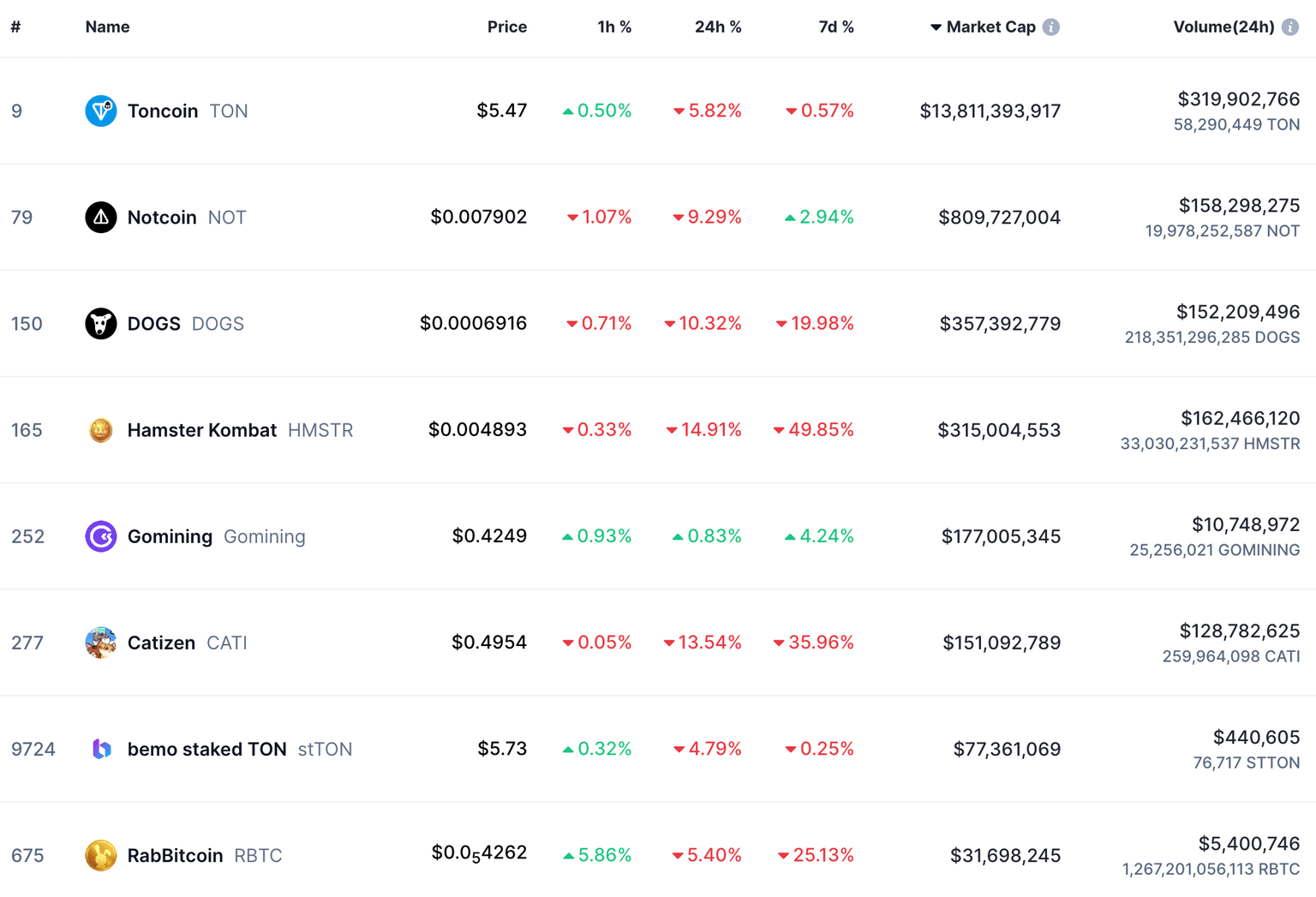

- Toncoin ecosystem tokens, which are listed on Binance, have observed a steep correction in their prices in the past seven days, according to data from Coinmarketcap.com.

Toncoin ecosystem tokens

- QCP capital predicts Bitcoin price rally to a high of $78,000 in October.

Asia Colour - 1 Oct 24

— QCP (@QCPgroup) October 1, 2024

1/We're officially in "Uptober," a historically bullish month for Bitcoin, with an average gain of 22.9% in 8 of the last 9 years. A similar move could push #BTC above 78k, breaking all-time highs.

Industry updates

- On-chain data from Lookonchain shows profit-taking by a whale wallet address. If more ETH holders engage in profit-taking, it could negatively influence the altcoin’s price.

The whale sold all 29,480 $ETH($76.8M) at an average price of $2,605 in the past 3 days, making ~$2.34M!

— Lookonchain (@lookonchain) October 1, 2024

The whale bought 29,414 $ETH($74.46M) at an average price of $2,532 from August 27 to August 30 and staked it.https://t.co/edvDTce8Y7 pic.twitter.com/5vzWkZsdt3

- Ripple receives a license from Dubai’s Financial Services Authority (FSA), plans to roll out services to firms based in the Emirates.

We’re delighted to have secured in-principle approval of a financial services license from Dubai Financial Services Authority, unlocking our end-to-end managed payments services in the UAE. https://t.co/4zq8YPlgaG

— Ripple (@Ripple) October 1, 2024

- Chainalysis’ executive, Chief Marketing Officer Ian Andrews, slams Russia for evading sanctions using crypto. Andrews was quoted as saying, “Russia has become an international force using cryptocurrency for everything from sanctions evasion to ransomware attacks, and most recently, interference and disinformation campaigns targeting the US elections,” in a video on the firm's YouTube channel on October 1.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.