Crypto Today: Bitcoin, Ethereum, XRP on cusp of another breakout

- Bitcoin consolidates between $118,000 and $120,000, bolstered by steady institutional demand.

- The Ethereum bullish case targets a breakout above $4,000, despite the RSI remaining overbought.

- XRP holds above the critical $3.00 level, but downside risks remain amid a decline in futures Open Interest.

The cryptocurrency market offers mixed signals on Tuesday, with Bitcoin (BTC) holding above $118,000 but staying below the $120,000 resistance. This consolidation comes after last week’s sell-off to $114,728 and mirrors growing institutional demand, as evidenced by the resurgence of BTC spot Exchange Traded Fund (ETF) inflows.

Ethereum (ETH) showcases resilience and a bullish bias likely to accelerate the price above the $4,000 mark. Following last week’s decline near $3,500, the price of ETH has rebounded, trading at around $3,870 at the time of writing.

Ripple (XRP) mirrors the stability in the broader cryptocurrency market, holding above $3.00 key support. Its upside has been capped under resistance at $3.20, reflecting the weakening technical structure.

Market overview: Bitcoin regains institutional appeal

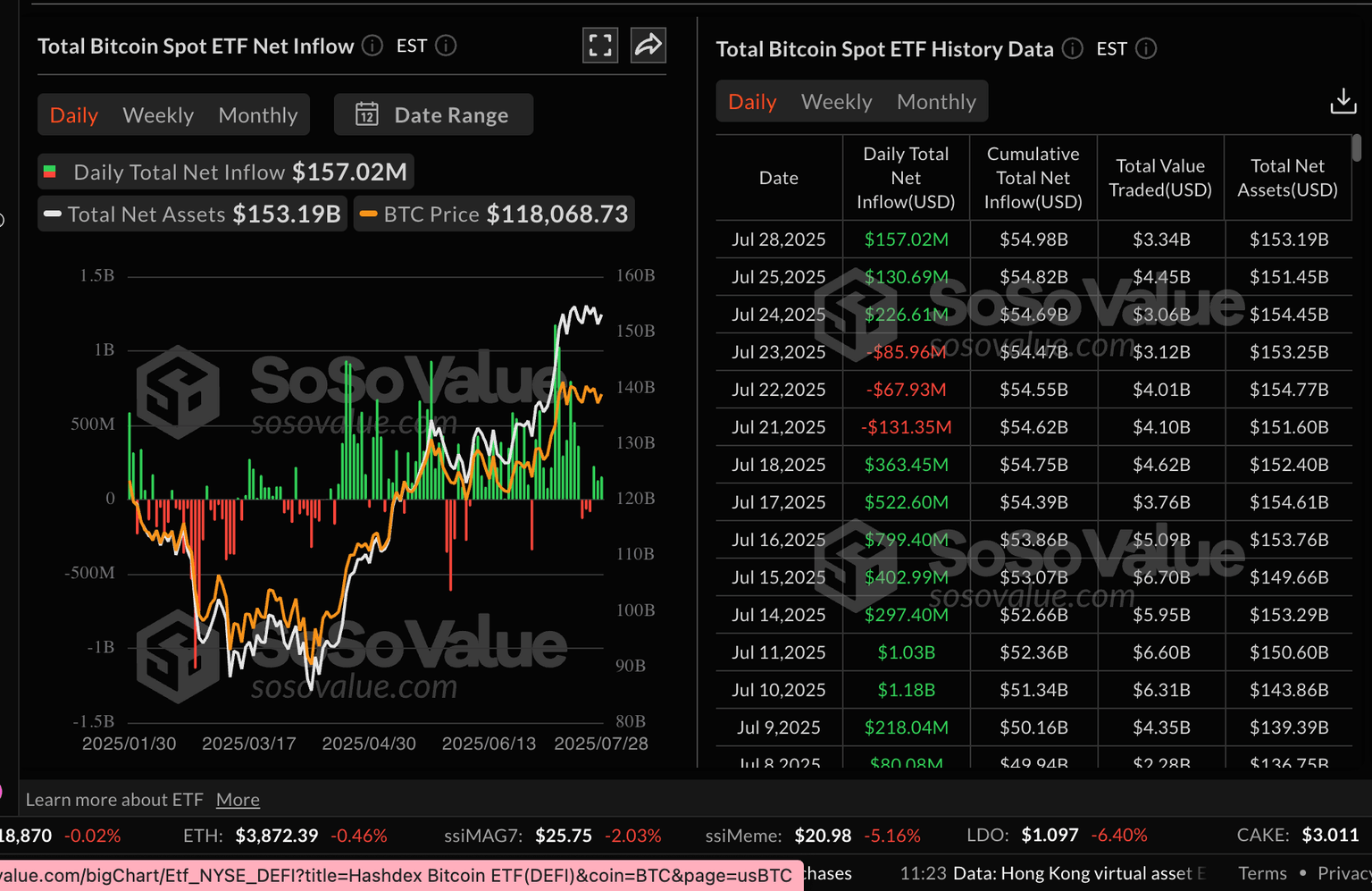

Bitcoin investment products experienced a decline in demand, with a net outflow volume of $175 million. Risk appetite was generally low with BTC spot ETFs licensed in the United States (US) averaging $72 million in net inflows, according to SoSoValue.

In contrast, capital inflow into spot ETFs started this week on a positive note, with approximately $157 million recorded on Monday. If this develops into a bullish trend, as institutions seek increased exposure, Bitcoin price could get a boost above the $120,000 resistance, and even close the gap toward the all-time high of $123,218.

Bitcoin spot ETFs | source: SoSoValue

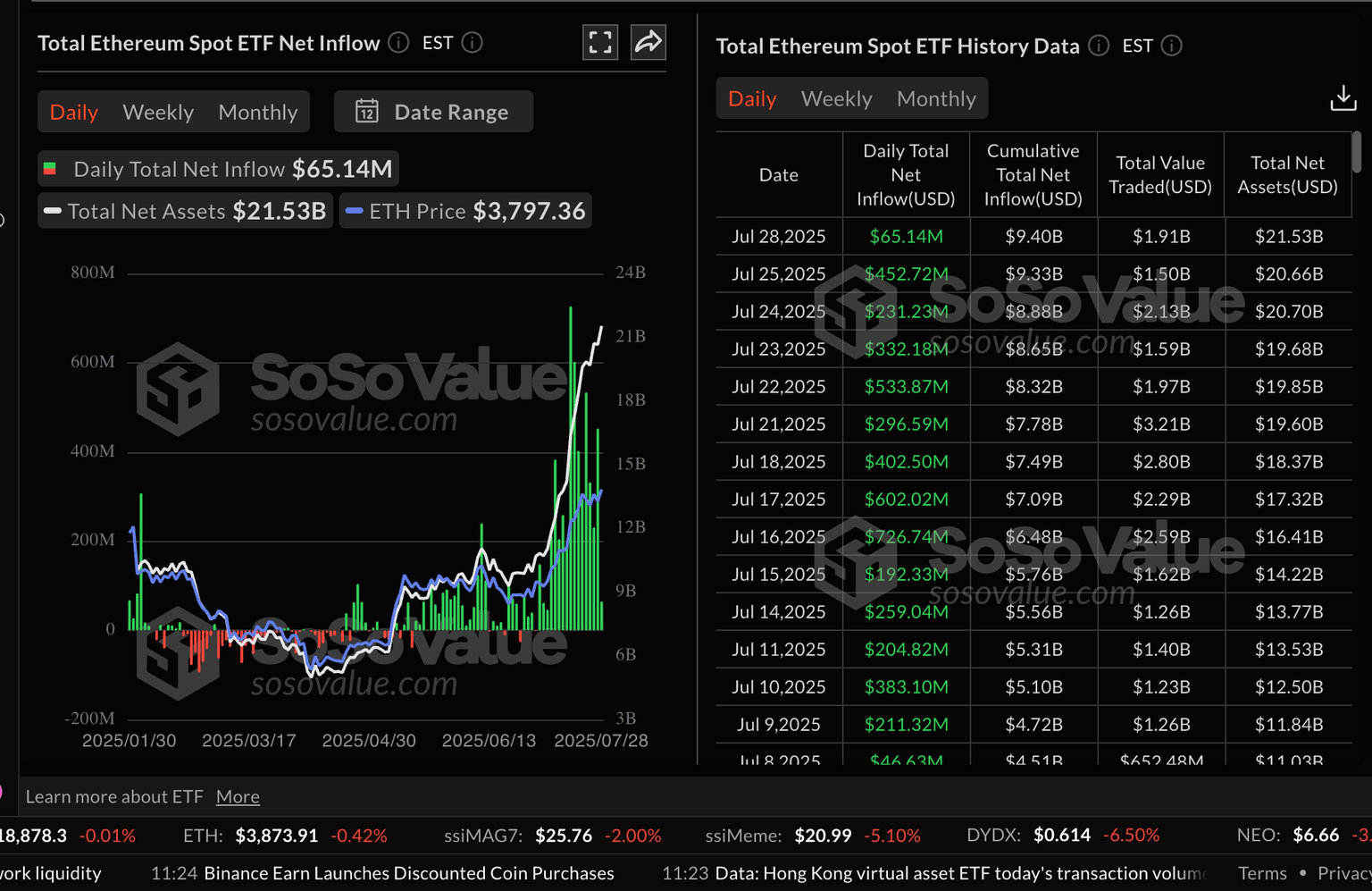

Ethereum, unlike Bitcoin, was the best-performing asset last week, boasting $1.59 billion in cumulative fund inflows. ETH spot ETFs operating in the US saw $1.85 billion in net inflow volume last week. The bullish trend has extended to this week, with Monday’s inflows averaging $65 million. NASDAQ-listed BTCS company announced the purchase of additional ETH on Monday, beefing up its holdings to $270 million. This steady increase in demand for Ethereum from both retail and institutional investors could predispose the largest smart contracts token to gains above $4,000 and toward the record high of $4,878.

Ethereum pot ETFs | source: SoSoValue

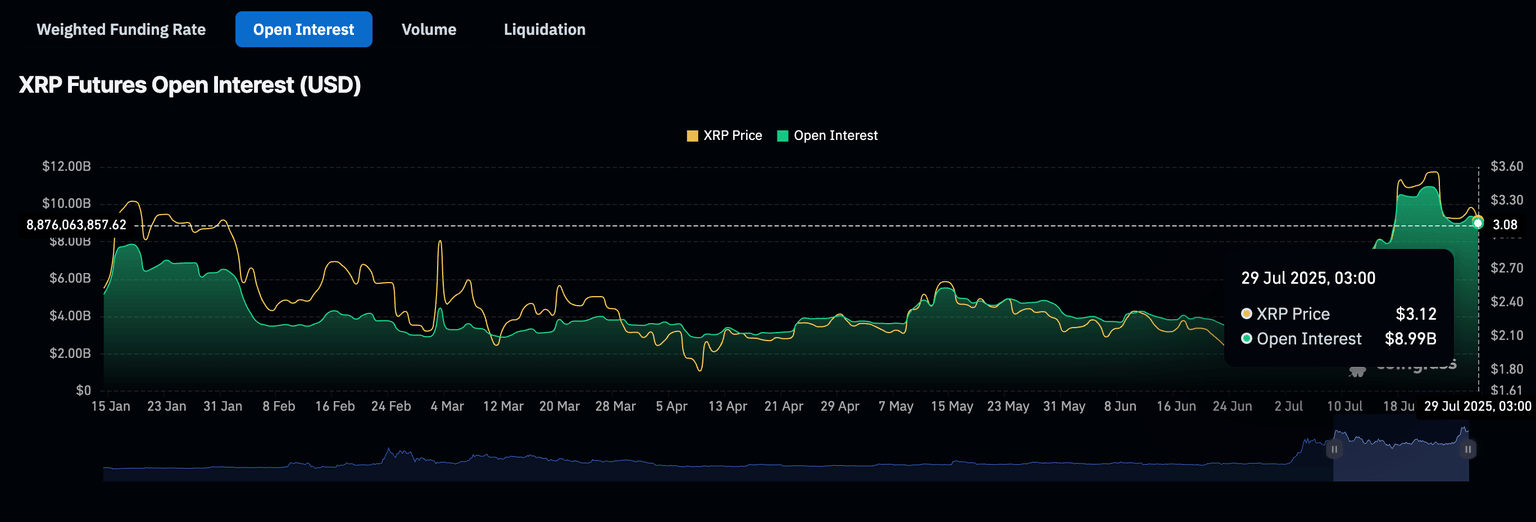

As for XRP, interest remains elevated based on the futures Open Interest (OI), which averages around $9 billion on Tuesday, up from $3.54 billion on June 23. However, it is worth mentioning that the OI, which is the notional value of outstanding futures or options contracts, has declined 18% after peaking at $10.94 billion on July 22.

Traders should pay attention to the direction of the OI indicator because a persistent decline means a lack of conviction in the token’s ability to sustain the uptrend, increasing the risk of the downtrend resuming.

XRP futures Open Interest | Source: CoinGlass

Chart of the day: Bitcoin market cools, breakout incoming?

Bitcoin price is no longer trading in overheated market conditions after the Relative Strength Index (RSI) declined from 75, averaging at 60 at the time of writing. Still, the technical picture remains in bullish hands, as the RSI shows signs of another recovery phase, likely to keep demand for BTC high.

A break above the descending trendline would affirm the bullish grip and increase the chances of a Bitcoin price edging above $120,000.

BTC/USDT daily chart

Downside risks remain of concern to investors, as the Moving Average Convergence Divergence (MACD) indicator showed a sell signal on Wednesday when the blue line crossed below the red signal line. If the MACD indicator continues to decline, it will affect risk appetite.

At the same time, macroeconomic uncertainty could cap price action in the coming days, especially with the Federal Reserve’s decision on interest rates looming and US President Donald Trump’s higher tariffs taking effect on August 1.

Altcoins update: Ethereum eyes $4,000 breakout

Ethereum bulls have renewed their bid for a break above the crucial $4,000 resistance, following a close approach on Monday, which stalled at $3,941. The token is currently trading at $3,870, representing a 2% gain on the day, backed by both retail and institutional demand.

Still, traders should be aware of the seemingly overheated market conditions, with the RSI within overbought region at 77 after peaking at 88 the previous week. Moreover, the MACD indicator could trigger a sell signal in upcoming sessions — a move that is likely to shift dynamics as investors consider reducing exposure following the rally in July.

ETH/USDT daily chart

As for XRP, bulls are fighting to retain control of the price, which has declined nearly 14% from the record high of $3.66. XRP is trading at $3.15 at the time of writing, following a recently confirmed MACD indicator sell signal and the RSI dropping from the overbought region to 58.

XRP/USDT daily chart

Key areas of interest to traders include the initial support at $3.00, the buyers' congestion at $2.95, which was tested on Thursday, and the 50-day Exponential Moving Average (EMA) at $2.74. These levels could absorb the selling pressure and prevent declines from aggressively trimming July gains.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren