Crypto stocks recover from dip as polls say Harris won debate against Trump

Crypto and Bitcoin mining-related stocks have bounced back following an early trading day dip in the wake of the debate between United States presidential candidates Donald Trump and Kamala Harris.

Publicly traded crypto and Bitcoin (BTC $58,049) mining firms saw their share prices plunge on Sept. 11, reacting to the debate the night before where opinion polls pinned Harris as outperforming the pro-crypto Trump.

The crypto-linked shares recovered from their lows, with most closing trading on only slightly down.

Shares of crypto exchange Coinbase (COIN) regained 5.3% following a dip to a Sept. 11 low of $150, returning to its pre-debate price at around $157 in after-hours trading, according to Google Finance.

Coinbase closed at $157.22, down a slight 0.79% on the day. Source: Google Finance

The Bitcoin (BTC $58,049) -buying MicroStrategy (MSTR) followed, dipping to $122 before recovering to close 0.26% down at $129.30 and dropping to $128.50 in after-hours trading.

Shares in BTC miners Marathon Digital (MARA) and Riot Platforms (RIOT) also saw early drops, recovering to close down 0.94% and 2.07%, respectively.

Mining firm Hut 8 (HUT) was the only crypto-linked stock to close up on the day at 1.29% at $10.58 after sliding to a $9.76 low.

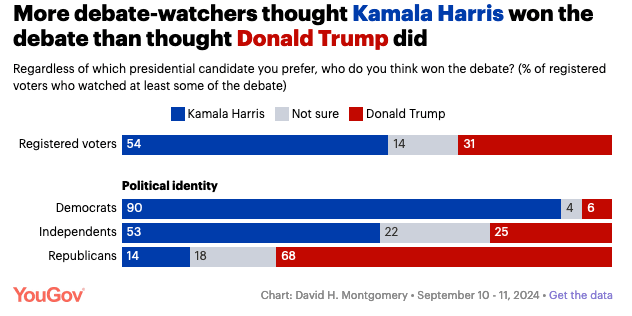

The dips came as markets reacted to Harris’ debate performance. A YouGov survey published on Sept. 11 showed voters pinned Harris as the night’s winner, with 54% of registered voters saying Harris won, over the 31% who said the same about Trump.

Democrats and Republicans were split down party lines over who they thought won the debate. Source: YouGov

A CNN flash poll also claimed that the majority of debate watchers said Harris outperformed Trump onstage.

The crypto industry has primarily backed Trump, who has made multiple pro-crypto policy promises, while Harris’ crypto stance is largely unknown.

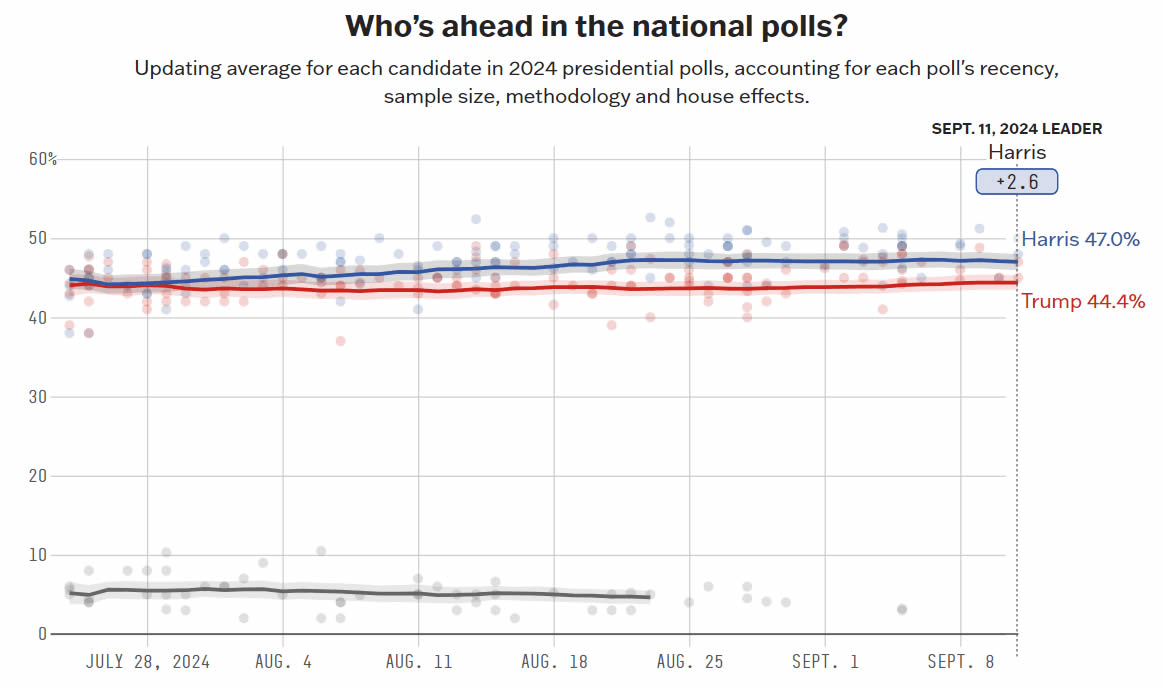

National polling from FiveThirtyEight for Sept. 11 shows Harris’ lead unaffected by the debate, leading Trump by 2.6 percentage points.

National polling from FiveThirtyEight has Harris ahead. Source: FiveThirtyEight

Crypto markets also took a dip dropping $60 billion from total capitalization on Sept. 11, but have since recovered 2.3% returning to pre-debate levels.

Bitcoin prices shed 3.7% in the wake of the debate falling to an intraday low of $55,573 on the day before recovering to reclaim $57,900 during early trading on Sept. 12.

However, Trump-themed memecoins have taken a beating with all of them dumping double-digits over the past 24 hours, according to CoinGecko.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.