Crypto Sleeping Giants: Enjin Coin Price - A 3000% rally by 2023

- Enjin Coin price has retraced 50% since its all-time highs.

- If the technicals are correct, a potential 3,000 percent increase in profit is possible.

- Invalidation of the uptrend is a breach into $0.23.

Enjin coin pric could become a crypto outperformer in the next bullrun. Key levels have been identified.

Enjin Coin price remains Macro bullish

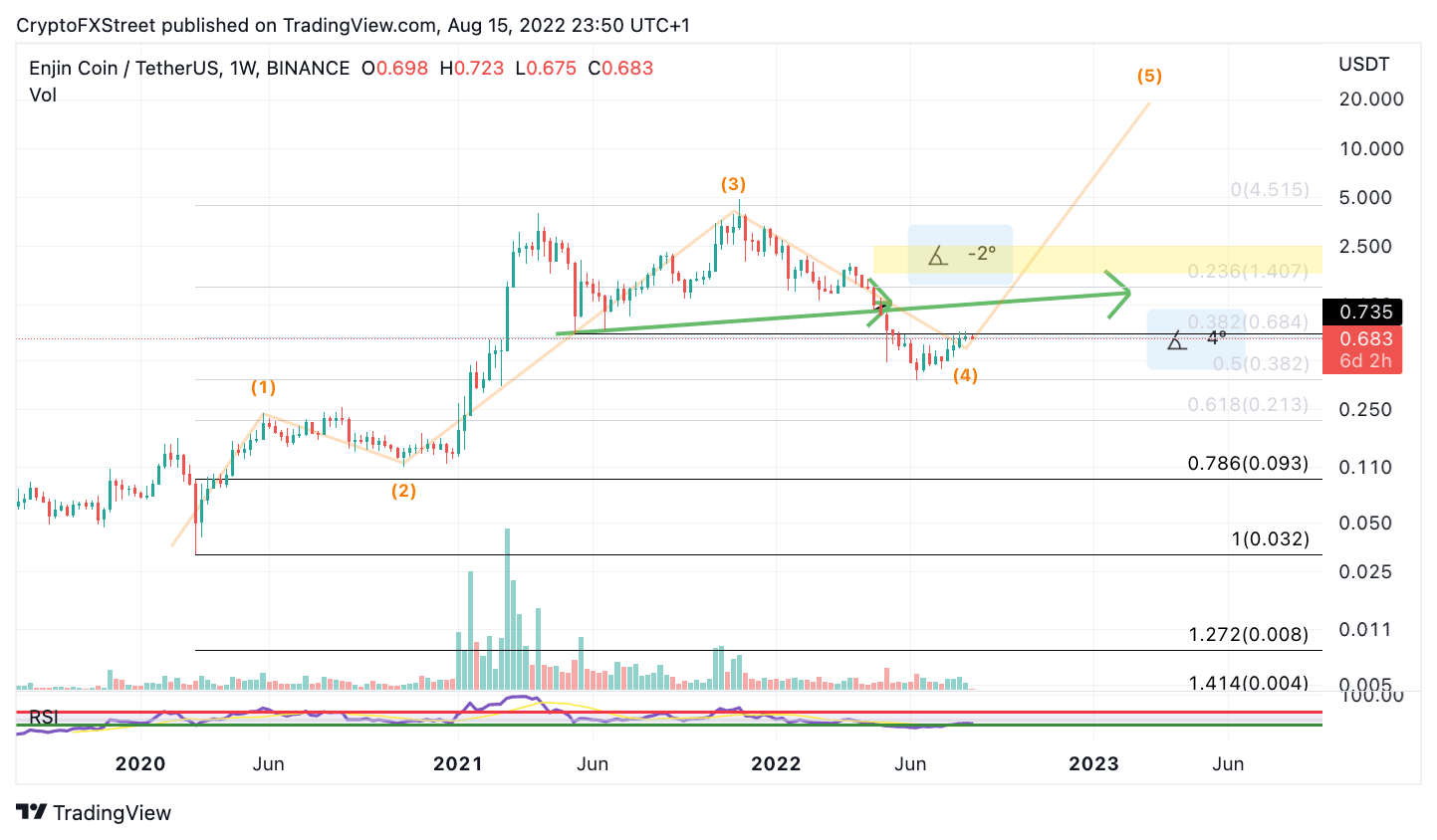

Enjin Coin price currently trades at $0.60. The Enjin token, an Ethereum based gaming token witnessed a 14,000% rise between March 2020 lows at $0.03 and the 2021 highs at $4.85. A Fibonacci Retracement tool surrounding the entirety of the move suggests the current downtrend is only a 50% loss in profit.

Enjin Coin price volume profile pattern confounds the idea of a possible macro bull run as sellers have substantially reduced amidst the dissension since $4.85. Based on the Elliott Wave theory and Classical price action, the ENJ price has potential to rally as high as $20. If Bitcoin is projected to accomplish its $180,000 macro trajectory, Enjin coin should be worth to a keep close eye on.

ENJ/USDT 1-Week Chart

For this reason ENJ coin has been named this week’s Crypto Sleeping Giant. A dollar cost approach could be a favorable investing plan as the invalidation of the bullish thesis is more than 50% below today’s current market value at $0.23.

In the following video, our analysts deep dive into the price action of Bitcoin, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.