Crypto markets dip, liquidating over $700 million from leveraged traders, 85.3% being longs

- Crypto markets fall sharply, triggering $737.36 million in leveraged liquidations over the past 24 hours.

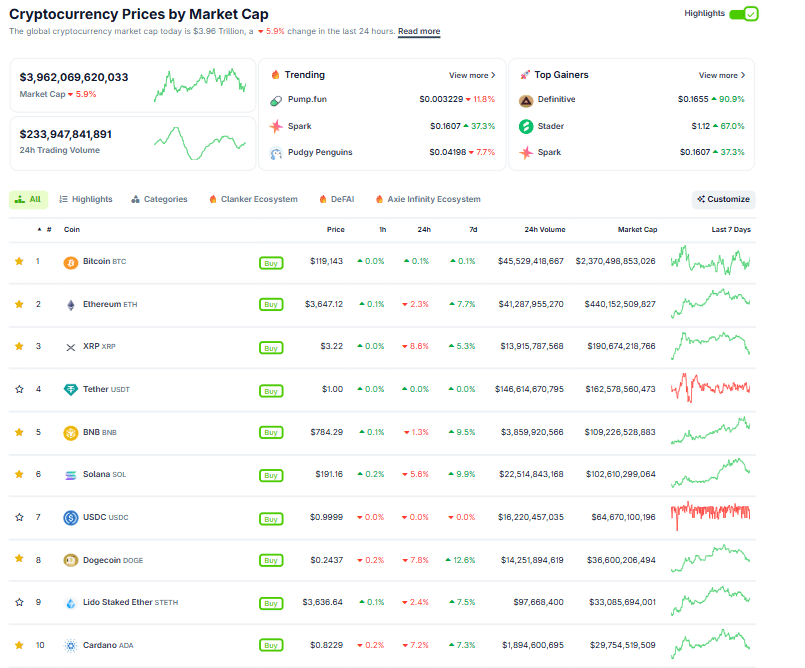

- Leading assets, such as Ethereum, XRP, and Solana, experienced notable losses, while meme coins declined more significantly.

- Traders should closely watch key support zones to determine whether the market will stabilize or enter a deeper correction phase.

Crypto markets experienced a sharp sell-off over the last 24 hours, resulting in widespread liquidations across leveraged positions. More than $737 million in positions were wiped out, with 85.3% of them being longs—highlighting the overly bullish positioning. Altcoins, such as Ethereum (ETH), Ripple (XRP), and Solana (SOL), experienced a pullback, while meme coins suffered deeper losses. Market participants are now eyeing critical support levels to assess whether this could be a brief shakeout or the beginning of a broader correction.

Over 240,000 traders liquidated with positions worth over $700 million

The cryptocurrency market faced a sharp pullback in the middle of this week, with Ethereum, Ripple, and other altcoins nosediving on Wednesday.

According to the CoinGlass Liquidation Map chart, a total of 243,970 traders were liquidated in the last 24 hours, resulting in a total liquidation value of over $700 million. Notably, 85.3% of the positions were long, indicating overly bullish positioning. The largest single liquidation occurred on Binance, where a BTCUSD position worth $2.96 million got liquidated.

The report explained that the drop in crypto prices is likely the result of profit-taking by retail traders or large wallet investors and capital rotation or positioning before the expected coming altcoin season.

What should traders watch for?

Despite this price dip in major altcoins and a popular meme coin on Wednesday, the largest cryptocurrency by market capitalization traded sideways.

Bitcoin price has been trading in a range-bound scenario between $116,000 and $120,000 after reaching a new all-time high of $123,218 on July 14. On Wednesday, it faced a slight rejection from its upper consolidation band at $120,000, to close at $118,755. At the time of writing on Thursday, it recovers slightly, trading around $119,200.

Traders should closely watch the aforementioned consolidation levels for Bitcoin to determine whether BTC will stabilize or enter a deeper correction phase, which will impact the prices of other cryptocurrencies.

If BTC recovers and closes above the upper boundary of the consolidation range at $120,000 on a daily basis, it could extend the recovery toward the fresh all-time high at $123,218, which altcoins and cryptocurrencies will likely follow.

On the contrary, if BTC falls below the lower consolidation boundary at $116,000 on a daily basis, it could extend the decline to retest the 50-day Exponential Moving Average (EMA) at $111,292, leading to a deeper correction phase for altcoins.

BTC/USDT daily chart

Moreover, CryptoQuant’s BTC Estimated Leverage Ratio (ELR) reads 0.263 on Thursday, indicating moderately leveraged but not excessively overexposed.

-1753330026836.png&w=1536&q=95)

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.