Could Bitcoin price rally end if Fed policy pivots?

- Bitcoin trades slightly below $120,000, eyeing a breakout to new record highs.

- The Fed's interest rate meeting on July 30 could alter the outlook for the crypto market if the central bank decides to change interest rates.

- Bitcoin's spot volume and futures market Open Interest remain elevated amid a narrowing volatility, which indicates bullish speculation.

Bitcoin (BTC) price slides, trading at around $118,369 on Wednesday after facing rejection from an intraday high of $120,090. Its technical structure offers minor bearish signals, likely to accelerate the decline in upcoming sessions.

Despite the decline in price from the record high of $123,218, reached on July 14, emerging data shows that the king of the cryptocurrency market has the potential to resume the uptrend and possibly extend it to reach a new record high over the coming weeks.

Meanwhile, investors may shift their focus to the United States Federal Reserve (Fed) meeting on interest rates on July 30, which could help shape the outlook for the cryptocurrency market for the remainder of the third quarter.

Could the Fed policy pivot dampen Bitcoin price rally?

The Fed has maintained interest rates steady in the range of 4.25% to 4.50% since December. This stance followed a series of rate cuts in the second half of 2024, amounting to 1%.

Fed Chair Jerome Powell, in his past speeches, has stressed the "wait and see" approach, preferring to pause cuts since the beginning of 2025 amid evolving market conditions and the need to balance the central bank's dual mandate of managing inflation (price stability) and ensuring economic growth as well as sustainable employment.

Tariffs and trade policies championed by US President Donald Trump have been the main factors influencing the Fed policy, especially with the Consumer Price Index (CPI) increasing 0.3% MoM in June after rising 0.1% in May.

CPI increased 2.7% in June on an annual basis after rising 2.4% in May. The CPI for all goods and services, excluding the volatile prices of food and energy, rose 2.9% YoY.

The CPI measures the change in prices paid by consumers for goods and services over a specified period. It is used to gauge inflation and directly influences the Fed's economic policy.

June's CPI data will play a crucial role in the Federal Open Market Committee (FOMC) meeting on July 30. Moreover, market participants cannot ignore the potential impact of the implementation of President Trump's higher tariffs on August 1, which could lead to sticky inflation in upcoming months.

"With the Fed's meeting slated for next week, all eyes will be on any shifts in interest rate guidance," said Tae Oh, founder and CEO of Gluwa, a blockchain platform for real-world credit infrastructure. "Even the slightest hints of a pivot in policy could significantly impact risk assets - including crypto, which tend to react sharply to changes in the monetary environment," he added.

At the same time, President Trump's consistent criticism of Fed Chair Powell continues to raise concerns about the central bank's independence. The President said at a conference on Tuesday that Powell is a "numbskull" who has kept interest rates elevated, according to a Reuters report.

"I think he's done a bad job, but he's going to be out pretty soon anyway. In eight months, he'll be out," President Trump said in a meeting at the White House with Philippine President Ferdinand Marcos Jr.

Jerome Powell is expected to be in office until May 15, when his term expires. He has insisted that he will not resign. If President Trump gets his way, it means that Powell could leave office early by mid-March.

Goldman Sachs economist Jan Hatzius said in a note on Monday that "market participants seem to agree that the risk to Fed independence is rising. A further increase could make Fed officials more reluctant to cut."

Powell and other Fed officials have been dovish on long-term inflation, saying that it remains stable. However, they emphasize the need to assess the short-term impact of higher tariffs on the prices of goods and services as companies pass the costs on to consumers. This could lead to inflation ticking up amid upward price pressure.

Can Bitcoin beat odds to keep the rally intact?

Bitcoin is trading in a dispensation unlike any other in history, with the US breaking the ceiling and establishing clear regulations for the crypto industry. The House of Representatives passed three crypto bills last week, including the GENIUS Act, the CLARITY Act and the Anti-Central Bank Digital Currency Act (Anti-CBDC Act).

President Trump signed the GENIUS Act into law on July 18, paving the way for institutions and builders to issue and operate stablecoins in the US in a regulated environment.

However, the CLARITY Act and the Anti-CBDC Act will head to the Senate for further deliberation before being sent to the President's desk for signing it into law.

"Additionally, the recent Crypto Market Structure Bill's passage in the US House adds a layer of regulatory optimism. If that momentum carries forward into Senate action, it could bolster institutional confidence and improve sentiment across digital assets," Tae Oh said in a commentary passed to FXStreet.

The GENIUS Act will bolster innovation in the stablecoin sector while protecting the interests of consumers and stakeholders. This law lays the groundwork for the broader adoption of stablecoin-centered financial solutions, especially in payments and the Decentralized Finance (DeFi) space.

Technical and fundamental outlook: Bitcoin bullish structure steady

Bitcoin is holding onto the $118,000 short-term support but is staying below the pivotal resistance at $120,000. The Relative Strength Index (RSI) in the spot market has cooled from overheated levels to a bullish 62.

Glassnode's Weekly Market Pulse report highlights that "spot volume remains elevated, suggesting continued market engagement and demand resilience."

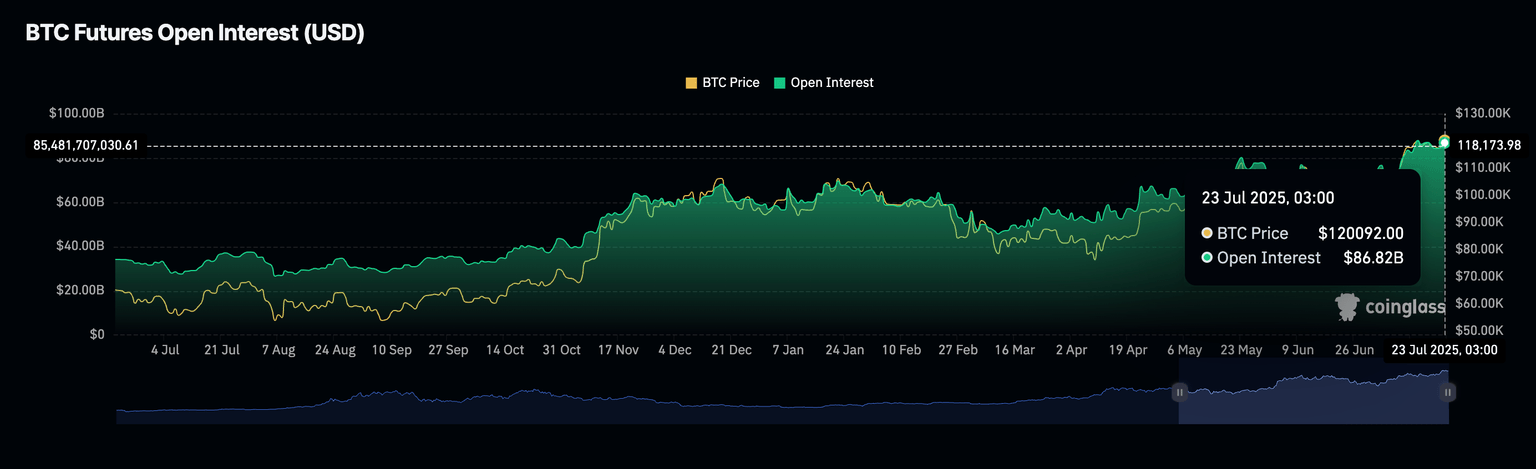

As for the derivatives market, the futures contracts Open Interest (OI) remains elevated at the highest level this year. CoinGlass data shows that Open Interest averaged $86.82 billion on Wednesday, up from $45.72 billion, the lowest level recorded in March.

A bullish outcome could follow a potential breakout above $120,000, with bulls setting their sights on the record high of $123,218 and the next major milestones at $125,000 and $130,000.

Institutional interest in Bitcoin remains steady, backed by an approximately $2.2 billion inflow into related investment products last week, according to a CoinShares report, released on Monday.

Bitcoin Open Interest data | Source: Coinglass

Traders should also monitor the Moving Average Convergence Divergence (MACD) indicator, which can confirm a sell signal as it retreats from its recent peak, following the peak in BTC price at record highs. This signal will be triggered when the blue MACD line crosses below the red signal line, in turn encouraging investors to consider reducing their exposure.

BTC/USDT daily chart

If the decline extends below the immediate $118,000 support, traders may shift their attention to the next tentative level at $115,748, which was tested on July 17, and the previous all-time high of $111,980. Other key levels likely to absorb selling pressure include the 50-day Exponential Moving Average (EMA) at $110,959 and the 100-day EMA at $105,728.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren