Crypto market is nicely recovering, but into some key levels ahead of Fed [Video]

![Crypto market is nicely recovering, but into some key levels ahead of Fed [Video]](https://editorial.fxsstatic.com/images/i/crypto-coins-1_XtraLarge.png)

Good morning Crypto traders! USDollar Index – DXY remains under strong bearish pressure, and there’s room for more weakness down to July lows, while NASDAQ100 keeps trading strongly bullish that is supportive for the Crypto market, as we talked on September 09. CLICK HERE

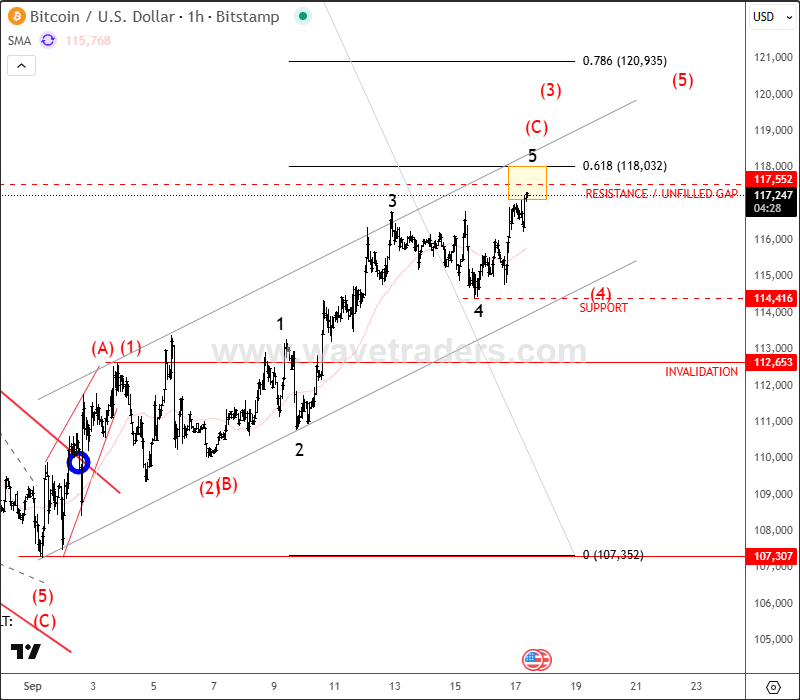

Bitcoin keeps pushing higher, while ALTcoins are a bit slow, as BTC is currently dominating due to a corrective recovery on BTC dominance chart. Bitcoin can actually still be approaching resistance for wave (C) or (3) around 117k area, so we may see at least a corrective pullback in wave (4) before a continuation higher for wave (5). Bears would be back only below 112k invalidation area.

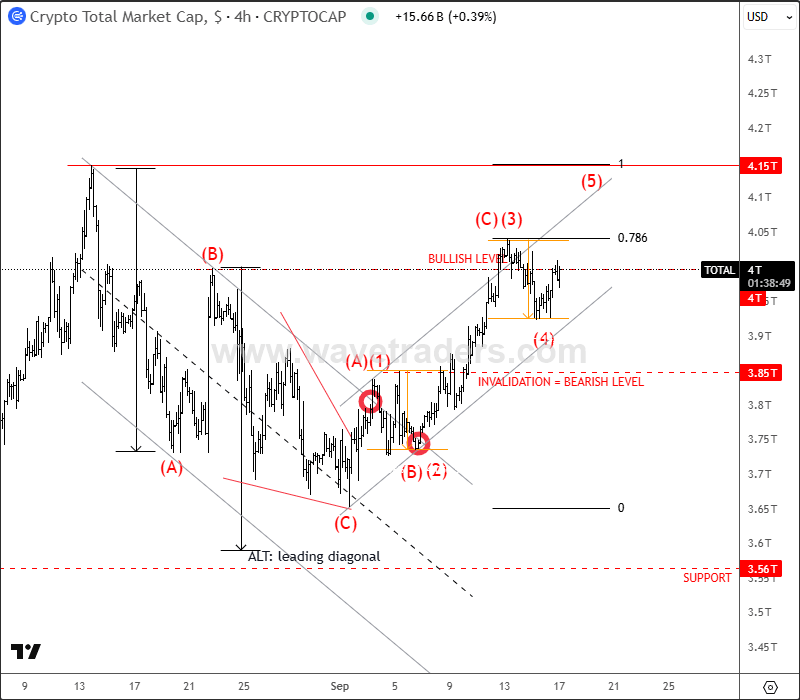

Crypto TOTAL market cap chart looks corrective in the 4-hour time frame, and it’s about to continue higher for wave (5) of an impulse. If that will be the case, then even BTC can be back to bullish mode, and ALTcoins may follow, as soon as BTC dominance chart starts falling again. However, still be cautious ahead of today’s important FED meeting, because it’s still an interesting and strong resistance, so we may see at least short-term corrective pullbacks. Bears may step back in only beneath 3.85T area.

Crypto TOTAL four-hour chart

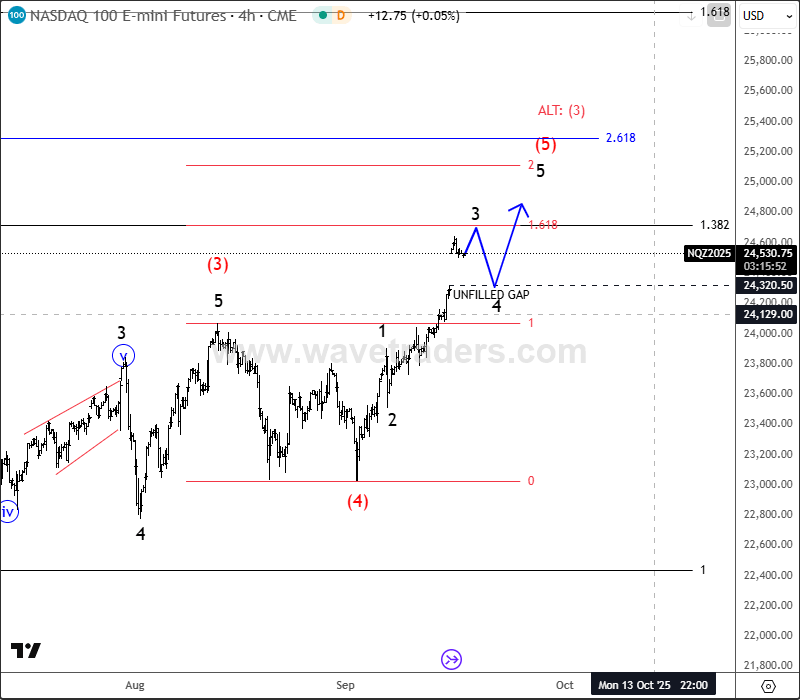

Notice that NASDAQ100 is extending nicely higher within wave (5) or (3) as anticipated, and there can be room for more gains up to 24700 – 25000 area, as we see an unfinished lower degree five-wave impulse. So more upside can be seen, which can be supportive for the Crypto market, just be aware of wave 4 pullback that can fill the open GAP before a bullish resumption within wave 5.

NASDAQ100 four-hour chart

For a detailed view and more analysis like this, you can watch below our latest recording of a live webinar streamed on September 15:

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.