Crypto market has become ‘very confusing,’ losing all logic – Traders

The crypto market isn’t following the same old patterns anymore — and it’s throwing crypto traders off.

“The market is totally cooked,” pseudonymous crypto trader Sykodelic said in a Feb. 4 X post. They added that despite pro-crypto moves from the US government and President Donald Trump, the market “just keeps on retracing.”

It has lost any sort of rhyme or reason…This is very confusing for almost every investor.

Crypto trader The Bitcoin Therapist said in a Feb. 4 X post that “something is terribly wrong with the market’s pricing of Bitcoin.”

“We are easily $50K-$100K undervalued. There is far too much to be bullish about. There is going to be a violent repricing,” they added.

The Crypto Fear & Greed Index, which measures overall market sentiment, dropped to a “Neutral” score of 54 on Feb. 5, down 18 points from its “Greed” score of 72 just a day earlier.

The confusion comes after the broad consensus among crypto analysts and traders in late 2024 was that Bitcoin's dominance would peak in early 2025 with Trump’s election win and speculation about the US making a Bitcoin (BTC $98,271) reserve.

Capital was anticipated to then rotate into the altcoin market, marking what many see as the beginning of “altcoin season.”

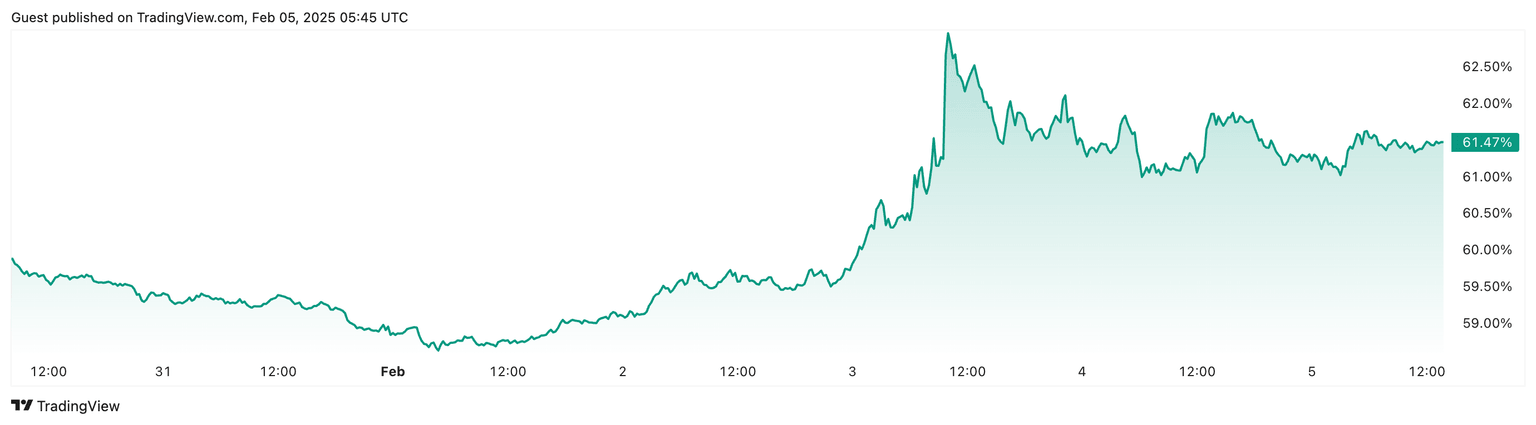

At the time of publication, Bitcoin dominance stands at 61.47% — already higher than crypto analyst Benjamin Cowen’s prediction in August that it would top out at 60% before an altcoin season would begin.

Bitcoin dominance has increased 2.91% over the past seven days. Source: TradingView

Despite Bitcoin reaching a new all-time high of over $109,000 on Jan. 20 around Trump’s inauguration, it has recently seen increased volatility. Macroeconomic events are often not accounted for by traders in their predictions, who typically rely on historical performance.

On Feb. 3, escalating concerns over a potential trade war caused by Trump’s new tariffs on Canada, Mexico and China led to the “largest liquidation event in crypto history.”

Over $2.24 billion was liquidated from the crypto markets within 24 hours, according to CoinGlass data, though some commentators suggest the figure could be as high as $10 billion.

Trump later paused the planned tariffs on Canada and Mexico after negotiations, yet Bitcoin continues to trade below the psychological $100,000 price level.

At the time of publication, it is trading at $97,925, as per CoinMarketCap.

MN Capital founder Michaël van de Poppe said in a Feb. 4 X post that despite the US government aiming for the “golden age for crypto,” people expect “the market to be peaked.”

“It’s literally just getting started,” he added.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.