Crypto inflows hit $2B in June, Ethereum sees best week since March with $69M

Digital asset investment products started positively in June with almost all providers seeing inflows and recording an overall inflow of $2 billion.

On June 10, CoinShares published its weekly fund flows report, highlighting that crypto investment products gathered over $2 billion in inflows. According to CoinShares, June’s initial inflows brought digital asset products’ five-week total to $4.3 billion.

In addition, the asset manager reported that trading volumes for exchange-traded products (ETPs) catapulted to $12.8 billion for the first week of June, a 55% increase compared to the previous week.

Almost all ETP providers saw inflows

Apart from the overall inflows, CoinShares also highlighted that almost all providers of crypto ETPs saw inflows in the first week of June. The asset manager described the pattern as unusual and shared that it may be a response to weaker macro data. CoinShares wrote:

We believe this turnaround in sentiment is a direct response to weaker than expected macro data in the U.S., bringing forward monetary policy rate cut expectations.

The asset manager added that positive price action pushed the total assets under management (AUM) to rise above $100 billion for the first time since March 2024.

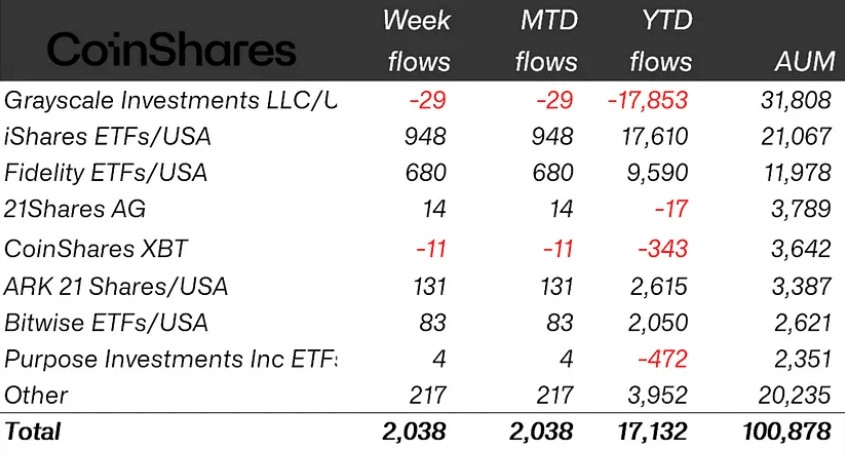

Flows by provider in millions. Source: CoinShares

Among the digital asset investment product providers, only Grayscale Investments and CoinShares XBT recorded outflows for the week.

Of those that recorded inflows, iShares exchange-traded funds (ETFs) in the United States recorded the most inflows, with $948 million, while Fidelity ETFs followed in second place, recording $680 million.

Ethereum products see “best week” of inflows

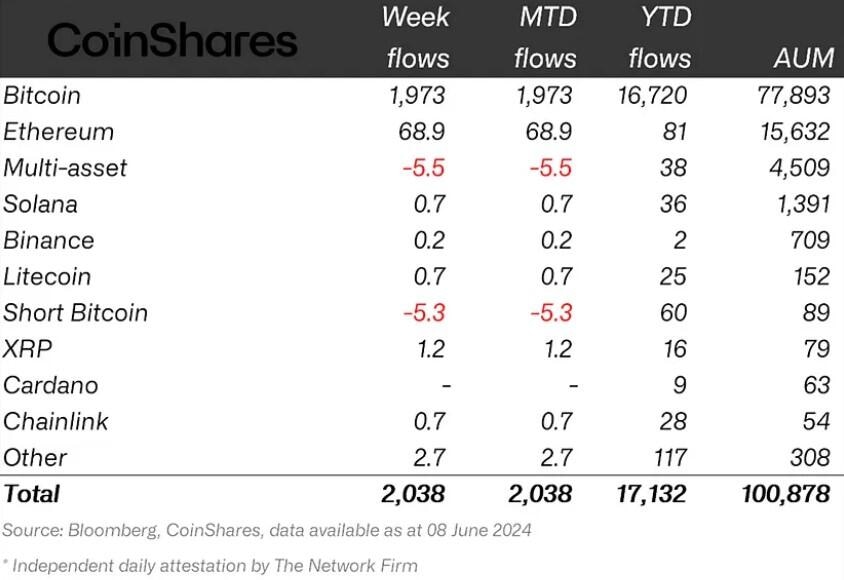

While Bitcoin (BTC $69,394) continued to dominate the ETP space with $1.97 billion for the week, Ether (ETH $3,674) -based products also broke records. CoinShares reported that Ethereum investment products saw a total inflow of $69 million for the week, their best record since March.

The asset manager believes this is likely a response to the recent approval of Ether-based spot ETFs. On May 23, the Securities and Exchange Commission officially approved several spot ETH ETFs in the U.S.

Flows by asset in millions. Source: CoinShares

Meanwhile, altcoin-based ETPs saw minor activities, with Fantom (FTM $0.68) and XRP (XRP $0.50) showing inflows of $1.4 million and $1.2 million, respectively.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.