CME’s Ether futures listing sends Ethereum price over the roof, bulls target $740

- Ethereum price climbed above $600 again as Bitcoin established a new all-time high beyond $20,000.

- The Chicago Mercantile Exchange (CME) just announced the launch of futures contracts for Ethereum.

Ethereum is currently trading at $630 after a massive price explosion following Bitcoin’s new all-time high above $20,000. At the same time, CME announced the launch of Ethereum's futures contracts for February 8, 2021.

Building on the success of Bitcoin futures and options, CME Group will add ether futures to the cryptocurrency risk-management solutions available to trade in February.

Ethereum price seems poised for a new 2020-high

Not only Bitcoin has breached $20,000 for the first time ever, but the announcement from CME listing Ethereum, its second cryptocurrency supported, has also proven to be a major bullish factor.

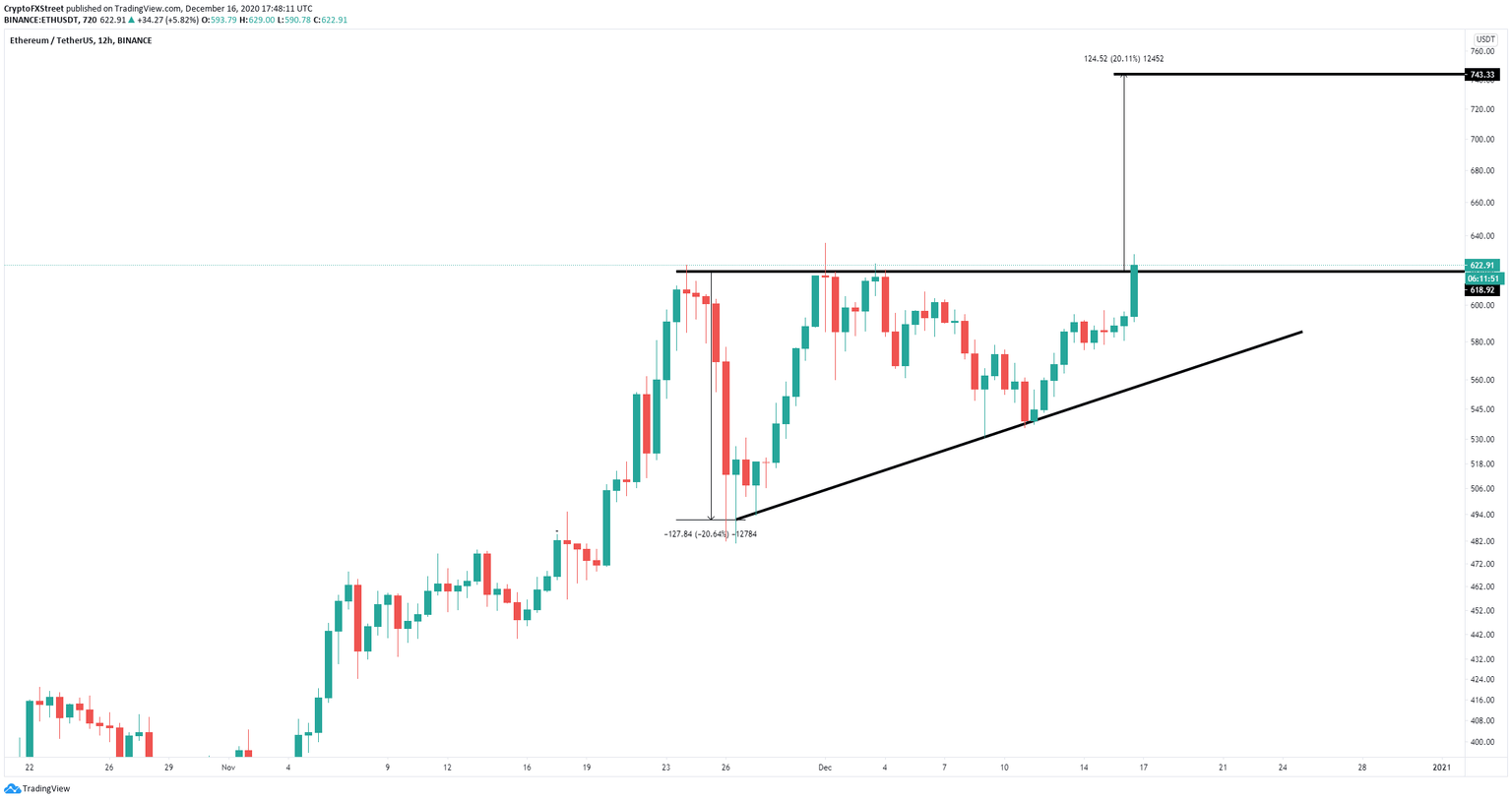

ETH/USD 4-hour chart

On the 12-hour chart, it seems that Ethereum price broke out of an ascending triangle pattern and targets $743 in the long-term. The next resistance level is $635.7, the 2020-high. A breakout above this point would most likely push ETH towards that $743 price target.

ETH Holders Distribution

Additionally, the number of whales holding between 100,000 and 1,000,000 of ETH coins has increased by four in the past week, despite Ethereum price rising fast. The number of ETH deposited inside Eth2 has reached 1.514 million, which is close to $1 billion in value at current prices.

The only potential bearish sign for Ethereum would be a rejection from the 2020-high at $635.7, which can easily push the digital asset below $600 and potentially as low as $560, but this is the least likely scenario.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B18.48.59%2C%252016%2520Dec%2C%25202020%5D-637437378897457432.png&w=1536&q=95)