Clearpool soars over 70% after Upbit listing sparks buying frenzy

- Clearpool price rallies over 70% on Wednesday following its listing on South Korea’s largest crypto exchange, Upbit.

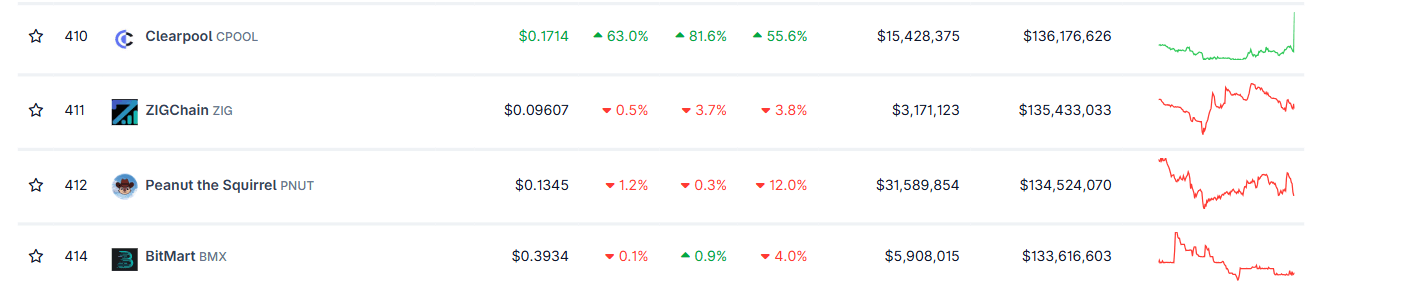

- Market capitalization jumps above $136 million, surpassing coins like PNUT and ZIG.

- The technical outlook suggests a continuation of the rally, with bulls targeting the $0.217 mark.

Clearpool (CPOOL) price surges more than 70%, trading above $0.173 at the time of writing on Wednesday. This rally follows the confirmation of Upbit, South Korea’s largest crypto exchange, for the CPOOL listing. The rally pushes CPOOL’s market cap above $136 million, overtaking rivals like PNUT and ZIG, while technicals suggest further upside toward the $0.217 target.

Why is CPOOL rallying today?

Clearpool, a decentralized capital markets ecosystem that enables institutional borrowers to access unsecured loans directly from the Decentralized Finance (DeFi) ecosystem, rallies by more than 70% on Wednesday. The main reason for this price surge is that Upbit, a crypto exchange, announced it would list CPOOL with trading pairs against KRW and USDT.

This news is triggering a massive surge in CPOOL price as a centralized exchange listing typically signals increased liquidity, accessibility, and investor confidence in the token.

CoinGecko data shows that Clearpool’s market capitalization reaches over $136 million on Wednesday, surpassing other popular altcoins such as ZIGChain (ZIG) and Peanut the Squirrel (PNUT), securing the 410th spot in the overall crypto market capitalization table.

Clearpool Price Forecast: CPOOL bulls aiming for $0.217 mark

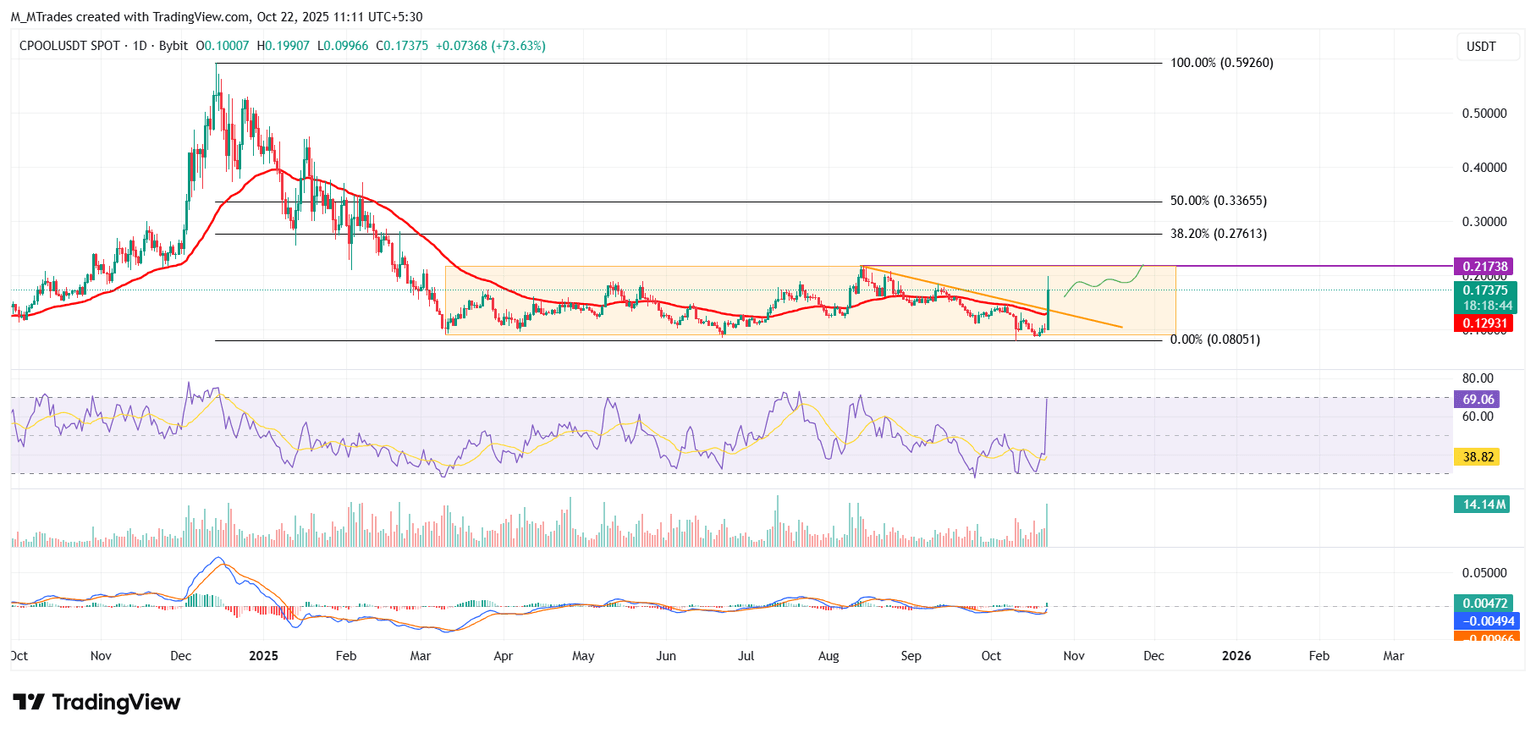

Clearpool price is breaking above a descending trendline (drawn by connecting multiple highs since mid-August) on Wednesday and rallies nearly 73%, trading around $0.173 as of writing.

If CPOOL continues its upward momentum, it could extend the gains toward the August 14 high of $0.217.

The Relative Strength Index (RSI) on the daily chart reads 69, pointing upward, indicating strong bullish momentum. Additionally, the Moving Average Convergence Divergence (MACD) shows a bullish crossover, giving a buy signal and indicating an upward trend.

CPOOL/USDT daily chart

On the other hand, if CPOOL faces a correction, it could extend the decline to retest the 50-day Exponential Moving Average (EMA) at $0.129.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.