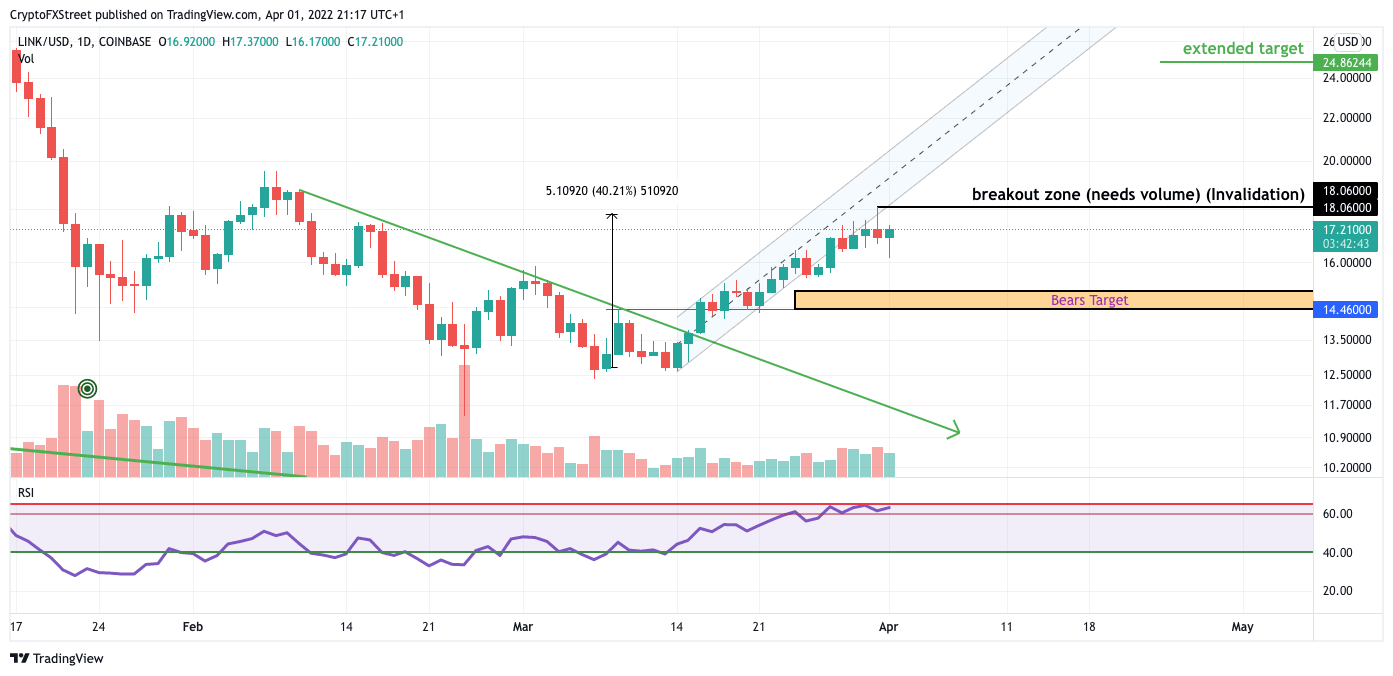

Chainlink price shows signs of weakness as the bears aim for $15

- Chainlink price has breached the parallel trend channel.

- LINK price has increased only 2% all week.

- Invalidation for the bearish idea will be a close above $18.

-637336005550289133_XtraLarge.jpg)

Chainlink price has been stagnant all week. The bears will likely send the digital asset to $15 in the coming weeks.

Chainlink price signals weakness of the uptrend

I will need Chainlink price has been deemed weeks "Crypto Lagger" as the price is only up 2% since last week's settling price of 16.85. The current $17.25 Link price looks in jeopardy as the daily trend channel has been breached with bearish price action. Last month's trade setup mentioned that a 20% bull run would likely commence for the LINK price. After the 20% target was actualized, analysts deemed the digital asset a "No Trade Zone," expecting sideways price action since the volume did not continue pouring in. One week later, the bulls seem to be losing faith in any more upside potential for the Chainlink price.

I Chainlink price appears to be showing significant resistance on the Relative Strength Index. The 60 and 65 levels where the LINK price resides are commonly known as the "Shorter's Playground" amongst professional traders. Secondly, the volume profile indicator also hints at bearish strength as the selling volume has increased to the upside.

LINK/USD 1-Day Chart

Chainlink price is likely to fall back into the $15.00 price zone. An invalidation for the bearish idea can only occur if the bulls establish a close above $18 with an uptick in bullish volume. If this scenario occurs, bulls should have enough steam to target $20 and 25, which would result in up to a 44% increase from the current Chainlink price.

Author

FXStreet Team

FXStreet