Chainlink price rises in stair-step fashion as LINK bulls hope for $24

- Chainlink price has rallied 15% since last week

- LINK price volume is a questionable component of the current price action

- A close below $15 will invalidate the bullish thesis

-637336005550289133_XtraLarge.jpg)

Chainlink price is currently fluctuating in the mid $16 zone with sparse evidence of a counter-trend.

Chainlink price could continue rallying higher

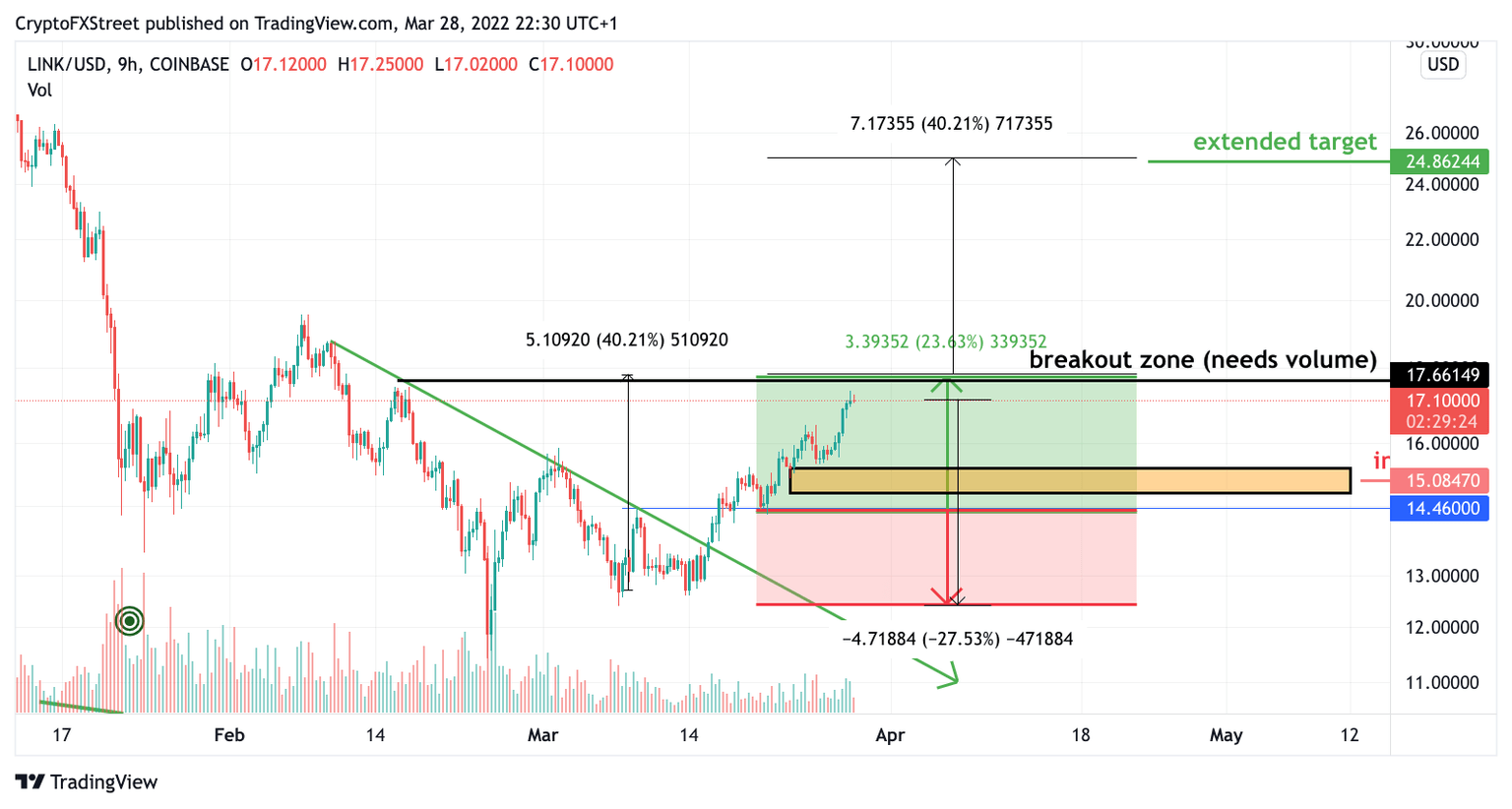

Chainlink price should have traders pleased as the digital asset has displayed classical style price action over the weekend. Last week’s thesis mentioned that a 20% rally was likely underway as the daily trend line had been breached. Over the weekend, Chainlink price cleared 75% of the target in a stair-step-like fashion.

LINK price volume is the only disappointing factor regarding the 15% rally it has accomplished. The bulls will need to breach $17.75 with an uptick in volume in order to push the Chainlink price into the hopeful $20 zone. If an uptick in volume does come into the equation, Chainlink price should be able to sustain a $20 price level. This scenario should be all of the bullish evidence needed for traders to aim for a $24 price target confidently.

LINK/USDT 9-Hour Chart

An invalidation for the bullish thesis will be a close into the previous support zone at $15. Should this occur, the Chainlink price will likely charge lower between $14 and $12, resulting in a 30% dip from the current price.

Author

FXStreet Team

FXStreet